Corning (NYSE:GLW) Partners With Samsung For Tougher Galaxy S25 Edge With Gorilla Glass

Reviewed by Simply Wall St

Corning (NYSE:GLW) recently announced a collaboration with Samsung to feature Corning® Gorilla® Glass Ceramic 21 in the upcoming Galaxy S25 Edge, suggesting a strategic positioning in the tech market. This partnership, likely contributing to the tech company's recent 14.98% monthly share price increase, coincides with executive changes aimed at driving future growth. These developments, set against a backdrop of broader market fluctuations with major indexes showing slight declines due to trade uncertainties, underscore Corning's alignment with resilience themes, possibly adding weight to its positive market performance contrasting the broader market trends.

Corning has 5 warning signs we think you should know about.

The recent announcement of Corning's partnership with Samsung to feature Gorilla Glass Ceramic 21 in the upcoming Galaxy S25 Edge may enhance the company's revenue forecasts, particularly by strengthening its position in the tech market and potentially expanding its customer base. This collaboration could support Corning's strategic emphasis on secular trends and help boost sales in its Optical Communications and Solar sectors. However, the benefits from this partnership are balanced against broader challenges, such as trade tensions and market competition, which could impact profitability. Analysts anticipate a revenue leap from US$13.60 billion to US$18.40 billion by 2028, driven by these sector strengths.

Over the past five years, Corning's total shareholder return was a substantial 161.63%, indicating enduring investor confidence and strong overall performance. This growth exceeds the USD market's one-year return of 8.2%, highlighting Corning's resilience. Despite a recent 14.98% rise in its share price, the stock currently trades at US$44.76, representing a 13.9% discount to the analyst price target of US$51.99. This suggests potential upside if analyst forecasts materialize. Investors should consider how the partnership with Samsung aligns with future growth narratives, as any deviations in expected revenue and earnings could affect the stock’s valuation trajectory.

Review our growth performance report to gain insights into Corning's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

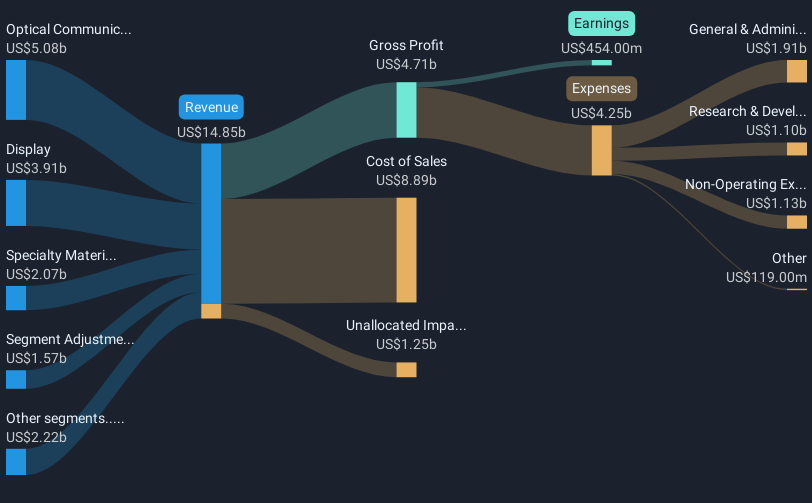

Engages in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally.

High growth potential moderate and pays a dividend.

Similar Companies

Market Insights

Community Narratives