Is It Too Late to Consider Corning After 97% Surge and AI Fiber Demand News?

Reviewed by Bailey Pemberton

Are you debating whether to jump into Corning stock or wondering if it is time to take profits? You are not alone. Corning’s meteoric share price surge has put the company right in the spotlight for growth-oriented investors and value seekers alike.

Let’s look at the numbers. In just the past week, Corning’s stock has climbed 6.3%, with an even more impressive 19.9% gain over the last month. If you zoom out further, the year-to-date return stands at an eye-catching 82.7%, and over the past twelve months, investors have seen gains of 97.7%. Going back even further, Corning has provided an astounding 209.2% return over three years and 183.5% over five years. That is the kind of outperformance that definitely makes you pause and reconsider what you thought you knew about this company.

Much of the recent upside can be linked to broader market optimism and positive sentiment around companies with exposure to next-generation technologies. As investors continue to reward firms poised to benefit from global trends, Corning has seen persistent buying interest. This has shifted the risk profile and reflects new confidence in its future.

But here is where things get interesting. According to a multi-check valuation system, Corning’s current value score sits at 0 out of 6. In other words, by these measures, the company does not appear undervalued at all. So, how should you think about its valuation today? Let’s size up the most common approaches first, before I share a smarter way to judge whether Corning deserves a spot in your portfolio.

Corning scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Corning Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to the present, reflecting the time value of money. This approach allows investors to gauge what a company's shares are truly worth today, based on what the business is expected to generate in the coming years.

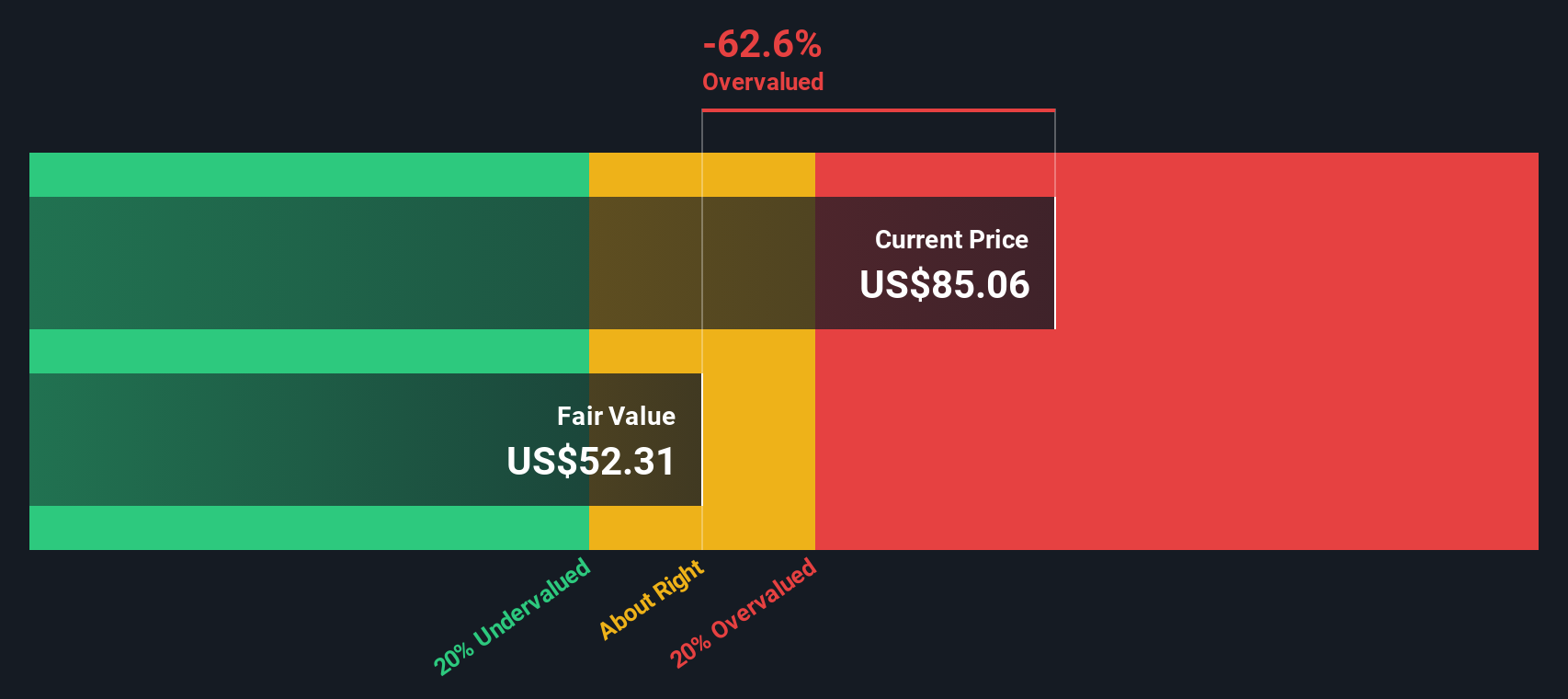

For Corning, the most recent Free Cash Flow stands at $850 million. Analysts provide cash flow estimates for the next five years, starting with $1.99 billion in 2026 and reaching up to $2.57 billion by 2029. After the analyst window, future cash flows are extrapolated, with projections rising gradually through 2035. All values are reported in US dollars.

Running these projections through the DCF model results in an intrinsic fair value of $52.25 per share for Corning. However, based on the current market price, the DCF model indicates the stock is roughly 63.3% overvalued. In other words, Corning’s share price is far ahead of its fundamental cash flow outlook right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corning may be overvalued by 63.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Corning Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used and effective valuation metric for profitable companies. It compares a company’s share price to its per-share earnings, allowing investors to see how much they are paying for one dollar of earnings. This is especially meaningful for businesses with steady profit streams.

Growth expectations and risk levels are key drivers of what qualifies as a “normal” or “fair” PE for any given stock. Rapidly expanding firms or those with lower risk profiles generally command higher PE ratios, reflecting the market’s confidence in their future profitability.

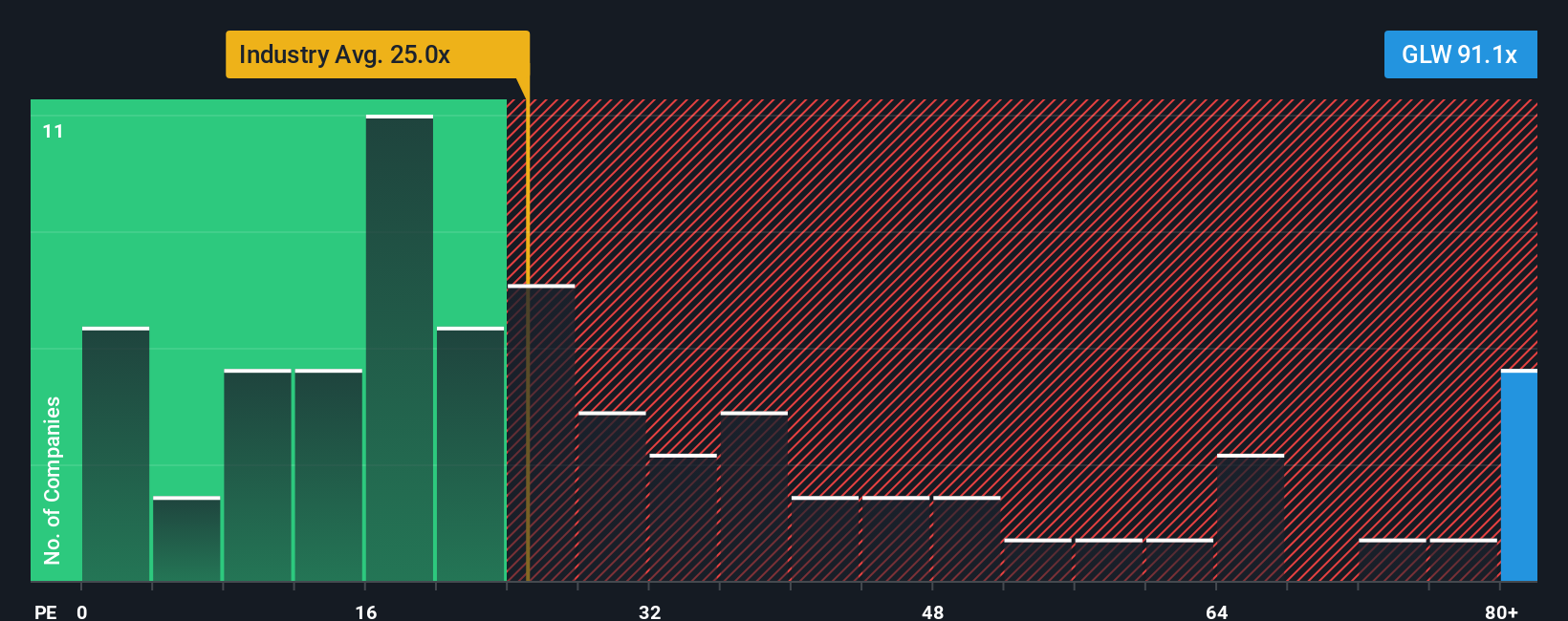

Corning currently trades at a hefty PE ratio of 89.3x. That is much higher than the electronic industry average of 25.2x and also notably above the peer average of 51.5x. Clearly, the market is pricing in a lot of optimism about Corning’s profitability.

Rather than simply comparing with industry or peers, Simply Wall St's “Fair Ratio” provides a more tailored benchmark. This proprietary metric weighs factors like Corning’s earnings growth prospects, profit margins, industry classification, market cap, and company-specific risks. As such, it offers a fairer apples-to-apples comparison when judging valuation.

For Corning, the Fair Ratio is calculated at 38.3x. That is well below the actual PE of 89.3x, reinforcing the takeaway that the stock is currently trading at a premium not justified by its fundamentals or outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corning Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you express your view on a company’s future growth by connecting your story (like how earnings, revenue, or profit margins might change) directly to a financial forecast and a fair value. Narratives bridge the gap between the numbers and the bigger picture, giving you a framework for turning your insights about Corning’s technology, market position, or risks into clear investment rationale.

Available right on Simply Wall St’s Community page, Narratives make it easy for anyone to craft their own scenario, see how it impacts fair value, and compare it to the current share price. Whether you believe Corning’s fastest expansion will come from solar and datacenter growth (as some bulls do, projecting a fair value as high as $84 per share), or you are more cautious and see potential challenges ahead (with a lower fair value near $47), Narratives provide a transparent way to capture your view and update dynamically as new news or earnings are released. This makes deciding when to buy or sell a lot smarter, letting you compare your Narrative’s fair value to the latest price so you’re always investing with your eyes open to the story and the data.

Do you think there's more to the story for Corning? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives