- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Chosen For DARPA Quantum Benchmarking Initiative

Reviewed by Simply Wall St

IonQ (NYSE:IONQ) experienced a significant price increase of 26% last week, coinciding with several key announcements. The company's selection for the DARPA Quantum Benchmarking Initiative and collaboration with Ansys highlight its advancements in quantum computing applications across various sectors. The global release of the IonQ Forte Enterprise supports this progress by offering enhanced capabilities for life sciences and financial services. These developments likely added weight to IonQ's price move, contrasting with the broader market's more modest rise of 5% over the same period.

Every company has risks, and we've spotted 2 possible red flags for IonQ you should know about.

Over the past year, IonQ's shares delivered a total return of 224.91%, showcasing a significant gain for investors. This performance contrasts markedly with the broader US market's return of 3.6% and the US Tech industry's 9.4% over the same period, positioning IonQ as an outstanding performer against these benchmarks.

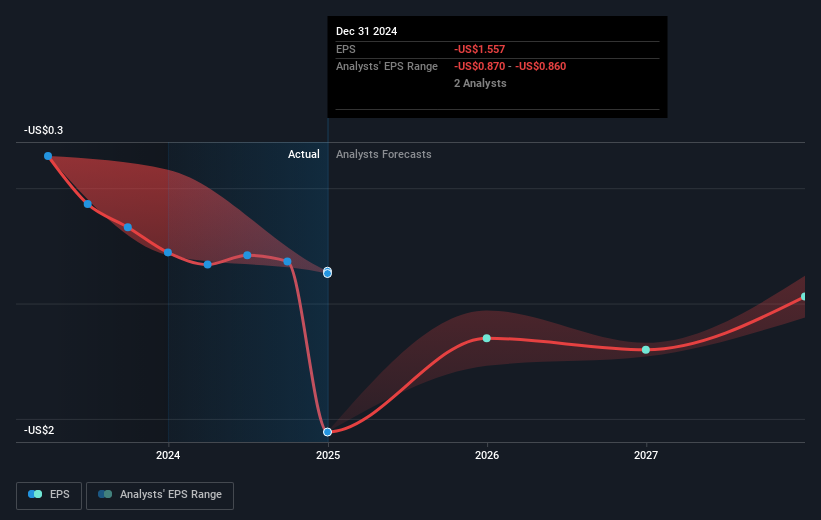

The recent announcements about IonQ's inclusion in the DARPA Quantum Benchmarking Initiative and the global release of the IonQ Forte Enterprise highlight burgeoning opportunities and advancements that could play a crucial role in shaping revenue and earnings forecasts. These strategic moves might bolster market confidence and potentially support the company's projection of achieving between US$75 million and US$95 million in revenue for 2025, although IonQ remains unprofitable. The stock's 26% share price increase last week emphasizes this optimism, yet the current share price still stands notably lower than the consensus price target of US$44.60, suggesting a potential for further alignment with market values as expectations evolve.

Assess IonQ's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IonQ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives