- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Unveils Cutting-Edge Networking Solutions At Mobile World Congress 2025

Reviewed by Simply Wall St

Hewlett Packard Enterprise (NYSE:HPE) recently unveiled new networking solutions and partnerships at Mobile World Congress 2025, emphasizing its focus on enhancing AI capabilities and Open RAN technology. Despite these advancements, HPE experienced a share price decline of 4.5% over the last week. This decline may reflect broader market trends, as major U.S. stock indices, including the Dow Jones and Nasdaq, also posted losses amid lingering economic concerns and the impact of tariffs and trade policies. Notably, manufacturing data missed expectations, exacerbating inflationary concerns. Additionally, Nvidia and other tech stocks experienced volatility last week, indicating investor caution towards tech shares despite HPE's encouraging developments. The company’s moves align with growth in AI and edge computing, yet short-term market influences and macroeconomic factors may have contributed to its share price movement in a challenging market environment.

Click to explore a detailed breakdown of our findings on Hewlett Packard Enterprise.

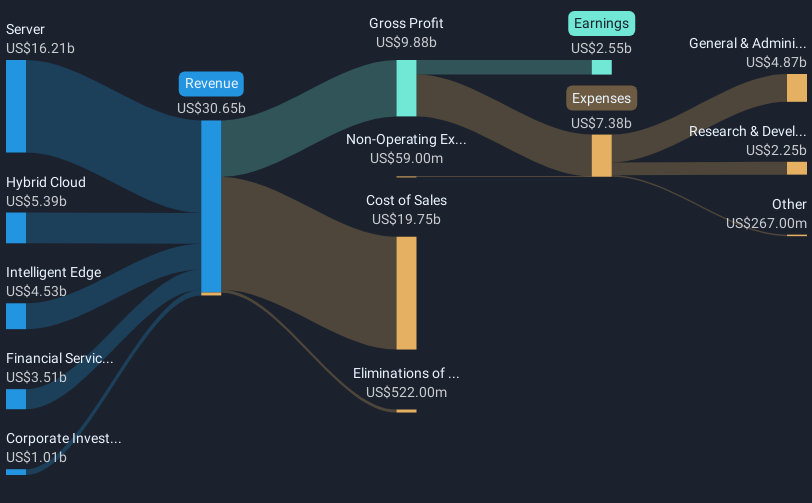

Over the last five years, Hewlett Packard Enterprise (HPE) delivered an impressive total return of 109.72%. This performance is partially underscored by HPE's significant profit growth, with earnings rising approximately 21.8% annually during the period, alongside diversified business expansions. Last year's 26.1% earnings growth further highlighted its robust financial health compared to the tech industry, which grew by 23.9%. HPE's collaborative endeavors, such as their partnership with Deloitte to bolster enterprise AI capabilities, have also likely fueled their long-term growth trajectory.

Initiatives like the introduction of HPE GreenLake cloud services and collaborations with research entities for advanced tech solutions set the tone for sustained growth. Despite recent market fluctuations, HPE's strategic measures to enhance its product offerings, combined with its compelling valuation relative to peers, established a strong foundation. Market participants have generally aligned on positive price targets, supporting the stock's trajectory over its broader five-year success.

- See how Hewlett Packard Enterprise measures up with our analysis of its intrinsic value versus market price.

- Discover the key vulnerabilities in Hewlett Packard Enterprise's business with our detailed risk assessment.

- Got skin in the game with Hewlett Packard Enterprise? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives