- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

Is HP’s Recent Hybrid Work Push Driving a Bargain for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with HP stock right now? You are not alone. With shares closing at $28.16 most recently, HP has become quite the conversation starter for both steadfast holders and curious would-be investors. This is a stock that has zipped up an impressive 85.0% over five years, though the last year has told a more complicated story, with shares down 19.1%. In fact, after a flat month (0.0%) and a modest 1.3% drop in the past week, it is fair to wonder just what is driving the mood swings around this tech staple.

Recently, much of the attention has centered on HP’s steady push into hybrid work solutions and its ongoing cost-optimization plans. News around these strategic bets and the company’s ability to adapt to changing office environments has played into investor sentiment, for better or worse. The longer-term return of nearly 14% over three years shows the company is no stranger to change. Recent sideways movement hints at some hesitation as the market sorts out the risk and reward balance.

HP currently earns a value score of 5 out of 6 by standard valuation checks, suggesting that, by most traditional measures, the stock rates as undervalued. But as any seasoned investor knows, no two valuation methods tell the whole story. Let’s explore how these valuation approaches stack up for HP, and be sure to stay tuned for a more insightful way to make sense of its true worth by the end of our article.

Why HP is lagging behind its peers

Approach 1: HP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For HP, this analysis uses the Free Cash Flow to Equity over a multiyear horizon, factoring in both analyst predictions and longer-term forecasts.

HP’s most recent reported Free Cash Flow stands at $3.01 billion. Analyst estimates suggest moderate variation in cash flows over the next five years, with projections such as $3.58 billion in 2026, $3.51 billion in 2028, and $3.30 billion by 2029. Beyond these analyst-driven years, future cash flows are extrapolated based on trend assumptions. All cash flow figures are analyzed in USD.

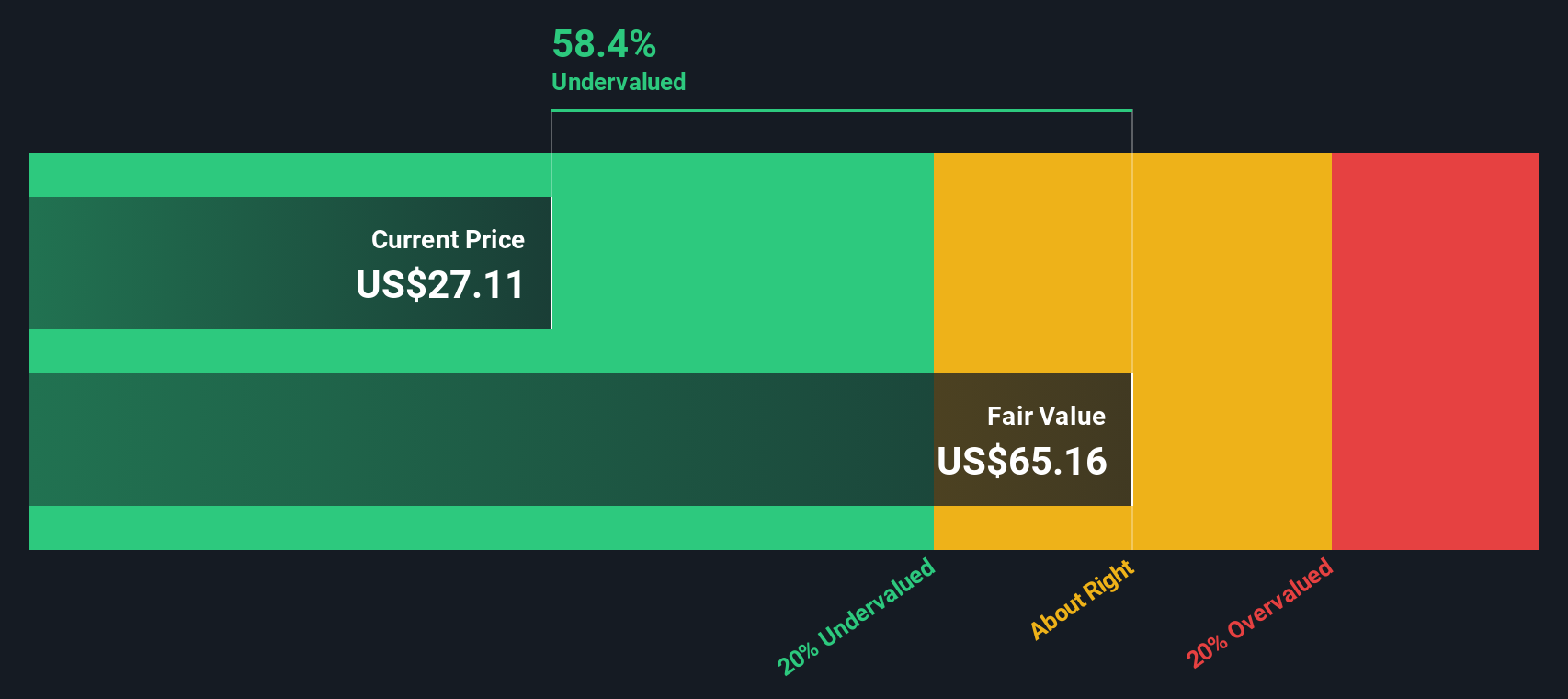

Taking these projections and discounting them at an appropriate rate, the model arrives at an intrinsic value for HP stock of $50.50 per share. With the current trading price at $28.16, the DCF calculation suggests HP may be trading at a significant 44.2% discount to fair value. This indicates potential undervaluation based on long-term fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HP is undervalued by 44.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: HP Price vs Earnings

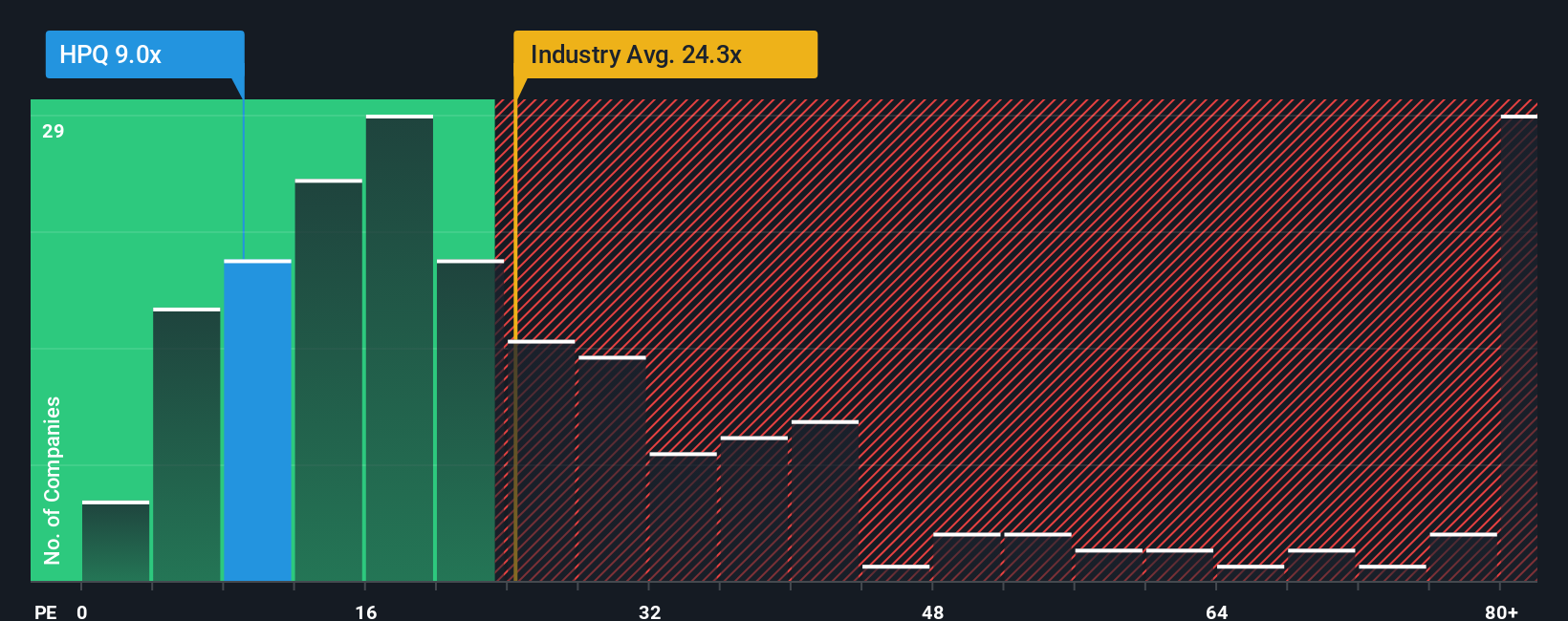

The price-to-earnings (PE) ratio is widely considered a reliable valuation tool for profitable companies like HP because it connects what investors are currently paying for each dollar of earnings. A lower PE can suggest a bargain if earnings are stable, while a higher PE might indicate strong growth expectations or potentially increased risk.

For HP, the current PE ratio is 10x, which sits well below the tech industry average of 23.9x and also undercuts the peer average of 26.1x. At first glance, this looks like an indicator of undervaluation. However, "normal" or fair PE ratios also hinge on how quickly a company is expected to grow and the risks it faces. Faster-growing and safer businesses typically command higher multiples.

This is where Simply Wall St's proprietary "Fair Ratio" helps sharpen the analysis. Instead of a simple comparison to the industry or peers, the Fair Ratio for HP is calculated as 26.9x. This reflects not just its industry setting, but also HP’s own earnings growth profile, profit margins, risk factors, and market size. Because this approach synthesizes the most relevant contributors to value, it creates a more precise benchmark.

Comparing HP’s actual PE of 10x to its Fair Ratio of 26.9x, the stock appears significantly undervalued by this measure. This gap suggests investors may be under-pricing HP’s future prospects relative to what would typically be expected for a company with its financial and market characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HP Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own “story behind the numbers” for a company like HP, combining your beliefs about future revenue, profit margins, and competitive factors with your interpretation of fair value. Narratives connect a company’s outlook and business changes directly to specific financial forecasts and ultimately a personal estimate of what the stock should be worth.

Narratives are easy to use and available right within Simply Wall St's Community page, making them accessible for investors of all experience levels. By clearly laying out your assumptions, Narratives help you see how different perspectives can lead to buy, hold, or sell decisions, especially as you compare your fair value to the current market price. Best of all, these Narratives update automatically when new information or news hits, so your perspective stays current.

For HP, one investor might use a Narrative focused on the company's momentum in AI computing and premium services to estimate a fair value at the high analyst target of $30.00. Others, more cautious about long-term print market declines, might set their fair value at the lower end, around $25.00. Whichever story fits your view, Narratives let you articulate and test it, helping you take action with clarity and confidence.

Do you think there's more to the story for HP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives