- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Technologies (DELL): Reassessing Valuation After Raised Guidance and Surging AI Server Demand

Reviewed by Kshitija Bhandaru

Dell Technologies (NYSE:DELL) is drawing investor attention after management reaffirmed stronger growth forecasts during its recent analyst meeting, highlighting robust demand for next-generation AI servers and infrastructure. The company’s positive outlook is closely related to momentum from its expanding AI-focused offerings.

See our latest analysis for Dell Technologies.

Momentum is building for Dell Technologies. After marching to fresh 52-week highs this week, the share price has soared over 20% in the past month alone and boasts a 29% return year-to-date. The three-year total shareholder return of nearly 368% underscores how transformative AI demand and Dell’s growing leadership in infrastructure are shaping a compelling long-term story, despite short-term volatility from broader market swings and recent insider sales.

If Dell’s AI-powered surge has sparked your curiosity, it’s an ideal moment to explore other high-growth tech names. See the full list for free with our See the full list for free..

With shares at record highs and analysts upping forecasts based on Dell’s booming AI server business, the key debate now is whether there is still a bargain to be had, or if expectations are already fully priced in.

Most Popular Narrative: 0.3% Overvalued

With Dell Technologies closing at $150.57 and the most widely followed narrative pointing to a fair value of $150.09, valuation and market reality are now nearly aligned. This close proximity between fair value and market price sets the stage for a deeper look at what’s driving analyst expectations.

Dell is shifting its business mix toward more IP-rich and margin-accretive storage and services through modernization and efficiency improvements. This is likely to expand operating margins and long-term earnings power. Improved capital allocation (such as ongoing buybacks and dividends) and a now fully deleveraged balance sheet provide flexibility for shareholder returns and investment in high-growth adjacencies like edge computing and telecom, supporting EPS growth and long-term total return.

Want a sneak peek into what drives this fair value? Only one set of financial assumptions powers the whole narrative, suggesting a bold future for earnings, margins, and the business mix. Unlock the details and judge if these upgrades justify today’s market price.

Result: Fair Value of $150.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures from AI server shipments and uncertainty around PC business recovery could challenge Dell’s optimistic growth projections in the near term.

Find out about the key risks to this Dell Technologies narrative.

Another View: What Does Our DCF Model Suggest?

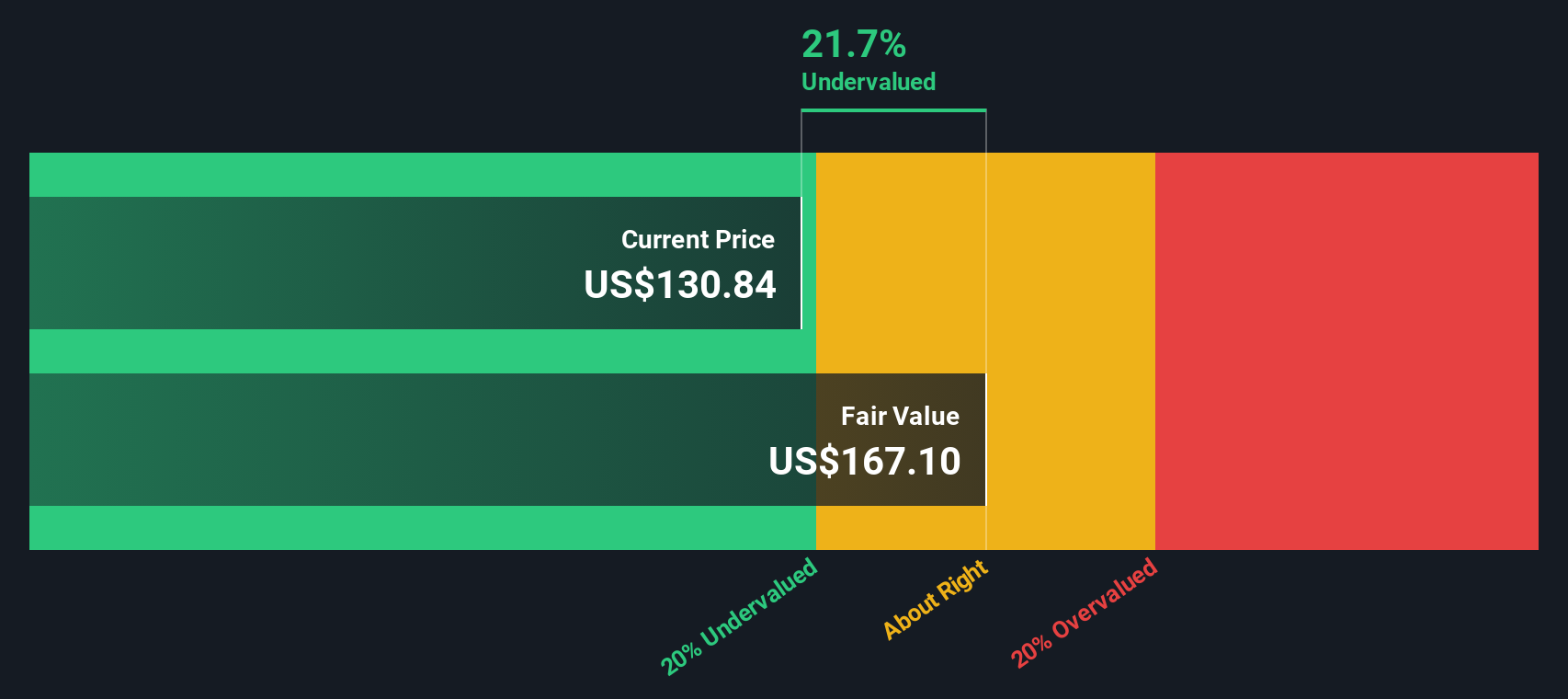

While analyst price targets suggest Dell is nearly fully priced, our SWS DCF model points in a different direction. This approach values Dell at $192.35 per share, roughly 21.7% above the current price. Could the market be underappreciating long-term cash flow growth? Or is there hidden risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dell Technologies Narrative

If you’re eager to dig into the numbers yourself or think you have a different angle on Dell’s story, there’s nothing stopping you from creating your own narrative in under three minutes. Do it your way

A great starting point for your Dell Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great investment ideas pass you by. Supercharge your portfolio now with powerful tools designed to uncover hidden gems and strong performers, tailored to your financial goals.

- Unlock potential growth by pursuing these 894 undervalued stocks based on cash flows to find high-quality companies trading below their intrinsic worth, ready for the next move up.

- Boost income streams by targeting these 19 dividend stocks with yields > 3% offering above-average yields to strengthen your passive earnings and create a resilient portfolio.

- Capture the edge in tomorrow’s tech by zeroing in on these 26 quantum computing stocks backing major leaps in computing and innovation, before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives