- United States

- /

- IT

- /

- NasdaqGS:SHOP

Exploring High Growth US Tech Stocks for May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 3.9% and over the past 12 months, it is up 12%, with earnings forecasted to grow by 14% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation, scalability, and adaptability to capitalize on these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.47% | 39.60% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Clene | 64.03% | 67.59% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| AVITA Medical | 27.25% | 60.66% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.54% | 110.32% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Shopify (NasdaqGS:SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shopify Inc. is a commerce technology company that offers tools to start, scale, market, and run businesses of various sizes across multiple regions including Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America with a market cap of approximately $119.06 billion.

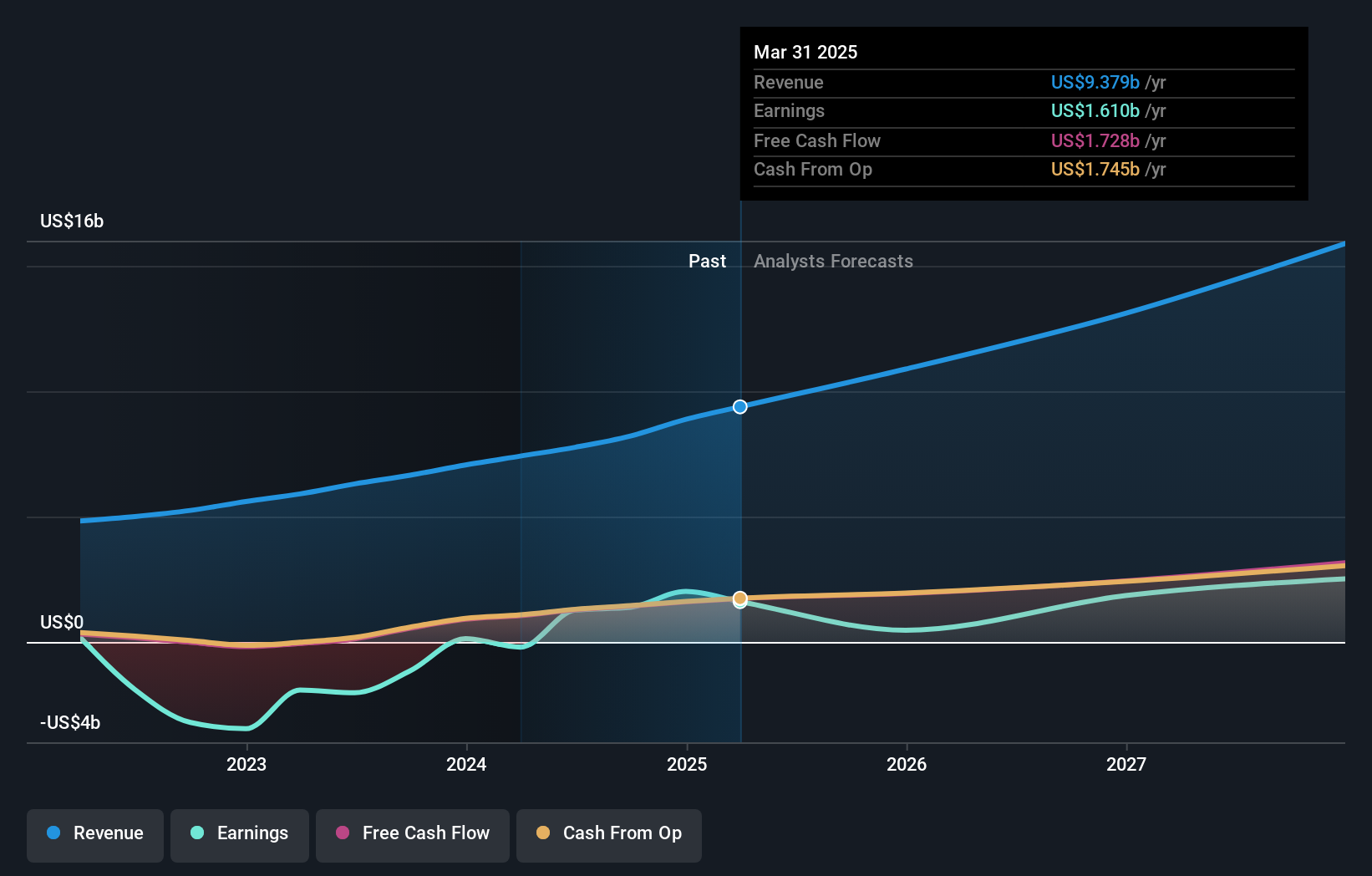

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, amounting to $9.38 billion. The company provides a comprehensive suite of tools for businesses to manage their operations across various global markets.

Shopify's recent financial performance reflects a dynamic trajectory, with first-quarter sales soaring to $1.74 billion from $1.35 billion year-over-year, and revenue reaching $2.36 billion, up from $1.86 billion in the same period last year. Despite these gains, the company reported a net loss of $682 million, significantly higher than the previous year's $273 million. This loss is tied to substantial R&D expenses aimed at expanding global reach and enhancing e-commerce solutions through strategic partnerships with firms like Affirm and Appriss Retail. These collaborations are designed to streamline payment processes and bolster fraud prevention capabilities across Shopify's platform—key moves expected to solidify its market position by capturing more international merchants and improving overall user experience.

- Get an in-depth perspective on Shopify's performance by reading our health report here.

Examine Shopify's past performance report to understand how it has performed in the past.

Synopsys (NasdaqGS:SNPS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synopsys, Inc. is a company that offers electronic design automation software for designing and testing integrated circuits, with a market capitalization of approximately $74.67 billion.

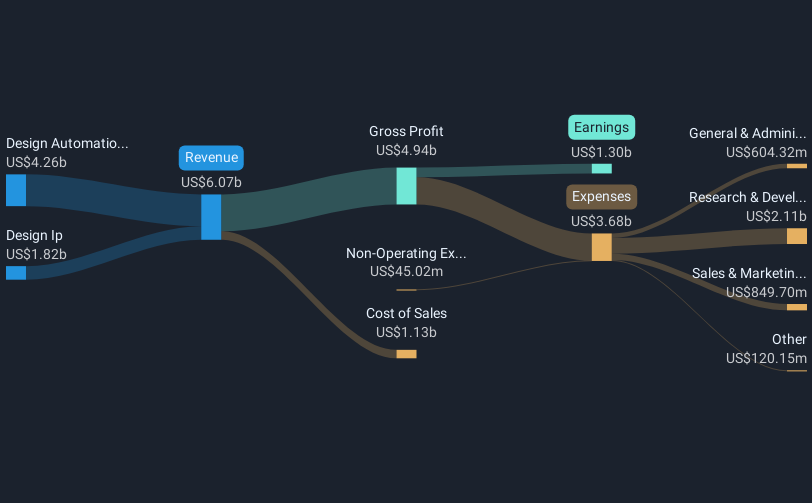

Operations: Synopsys generates revenue primarily from its Design IP and Design Automation segments, with the latter contributing $4.26 billion. The company's focus on electronic design automation software plays a critical role in the design and testing of integrated circuits.

Synopsys, a key innovator in the semiconductor sector, recently showcased its prowess at the Intel Foundry Direct Connect 2025 event, revealing significant EDA and IP collaborations. These advancements are set to enhance AI and HPC chip designs with groundbreaking technologies like the RibbonFET and PowerVia. Synopsys' commitment is evident in its R&D expenditure which consistently fuels such innovations, ensuring it remains at the forefront of addressing complex design challenges in an evolving tech landscape. Moreover, by expanding its IP portfolio for angstrom-level processes and joining forces with industry giants like TSMC and Intel, Synopsys is strategically positioned to influence next-gen semiconductor advancements significantly.

- Click here to discover the nuances of Synopsys with our detailed analytical health report.

Gain insights into Synopsys' past trends and performance with our Past report.

Corning (NYSE:GLW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corning Incorporated operates across various sectors including optical communications, display technologies, environmental technologies, specialty materials, and life sciences on a global scale, with a market capitalization of approximately $38.61 billion.

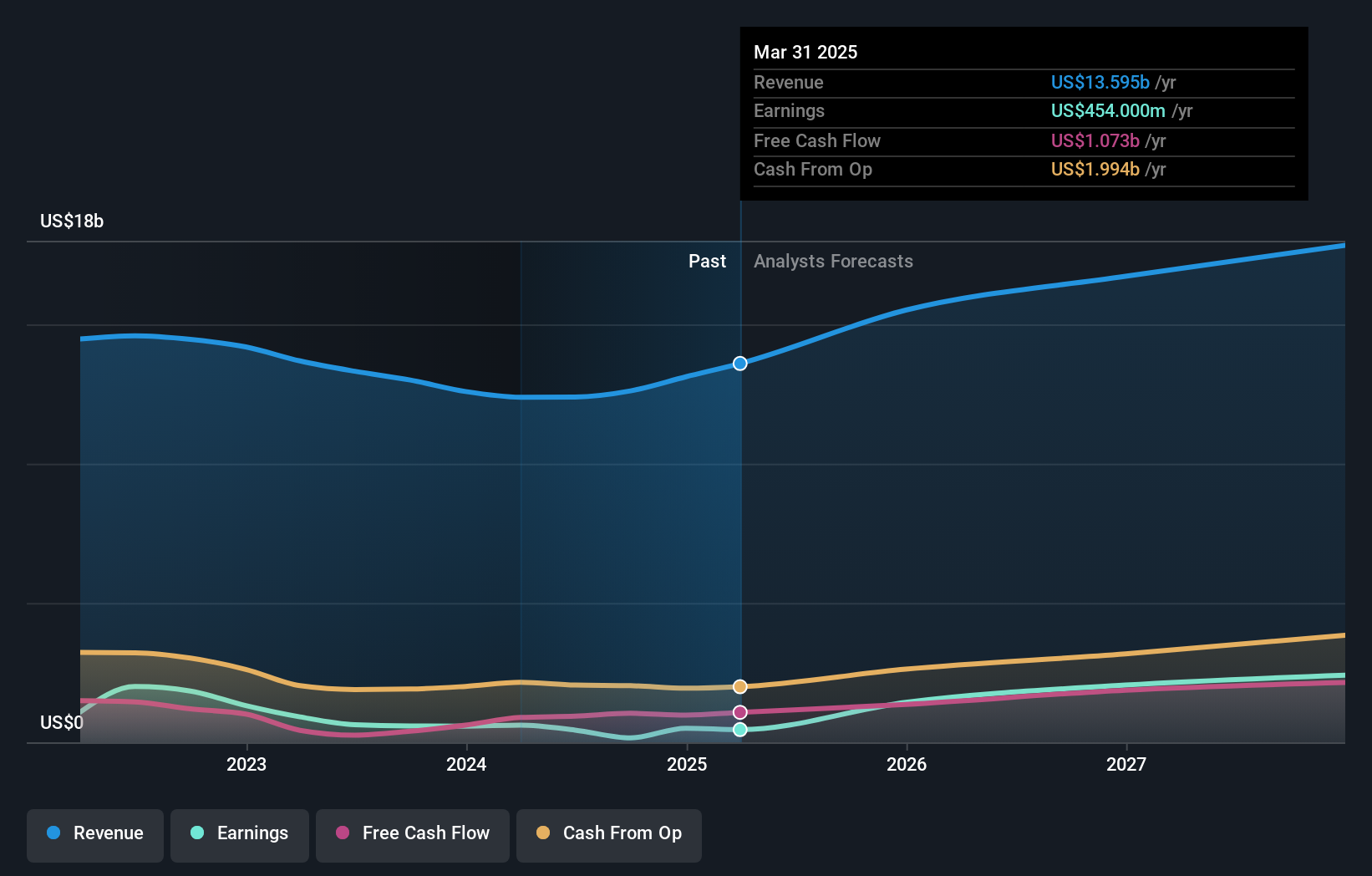

Operations: Optical communications and display technologies are the leading revenue drivers for Corning, contributing $5.08 billion and $3.91 billion respectively. Specialty materials also play a significant role with $2.07 billion in revenue, while life sciences add another $977 million to the company's diverse portfolio.

Corning's recent collaboration with Samsung on the Galaxy S25 Edge, featuring Gorilla Glass Ceramic 21, underscores its innovative edge in materials science, crucial for next-gen consumer electronics. This partnership not only enhances product durability but also aligns with Corning's strategic focus on high-performance materials, evidenced by a significant R&D spend aimed at pioneering advanced glass and ceramics technologies. Financially, Corning is navigating through challenges as evidenced by a dip in net income to $157 million from $209 million year-over-year despite a revenue rise to $3.45 billion from $2.98 billion; yet it maintains robust growth forecasts with expected earnings growth of 27.1% annually and revenue growth outpacing the US market at 9.2%. These figures reflect Corning’s resilience and capacity to innovate in response to dynamic market demands.

Turning Ideas Into Actions

- Gain an insight into the universe of 235 US High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives