Jabil (JBL): Evaluating Valuation After Strong Earnings Growth and Upbeat Guidance

Reviewed by Kshitija Bhandaru

Jabil (NYSE:JBL) just reported strong fourth-quarter results, with sales and net income both climbing meaningfully from a year ago. The company also issued upbeat guidance for the upcoming quarter and for 2026.

See our latest analysis for Jabil.

After climbing on the back of upbeat earnings and fresh guidance, Jabil’s recent momentum stands out, with a 12-month total shareholder return of 80.2% and the stock building real optimism among investors focused on technology and manufacturing. Even with some shorter-term swings, those robust long-term gains reflect renewed confidence in the company’s prospects as demand for supply chain partners like Jabil grows.

If strong results in tech manufacturing are piquing your interest, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains and positive earnings momentum, investors must now ask whether Jabil’s strong run is still leaving room for value or if the market is already factoring in all of its anticipated growth ahead.

Most Popular Narrative: 6.3% Undervalued

With a narrative fair value of $230.25 compared to Jabil’s last close of $215.69, the market may not be fully factoring in consensus expectations for the company’s future performance. This creates a striking tension between strong momentum and the narrative’s projected upside.

The expansion in India, particularly in Gujarat, to support photonics capabilities indicates growth potential in a promising market, likely enhancing future revenues from domestic demand and infrastructure projects. Jabil’s acquisition of Pharmaceutics International, Inc. opens access to a $20 billion market, suggesting potential revenue growth and improved margins by expanding its pharmaceutical solutions offering.

Curious how ambitious expansions and major new markets shape this bold valuation? The narrative depends on forecasts that only a handful of technology manufacturers are expected to deliver. There is a powerful assumption behind these numbers, and it is all in the details you have yet to see.

Result: Fair Value of $230.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key segments and inventory pressures could challenge Jabil’s growth outlook and put recent optimism to the test.

Find out about the key risks to this Jabil narrative.

Another View: What Do the Multiples Say?

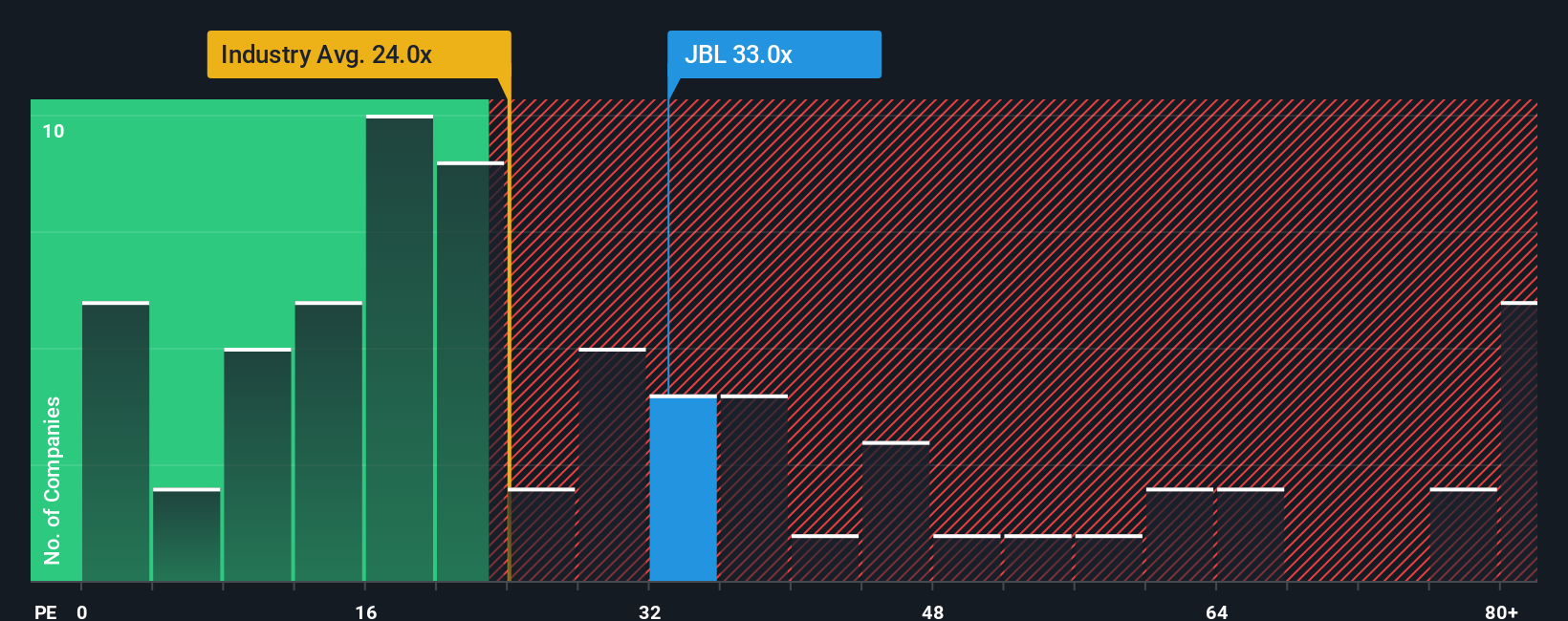

While fair value estimates suggest Jabil is undervalued, its price-to-earnings ratio of 35.2x stands out as higher than both the industry average (24.4x) and its peers (33.3x). This premium could mean investors are paying up for future growth, or it could introduce valuation risk if growth falters. Will the market’s optimism prove justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jabil Narrative

If you see the story differently or want to dig into the numbers for yourself, you can craft your own view in under three minutes, and Do it your way

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not settle for a single story. Expand your opportunities and access powerful trends shaping tomorrow’s markets by targeting stocks with unique strengths and future potential.

- Find stability in turbulent markets by exploring these 19 dividend stocks with yields > 3% and identifying companies offering attractive yields and steady income streams.

- Capitalize on technological breakthroughs by focusing on these 26 quantum computing stocks, which highlights firms making waves in quantum innovation before the rest of the market catches on.

- Catch the wave of artificial intelligence with these 24 AI penny stocks, where you can pinpoint trailblazers set to disrupt industries and lead in AI-driven growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in