- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Advances Networking Solutions With Expanded HPE Aruba Offerings

Reviewed by Simply Wall St

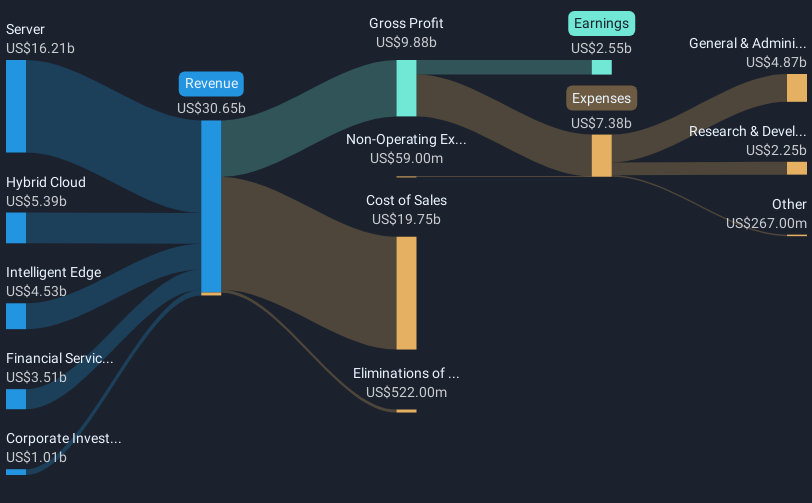

Hewlett Packard Enterprise (NYSE:HPE) recently announced significant expansions of its HPE Aruba Networking portfolio, including the introduction of new distributed services switches, which are geared towards enhancing performance for AI and enterprise applications. This comes amid a favorable market environment, with the S&P 500 up 11% over the past year and stability in recent trading. These developments likely added weight to HPE's stock appreciation, as the company's shares advanced 10% over the past month. The broader market's flat performance would have provided little resistance to HPE's upward movement, supporting its gains driven by product innovation.

Find companies with promising cash flow potential yet trading below their fair value.

Hewlett Packard Enterprise's recent expansion in its HPE Aruba Networking portfolio could potentially have a positive impact on its revenue and earnings. The focus on AI and enterprise applications might attract new business, boosting the company's high-margin offerings and supporting future financial growth. This aligns with its AI and cloud strategies, including GreenLake, which are poised for capturing AI workload revenues.

Over the past five years, HPE's total shareholder return, including dividends, has reached 112.05%. This reflects a significant growth in value for investors over this extended period. In contrast, over the past year, HPE underperformed compared to the broader US market, which returned 11.3%, and the US Tech industry, which returned 4%. This discrepancy suggests a challenging environment in the short term despite an overall positive long-term trajectory.

Analysts currently forecast HPE's revenue growth at 4.8% annually for the next three years, with earnings projected to reach US$2.7 billion by 2028, showing a slight decline from current levels. The expected synergies from the Juniper Networks acquisition and focus on AI might counterbalance some market and regulatory challenges that HPE faces. The current share price of US$16.49 indicates an 11.36% discount to the consensus price target of US$18.98, reflecting potential for upward movement if HPE successfully addresses these hurdles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives