Assessing Ingram Micro Holding’s (INGM) Valuation Following Major Leadership Change and New India Strategy

Reviewed by Kshitija Bhandaru

A new chapter is about to begin at Ingram Micro Holding, with the company announcing Flavio Moraes Junior as the incoming Managing Director and Chief Country Executive for India. This is no minor personnel change. Moraes steps in after an impressive run heading up Ingram Micro Brazil, known for digital innovation and strategic expansion. His predecessor, Navneet Singh Bindra, leaves behind a legacy of more than 22 years, but Moraes’s arrival draws attention from investors eager to see if his growth-focused playbook can be translated to the high-potential Indian market.

The news of Moraes’s appointment comes as Ingram Micro Holding shows steady, if not electrifying, price action. Over the past month, shares are up just over 5%, while the year to date paints a similar picture. The consistent, moderate upward trend suggests that the market is weighing both the promise of leadership-driven transformation and the measured pace of previous growth. There is a sense that momentum could be on the verge of building, especially if the Indian operations follow the trajectory set by Moraes in Brazil, including successful moves in cybersecurity and cloud platforms.

But after months of incremental gains, should investors treat this leadership shift as a true buying opportunity, or has the market already priced in next-level growth for Ingram Micro Holding?

Price-to-Earnings of 18.3x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Ingram Micro Holding appears undervalued relative to its sector. The company's P/E of 18.3x stands well below the estimated fair P/E of 31.6x and also below the US Electronic industry average of 23.8x, suggesting the stock may be trading at an attractive valuation for earnings-focused investors.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of the company’s earnings, with a lower number often indicating better value if earnings quality is solid. In sectors like technology distribution, where margins can be thin and growth tends to be steady rather than explosive, the P/E ratio helps investors compare value across similar companies.

This gap implies that the market may be underestimating Ingram Micro Holding’s earnings potential or overlooking quality factors in its profit stream. For investors, the discount could signal untapped upside if forecasts and execution hold up.

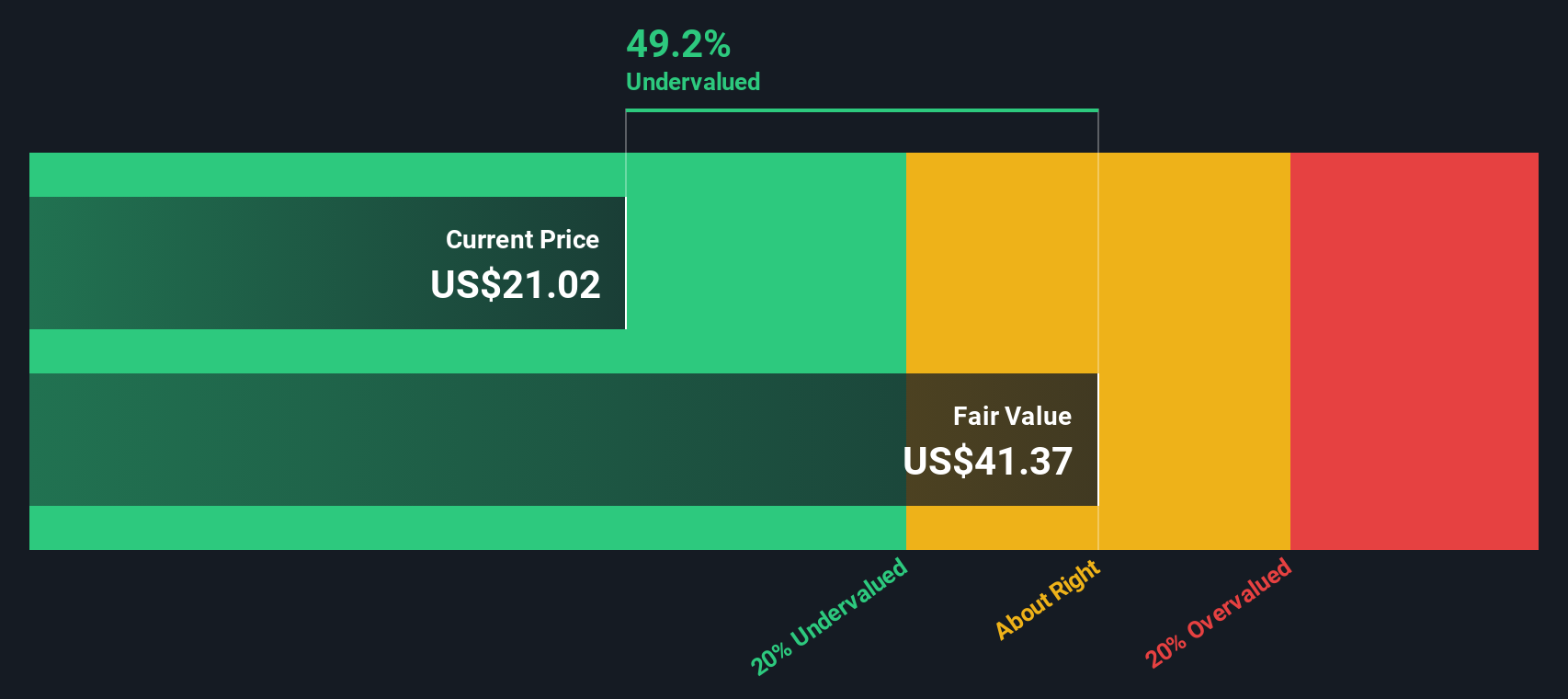

Result: Fair Value of $41.18 (UNDERVALUED)

See our latest analysis for Ingram Micro Holding.However, slowing annual revenue growth and sector uncertainty could pose challenges. This makes it important for investors to keep expectations in check for now.

Find out about the key risks to this Ingram Micro Holding narrative.Another View: What Does the SWS DCF Model Say?

Looking from a different angle, our DCF model also finds the stock trading below its fair value. This provides a second hint that INGM could be undervalued. However, do both approaches overlook deeper risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ingram Micro Holding Narrative

If you have a different perspective or want to dig a little deeper, you can easily build your own take in just a few minutes. Do it your way

A great starting point for your Ingram Micro Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sticking to just one stock means risking missed opportunities. Take your portfolio to the next level by uncovering powerful trends and breakthrough companies with these handpicked ideas:

- Spot untapped potential and amplify your returns when you scan the market for undervalued stocks based on cash flows hiding in plain sight.

- Boost income and stability by zeroing in on dividend stocks with yields > 3% that consistently reward shareholders with attractive payouts.

- Tap into the next big tech wave by targeting AI penny stocks pushing boundaries in machine intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGM

Ingram Micro Holding

Through its subsidiaries, distributes information technology products, cloud, and other services in North America, Europe, the Middle East, Africa, the Asia-Pacific, Latin America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives