- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

Backed by Berkshire - What can Investors Expect from HP (NYSE:HPQ) Before Today's Earnings Release

Key takeaways:

- Berkshire built an 11.5% stake in HP, indicating that investors expect improved performance.

- The fundamentals of HP are stable and revenue is expected to increase.

- Investors have a chance to revisit the company before earnings and claim a 2.6% dividend in the next 7 days

HP (NYSE:HPQ) is reporting earnings today, and investors have been riding new price levels on the back of Warren Buffett's team of stock pickers. In this analysis, we will go over the latest insider buys at HP, as well as re-cap the fundamentals before today's release.

See our latest analysis for HP

HP Insider Transactions In The Last 12 Months

An insider transaction is when someone affiliated with the company buys/sells a position. When a company like Berkshire (NYSE:BRK.A) builds up a large enough position, they become insiders and their transactions have to be made available to the public.

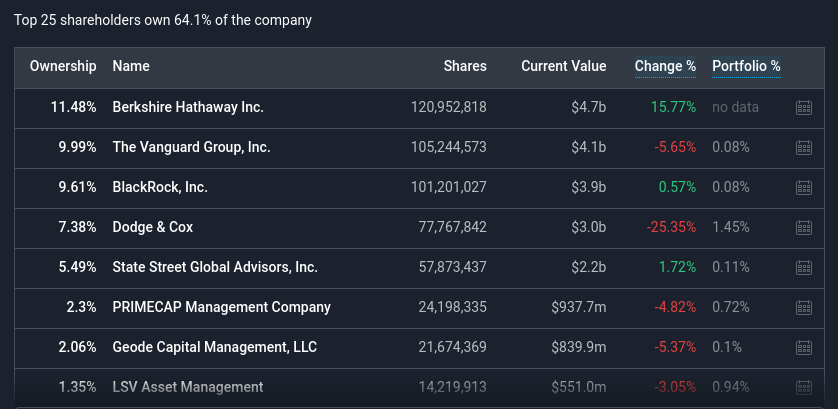

In the table below, we can see a large position from Berkshire, making the company the largest shareholder with an 11.5% stake.

After investors got wind that Warren's team has been entering HP, the mood changed, and both retail and institutions got in.

Berkshire first reported this position last month, while the stake was initiated on the 6th of April. The current ownership distribution of HP, makes it predominantly an institutionally held stock, but the new stake from Berkshire may inspire more management discipline and efficiency.

Next, we will review the key fundamentals for HP, and see if the stock makes sense before today's earnings.

Fundamentals

HP has been making $65b in revenue in the last 12 months. The company is stable and operating at a 10% net margin. Analysts expect the company to grow revenue to $65.8b, but earnings to fall to $4.24b by the end of 2022.

The stock is going ex-dividend in the next 7 days, so investors that want to get the next dividend need to be shareholders before that. At the current price level, the stock will yield a 2.6% dividend, which is above the market bottom and average industry rates.

HP is well capitalized, and even though some investors are uneasy about the negative book value of equity, the company has a debt to market value of equity of 17%, plus a cash cushion of $3.4b.

The biggest quality of HP however, is their hardware. While this is hard to estimate, it seems that HP has become the preferred vendor for professional notebooks at the offices for companies which don't work with Apple MacBooks.

Conclusion

HP will report earnings after today's close, and investors that are interested in the company can take a deeper dive in the fundamentals before the announcement.

A large part of the increased enthusiasm from investors, is the building of a significant 11.5% stake from Berkshire in the company. Some investors use this as a proxy for good decision-making from seasoned analysts and managers.

Both the fundamentals and the quality products indicate that HP is a valuable company, that may even be able to increase its efficiency from the active investors at Berkshire.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives