- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Sees 14% Price Drop Over Trade Tensions and Tariffs

Reviewed by Simply Wall St

Hewlett Packard Enterprise (NYSE:HPE) has recently been making noteworthy advancements in AI integration and client services, highlighted by its collaboration with Compucom and the enhancement of its Full Lifecycle Observability capabilities. Despite this, over the past week, HPE experienced a 14% price decline. This drop occurred amid broader market turmoil, with the Dow Jones down 4% and the tech-heavy Nasdaq falling 5% due to growing trade tensions and newly announced tariffs. The overall market performance and economic uncertainties likely influenced investor sentiment, overshadowing HPE's recent positive developments and robust financial growth reports.

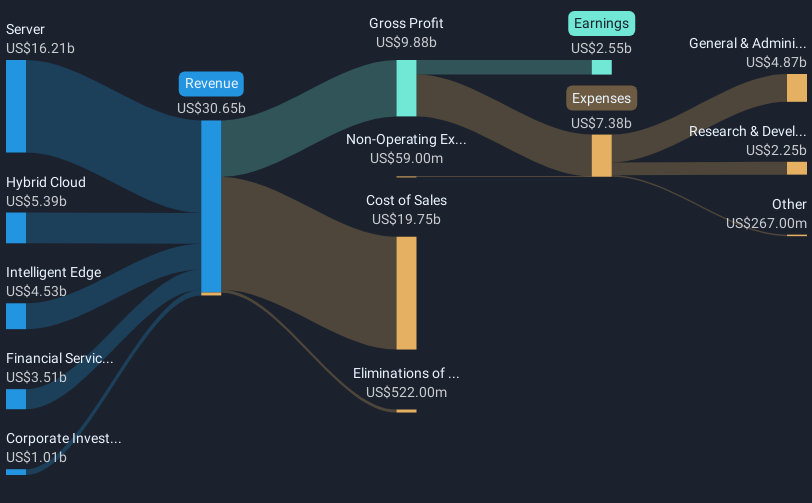

Over the last five years, Hewlett Packard Enterprise (HPE) delivered a total return of 52.79% when considering both share price and dividends, even as it faced regulatory and competitive challenges. Notable efforts included the integration of AI-focused solutions and cloud strategies through its GreenLake platform, which achieved an Annualized Recurring Revenue exceeding US$2 billion for the first time. HPE's acquisition of Juniper Networks aimed to deliver synergies of at least US$450 million over three years, promising to streamline operations, although it faced some litigation by the Department of Justice that may impact future prospects.

Their performance in Q1 2025 saw sales rise to US$6.98 billion, with net income reaching US$627 million, reflecting a consistent financial upswing. However, workforce reductions, significant buyback activity, and pricing pressures in the server segment indicate ongoing adjustments in operations. Despite outstripping industry earnings growth over the past year, HPE underperformed both the US market and the tech industry in one-year returns, highlighting the complex landscape HPE navigated to secure such a five-year return record.

Understand Hewlett Packard Enterprise's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives