Has Corning’s 101% Surge in 2025 Already Reflected Its Growth Story?

Reviewed by Bailey Pemberton

- If you are wondering whether Corning's blistering run has already priced in the upside, you are not alone; this is exactly the kind of stock where valuation really matters.

- The share price has jumped 12.7% over the last week and 6.4% over the past month, with year to date gains of 101.7% that build on a 1 year return of 101.5%, 3 year return of 203.5% and 5 year return of 198.2%.

- Those kinds of moves have been underpinned by growing optimism around Corning's role in enabling next generation display, fiber and semiconductor technologies, as investors bet on multi year demand for its specialty glass and optical solutions. At the same time, renewed interest in infrastructure, AI data centers and high bandwidth networks has pushed anything tied to advanced materials and connectivity into the spotlight.

- Despite all that enthusiasm, Corning currently scores just 0/6 on our valuation checks, which suggests the market may already be paying up for the story, or that traditional models are missing something. Next we will walk through the standard valuation approaches for Corning, then finish by looking at a more nuanced way to think about what this business is really worth.

Corning scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Corning Discounted Cash Flow (DCF) Analysis

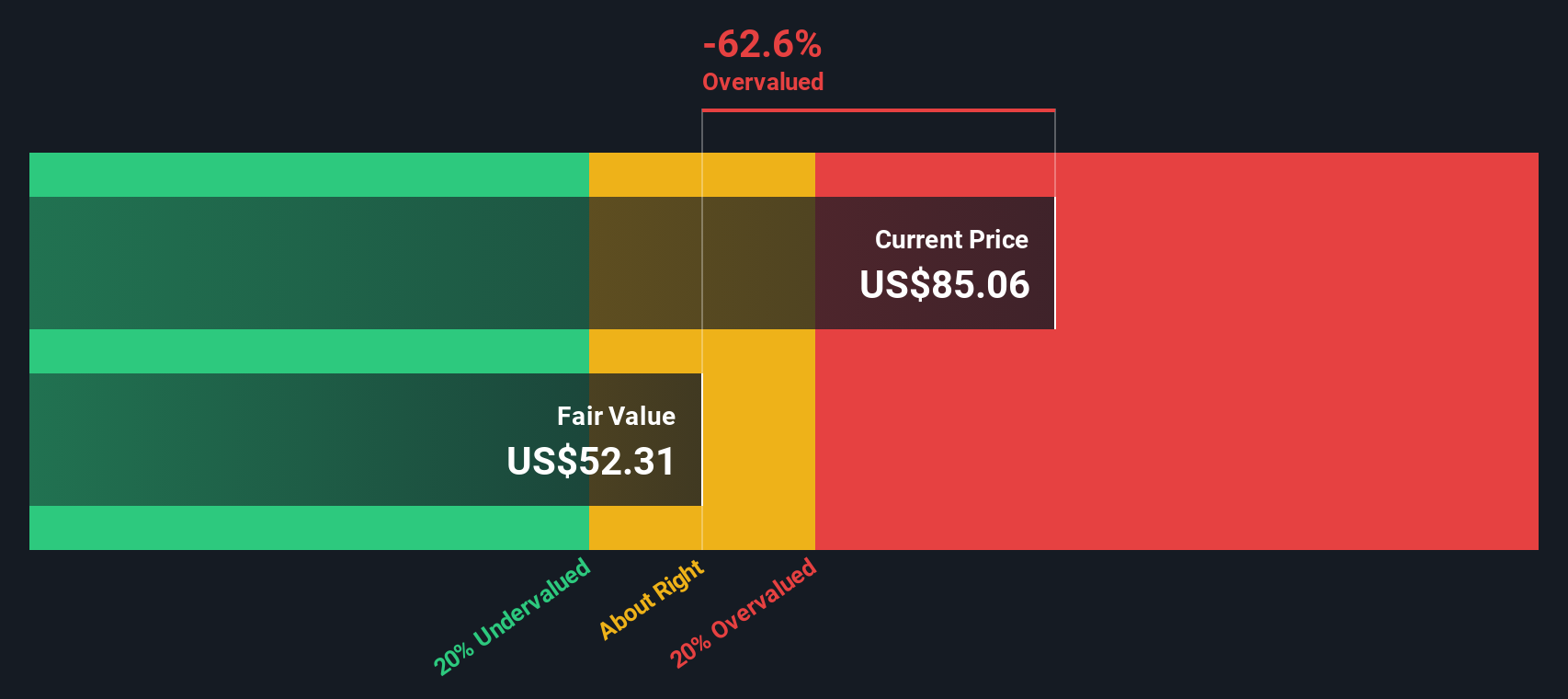

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Corning, the model starts with last twelve months Free Cash Flow (FCF) of about $938 million and builds out a two stage forecast using analyst estimates and longer term extrapolations.

Analysts expect FCF to climb into the low to mid single billions over the next decade, reaching around $4.3 billion by 2035 as demand for its specialty glass, optical and semiconductor related products grows. Simply Wall St projects these cash flows out to 2035 and beyond, then discounts each year’s figure back to today to arrive at a total equity value. On this basis, the intrinsic value is estimated at roughly $65.88 per share.

Relative to the current market price, that implies Corning is about 43.0% overvalued, indicating that investors may be paying a steep premium for its growth story and strategic positioning.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corning may be overvalued by 43.0%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

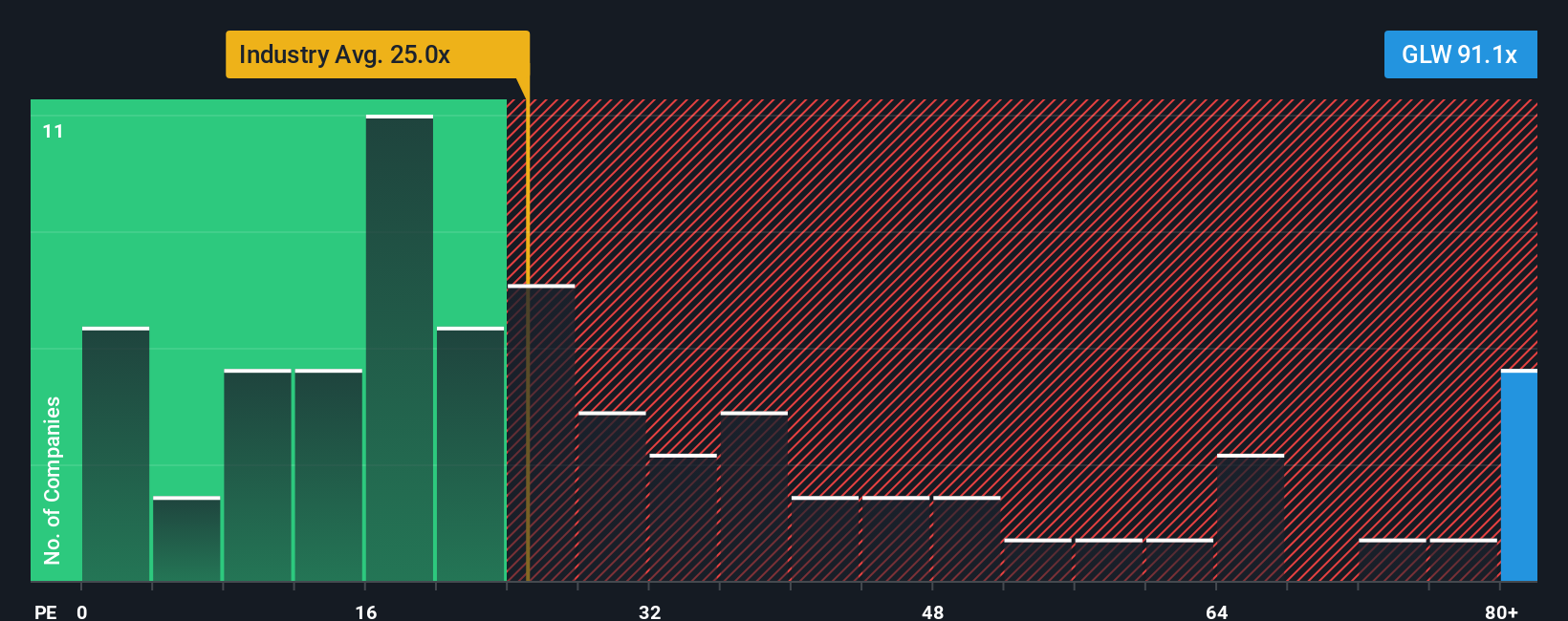

Approach 2: Corning Price vs Earnings

For profitable companies like Corning, the Price to Earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, faster expected earnings growth and lower perceived risk justify a higher PE. In contrast, slower growth, more cyclical earnings or higher uncertainty usually mean a lower, more conservative multiple is appropriate.

Corning currently trades on a PE of about 59.1x, which is well above both the broader Electronic industry average of roughly 25.4x and the peer group average of around 37.8x. To go a step further, Simply Wall St calculates a proprietary Fair Ratio for Corning of 35.2x. This Fair Ratio is designed to reflect what a reasonable PE should be, given the company’s specific earnings growth outlook, profit margins, risk profile, industry positioning and market cap.

Because the Fair Ratio is tailored to Corning’s fundamentals rather than relying on broad peer or sector comparisons, it offers a more nuanced benchmark. With the current PE of 59.1x sitting significantly above the 35.2x Fair Ratio, the stock again screens as overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corning Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company, translated into numbers like fair value, future revenue, earnings and margins, then connected back to today’s share price. A Narrative on Simply Wall St’s Community page lets you spell out why you think Corning’s data center, fiber and solar opportunities will or will not play out, link that view to a financial forecast, and arrive at your own Fair Value that you can compare to the current price to help decide whether to buy, hold or sell. The platform dynamically updates those Narratives as new earnings, news and guidance come in. For example, a bullish Corning Narrative might assume mid teens revenue growth, margin expansion toward the mid teens and a fair value near the upper analyst target of about $84. A more cautious Narrative could lean on slower growth, flatter margins and a fair value closer to the $47 bear case, all using the same framework but different assumptions.

Do you think there's more to the story for Corning? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion