- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Can HPE’s (HPE) AI Security Bet Redefine Its Competitive Edge in Enterprise IT?

Reviewed by Simply Wall St

- At Black Hat USA 2025, Hewlett Packard Enterprise announced a major expansion of its cybersecurity and data protection portfolio, introducing AI-driven network security features, integrations with partners like CrowdStrike, and new hardware solutions such as the Alletra Storage MP X10000 for modern data protection.

- This multi-layered approach highlights HPE's commitment to integrating AI and zero trust technologies across its networking and hybrid cloud offerings, aiming to enhance enterprise protection and system resiliency.

- We'll explore how this focus on AI-enabled security and data protection may influence Hewlett Packard Enterprise's investment outlook and analyst assumptions.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hewlett Packard Enterprise Investment Narrative Recap

To be a shareholder in Hewlett Packard Enterprise today, you need to believe in the company’s ability to capitalize on AI-driven security and hybrid cloud trends, especially if its integration of Juniper Networks is successful. The recent launch of AI-powered cybersecurity and data protection solutions meaningfully supports HPE’s positioning in these growth areas but does not materially reduce the regulatory risk tied to the Juniper merger, which remains a key short-term catalyst and uncertainty.

HPE’s expanded global alliance with Kyndryl to deliver HPE Private Cloud AI through NVIDIA-backed solutions stands out as especially relevant. These collaborations are closely aligned with HPE’s emphasis on higher-margin AI workloads and cloud services, potentially supporting earnings forecasts if the execution matches management’s expectations and integration hurdles are managed.

Yet, in contrast to these opportunities, investors should be aware of ongoing legal and regulatory uncertainty around the Juniper deal, as ...

Read the full narrative on Hewlett Packard Enterprise (it's free!)

Hewlett Packard Enterprise is projected to reach $41.4 billion in revenue and $4.1 billion in earnings by 2028. This outlook reflects an annual revenue growth rate of 9.4% and an increase in earnings of $2.7 billion from the current $1.4 billion.

Uncover how Hewlett Packard Enterprise's forecasts yield a $23.07 fair value, a 11% upside to its current price.

Exploring Other Perspectives

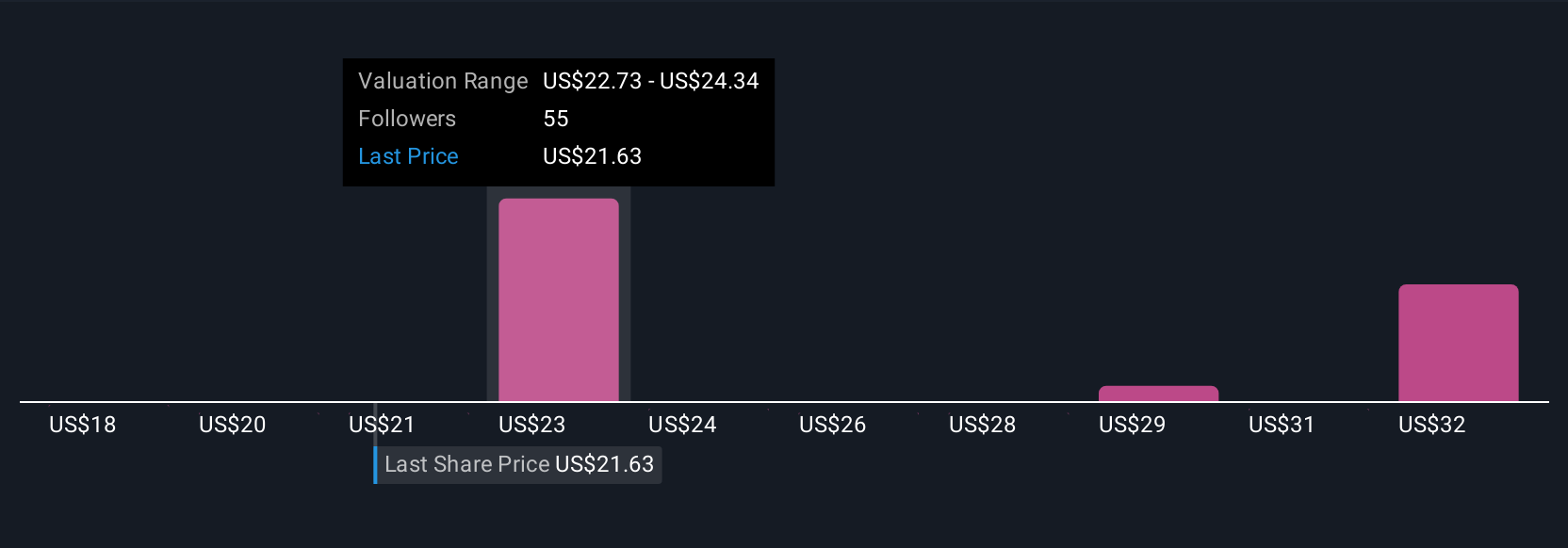

Six private investor fair value estimates for HPE from the Simply Wall St Community range from US$18.54 to US$33.84 per share. While many focus on earnings potential from AI and cloud integration, ongoing DOJ scrutiny of the Juniper acquisition could have broader implications for HPE’s growth trajectory, considering all these viewpoints is important before forming your own outlook.

Explore 6 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth 11% less than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives