- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Partners With Klein And Spark To Drive AI And Cloud Growth

Reviewed by Simply Wall St

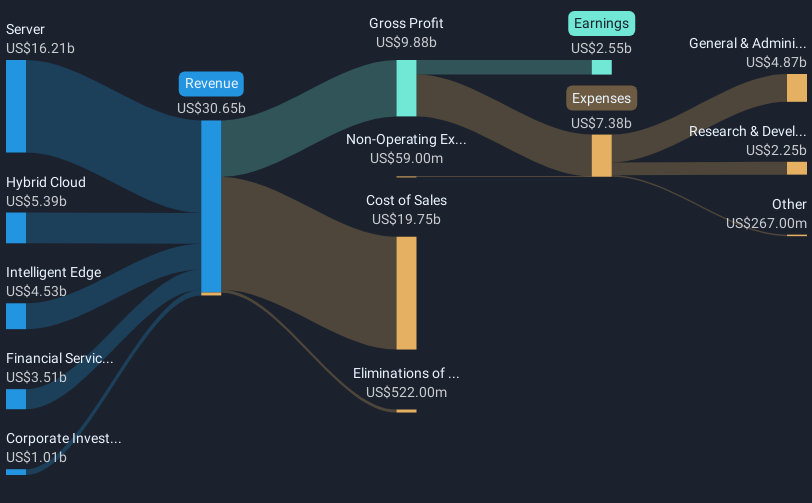

Hewlett Packard Enterprise (NYSE:HPE) has recently embarked on notable client partnerships, such as its collaboration with Klein Computer System AG to deploy HPE Private Cloud AI and with Spark New Zealand to enhance IT infrastructure through HPE GreenLake services. Despite these initiatives, HPE's share price fell 19% last week, amidst a broader market downturn of 3.7%. This decline coincides with concerns emanating from fiscal policy uncertainties and recession expectations impacting investor sentiment across the tech sector. While HPE reported impressive Q1 2025 financial results, these were not enough to shield the company from a volatile market landscape, exacerbated by policy uncertainty and economic apprehensions affecting technology stocks generally. During the same period, indices like the Nasdaq saw significant volatility, with tech stocks experiencing varied performance, including gains in companies like Nvidia and Tesla, but overall market sentiment remained pressured.

Over the past five years, Hewlett Packard Enterprise has achieved a total shareholder return of 116.4%, reflecting both stock appreciation and dividends paid. This significant gain indicates solid performance relative to its historical baseline. Factors contributing to this return include consistent earnings growth, notably with earnings expanding by 23.1% annually. Key developments, such as the introduction of HPE GreenLake improvements and collaborations with firms like Deloitte for AI solutions, have aided the company's competitive positioning. The announcement of AI-driven cloud solutions has further bolstered this growth trajectory.

Despite this success, HPE's recent performance has seen some lag when compared to the broader tech industry and market, with the company underperforming both over the last year. Noteworthy is the impact of substantial insider selling in recent months, which could have influenced investor confidence. However, HPE continues to emphasize returning value through consistent dividend payouts and stock buybacks, reinforcing its commitment to shareholder interests.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hewlett Packard Enterprise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives