- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Does HPE’s Recent AI Supercomputer Deal Signal More Room for Growth in 2025?

Reviewed by Bailey Pemberton

Are you eyeing Hewlett Packard Enterprise (HPE) and wondering if now is the right moment to jump in, hold steady, or take some gains off the table? You are definitely not alone. HPE has been turning heads with its performance lately, and investors are continuously trying to gauge if the current stock price lines up with its true value or the broader market mood.

Over the last year, HPE's journey has been anything but dull. A 23.8% gain in the past 12 months may have outpaced many peers, and that strong upward momentum is even clearer when you zoom out. A total return of 211.5% over five years stands out in any comparison. This kind of steady long-term growth suggests that investors, perhaps reassured by HPE’s adaptability to market changes and its ongoing focus on strategic sectors, see both potential and resilience here. Shorter-term moves remain positive too, with the stock up 0.4% in the last week and 16.4% year-to-date. This may reflect the ongoing market recognition of HPE's positioning as well as broader tech sector optimism.

But what about value? Is HPE still an underrated pick, or has the price run too far ahead of fundamentals? Taking a step back and assessing its valuation score, 3 out of 6 checks, suggests there is still something to analyze. Let’s break down how HPE stacks up with classic valuation tools first and, later on, I’ll share a smarter way to cut through the noise and spot when a stock is truly undervalued.

Approach 1: Hewlett Packard Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and bringing those estimates back to today’s dollars using a discount rate. This helps investors assess what the business is truly worth based on its ability to generate cash in the years ahead.

Looking at Hewlett Packard Enterprise, the latest reported Free Cash Flow stands at $-344.4 Million. While this negative figure might give some pause, forward projections are much more positive. Analyst estimates for 2026 expect Free Cash Flow to reach about $2.35 Billion, and by 2028, projections see this rising further to approximately $3.54 Billion. Simply Wall St extends these estimates over a 10-year period, showing a continued trajectory upwards, with cash flows climbing each year and exceeding $6.4 Billion by 2035.

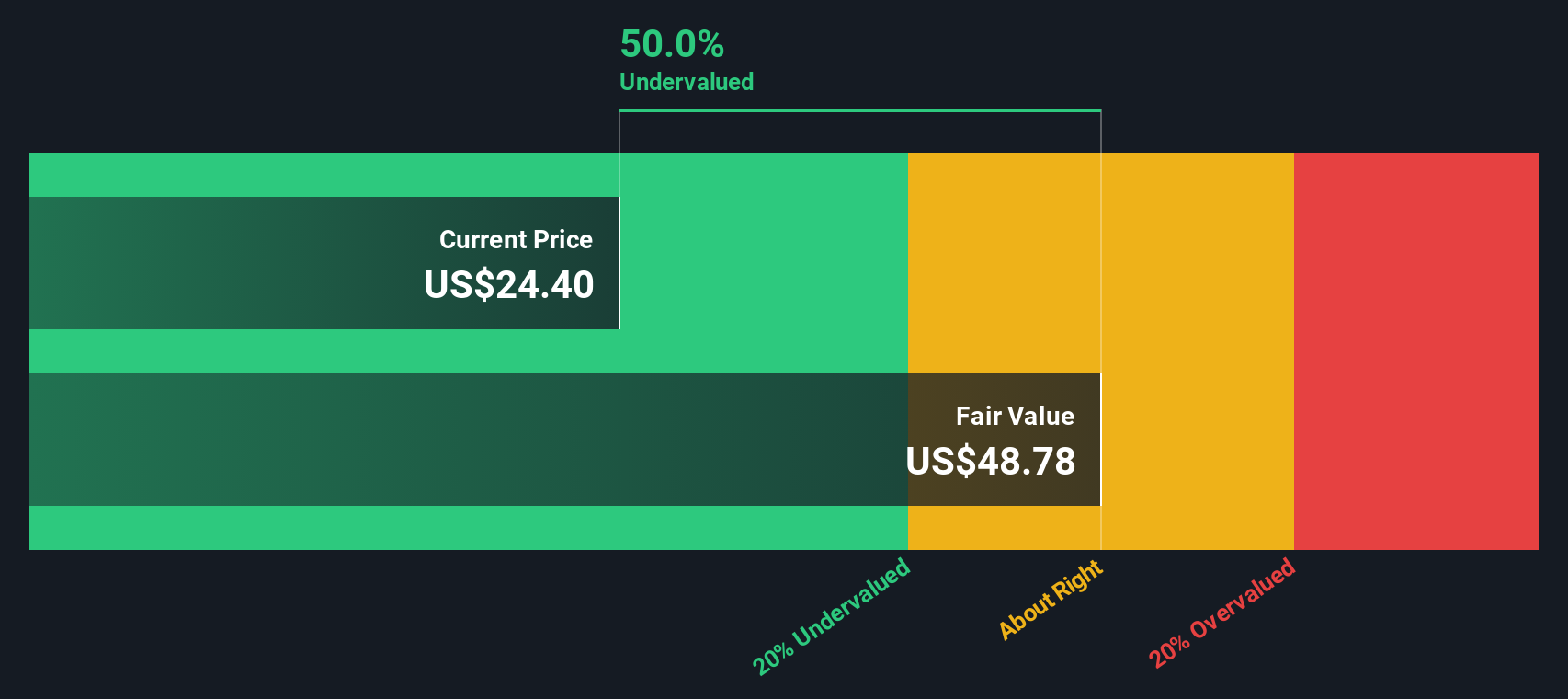

Based on these projections, the DCF analysis calculates an intrinsic value of $47.91 per share. With HPE currently trading at a substantial discount compared to this estimate, and suggesting the stock is 47.8% undervalued, this indicates a notable margin of safety for investors considering the stock’s future cash-generating potential versus its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hewlett Packard Enterprise is undervalued by 47.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hewlett Packard Enterprise Price vs Earnings

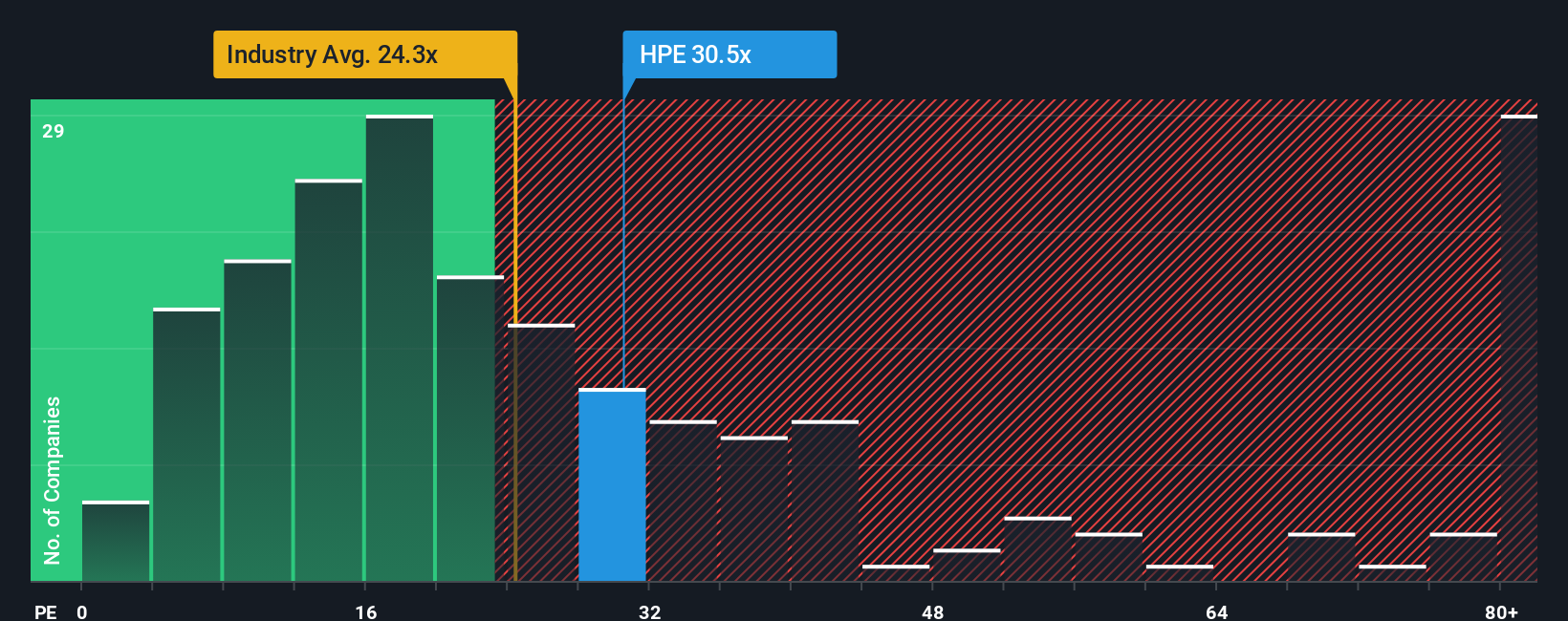

The price-to-earnings (PE) ratio is a classic tool for valuing profitable companies like Hewlett Packard Enterprise. It helps investors gauge whether a stock’s price matches the company’s earnings power, providing a quick reality check against market expectations. Generally, higher growth prospects or lower perceived risk can justify a higher PE ratio, while slower growth or more risk tends to keep the ratio lower.

Currently, HPE’s PE ratio sits at 29x, which places it above both the Tech industry average of 23.5x and the peer average of 21.4x. At first glance, that could suggest HPE might be a little expensive on straight comparisons. However, Simply Wall St offers deeper insight through its proprietary Fair Ratio. The Fair Ratio reflects what a reasonable PE might be for HPE, accounting for nuanced factors such as its particular growth outlook, earnings quality, market cap, profit margins, and risk profile, rather than just simple industry averages.

For HPE, the Fair Ratio is calculated at 47.7x. This higher Fair Ratio suggests that, once we consider the company’s specific fundamentals and prospects, the stock may actually be undervalued by comparison. It demonstrates why weighing up the Fair Ratio gives a more complete and tailored perspective than peer or sector averages alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hewlett Packard Enterprise Narrative

Earlier we mentioned there is an even better way to understand a company’s value, so let’s introduce you to Narratives. Narratives on Simply Wall St are your way to create a story behind the numbers by blending your perspective on a company's future with forecasts for revenue, profits, margins, and ultimately a fair value estimate.

A Narrative connects what you believe about a company’s direction to a concrete financial forecast, so you can clearly see how your story lines up with where a stock should trade today. It’s simple and accessible: just visit the Hewlett Packard Enterprise Community page on Simply Wall St, where millions of investors compare and discuss Narratives for the same stock.

Using Narratives, you can make buy or sell decisions faster by seeing at a glance whether your fair value (based on your expectations) is higher or lower than the current price. And because Narratives update automatically when new news or earnings are released, your view is always relevant and timely.

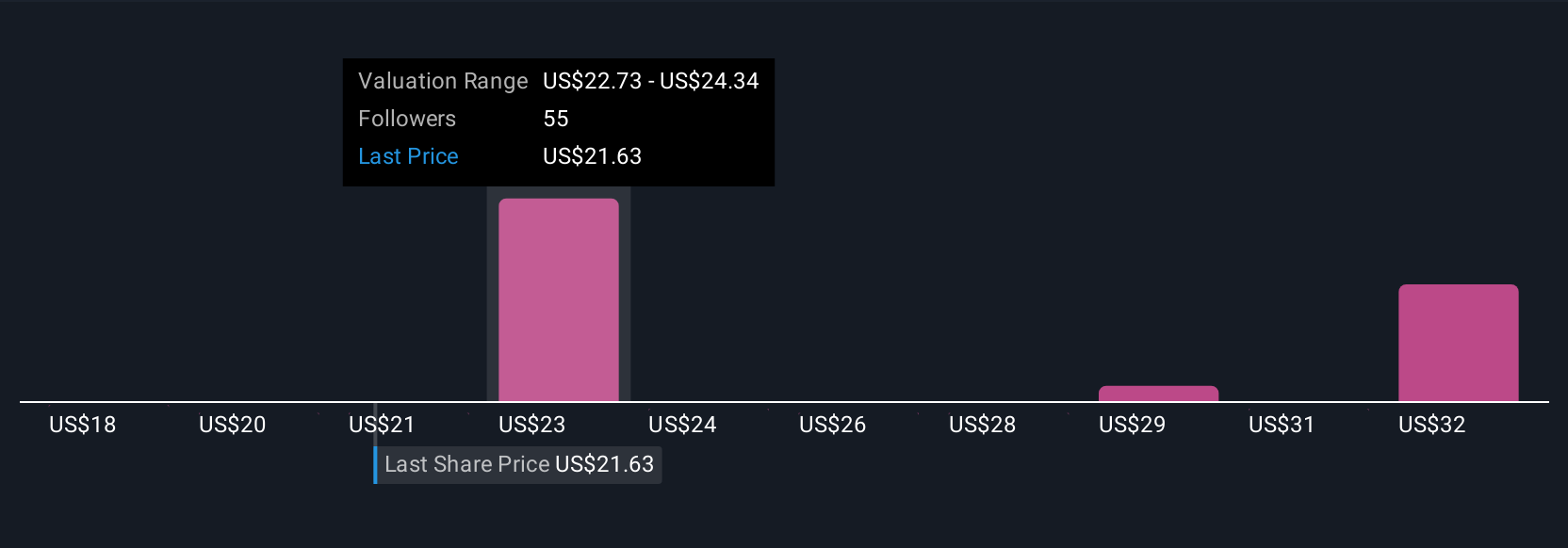

For example, some Hewlett Packard Enterprise investors are bullish, forecasting rapid AI and hybrid cloud growth, and as a result estimate the company could be worth up to $30 per share, while others cite increased competition and set a more cautious price target as low as $19. This highlights how Narratives put your own investment thesis front and center in your valuation process.

Do you think there's more to the story for Hewlett Packard Enterprise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)