- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

HP (NYSE:HPQ) Surges 23% Over Last Month Outpacing Market

Reviewed by Simply Wall St

HP (NYSE:HPQ) made headlines recently with its co-designed livery with Scuderia Ferrari, blending innovation and tech integration in a celebration during the Miami Grand Prix. This branding exercise, paired with the restructuring of its Fixed-Income Offering through key underwriter additions, underpins HP's strategic alignment with technology and financial partners. Over the last month, HP's share price moved up by 23%, a significant leap compared to the overall market increase of nearly 4%. These initiatives likely added momentum to HP's stock performance, aligning with broader market trends while enhancing its brand presence and financial positioning.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

The recent branding initiatives and strategic restructurings are likely to sustain HP's momentum in fostering market engagement and financial stability. While the collaboration with Scuderia Ferrari could enhance brand visibility and support marketing endeavors, it's essential to assess these developments against the broader backdrop of HP's progress. Over the last five years, HP's total shareholder return, including share price appreciation and dividends, stood at 102.65%, reflecting the company's long-term performance trajectory.

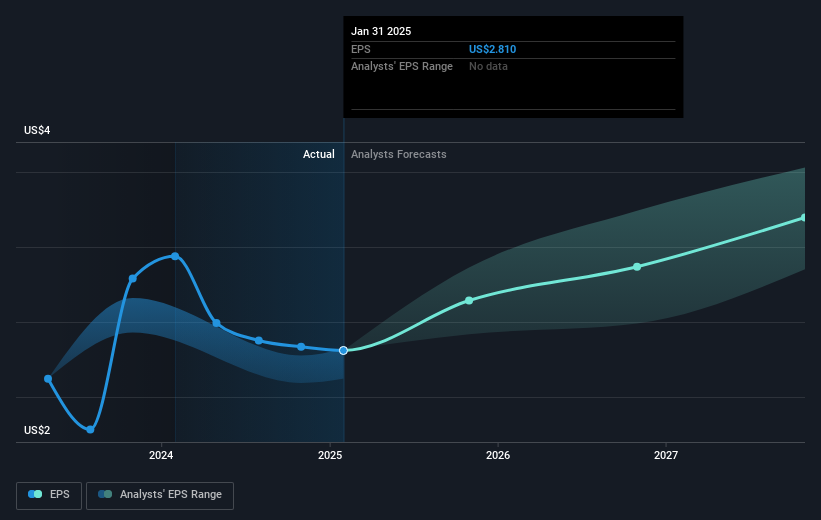

In the shorter-term context, HP's shares have not matched the US tech industry's 11.4% gain over the past year, suggesting there are challenges in maintaining pace with industry growth. The recent corporate actions have potential implications for HP's earnings and revenue forecasts, which estimate a moderate increase to approximately US$56.5 billion in revenue and US$3.3 billion in earnings by 2028. This narrative must also be viewed in light of the analysts' price target of US$32.35, representing a potential 20.8% upside from the current share price of US$25.63, assuming the company's assumptions hold. The strategic investments in AI and diversification of the supply chain are expected to bolster HP's net margins and address revenue stability, providing a foundation for future initiatives. However, aligning these factors with revenue and earnings forecasts remains critical for achieving desired financial outcomes.

Examine HP's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives