- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Why Hewlett Packard Enterprise (HPE) Is Up 7.2% After Nokia Licenses AI Networking Technology

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Nokia announced it had licensed technology assets from Hewlett Packard Enterprise (HPE) to strengthen its AI-powered radio access network (RAN) automation, integrating HPE’s RAN Intelligent Controller with Nokia’s MantaRay platform and transferring an HPE development team to Nokia.

- This agreement highlights HPE’s influence in next-generation networking technologies and its expanding role in collaborative innovation within the telecommunications sector.

- We'll examine how the Nokia licensing partnership and record AI revenues may shape HPE's investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hewlett Packard Enterprise Investment Narrative Recap

To be a shareholder in Hewlett Packard Enterprise, you need confidence in its ability to capitalize on AI-demand and hybrid cloud adoption, balanced against execution risks, particularly the integration of Juniper and intense industry competition. The recent Nokia licensing deal underscores HPE’s credibility in AI networking, but does not materially alter the reality that Juniper integration remains the near-term catalyst and the main risk to margin expansion.

HPE's record AI Systems revenues of $1.6 billion in the third quarter, driven by accelerated deployments and strong enterprise demand, tie directly to the optimism behind the recent Nokia partnership. Together, these announcements reinforce HPE’s pursuit of higher-growth, higher-margin opportunities amid intensifying sector competition, but they do not remove the hurdles posed by acquisition integration and evolving industry pricing.

Yet, behind the headlines, investors should be aware that should integration of Juniper stumble, the much-anticipated margin and growth benefits may not materialize as swiftly as expected...

Read the full narrative on Hewlett Packard Enterprise (it's free!)

Hewlett Packard Enterprise's outlook suggests revenues of $44.4 billion and earnings of $2.7 billion by 2028. This is based on analysts forecasting 10.3% annual revenue growth and an earnings increase of $1.6 billion from the current $1.1 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $25.82 fair value, in line with its current price.

Exploring Other Perspectives

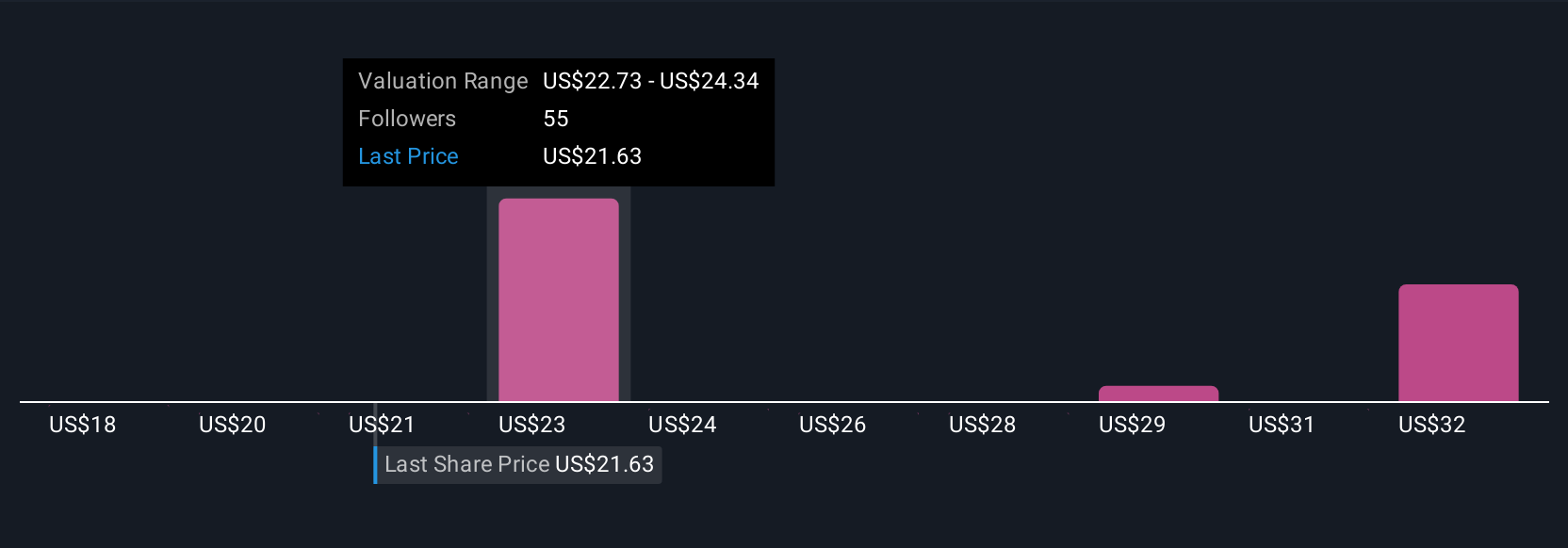

Seven members of the Simply Wall St Community estimated HPE’s fair value from US$17.90 to US$48.01. While many anticipate margin growth from Juniper, sharply different views signal that investors weigh the integration risk very differently.

Explore 7 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth 32% less than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate risk and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success