- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Stock Rally Continues as OpenAI Chooses Dell for $100B AI Infrastructure Investment

Reviewed by Bailey Pemberton

Wondering whether to buy, hold, or sell Dell Technologies stock? You’re not alone. Dell’s price chart has been anything but dull recently. After powering up by an impressive 19.0% in the last month alone, shares sit at $148.77 as of last close. Zoom out, and the rally looks even stronger, with a 27.7% jump year-to-date and more than 350% growth over the past three years. That kind of performance might get anyone’s attention, especially if you’ve been following headlines about Dell CEO Michael Dell’s name surfacing in high-stakes tech deals (like the latest TikTok US news) and Dell’s role in the booming world of AI server infrastructure.

Despite the stellar run, last week’s dip of -1.4% hints at how quickly risk appetite can shift in this space. News about major industry partnerships, such as OpenAI’s reported $100B move to bolster AI infrastructure with Dell right in the mix, suggests that investors are factoring in both explosive potential and increasing competition. So what’s priced in now, and is there more room to run?

On a pure numbers basis, Dell currently notches a 5 out of 6 on key valuation checks. This means the stock is undervalued in nearly every category we assess. But what actually goes into that score, and how should you weigh it compared to the big-picture shifts happening with Dell? Let’s dig into how these valuation methods work and why, by the end of this article, you’ll have an even sharper lens for spotting opportunity.

Approach 1: Dell Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that projects a company’s future cash flows and then discounts them back to their present value. This process estimates what those future dollars are worth today. For Dell Technologies, analysts consider expected future Free Cash Flow (FCF) in dollars and calculate the present value of each year’s stream when adjusted for time and risk.

Currently, Dell generates $4.59 billion in Free Cash Flow over the last twelve months. Analyst forecasts anticipate continued growth, with FCF projected to reach about $8.52 billion by 2030. The numbers leading up to this estimate are based on five years of analyst predictions, with subsequent years extrapolated to reflect longer-term potential. This approach aims to capture both Dell’s robust cash generation and the ongoing momentum in its business fundamentals.

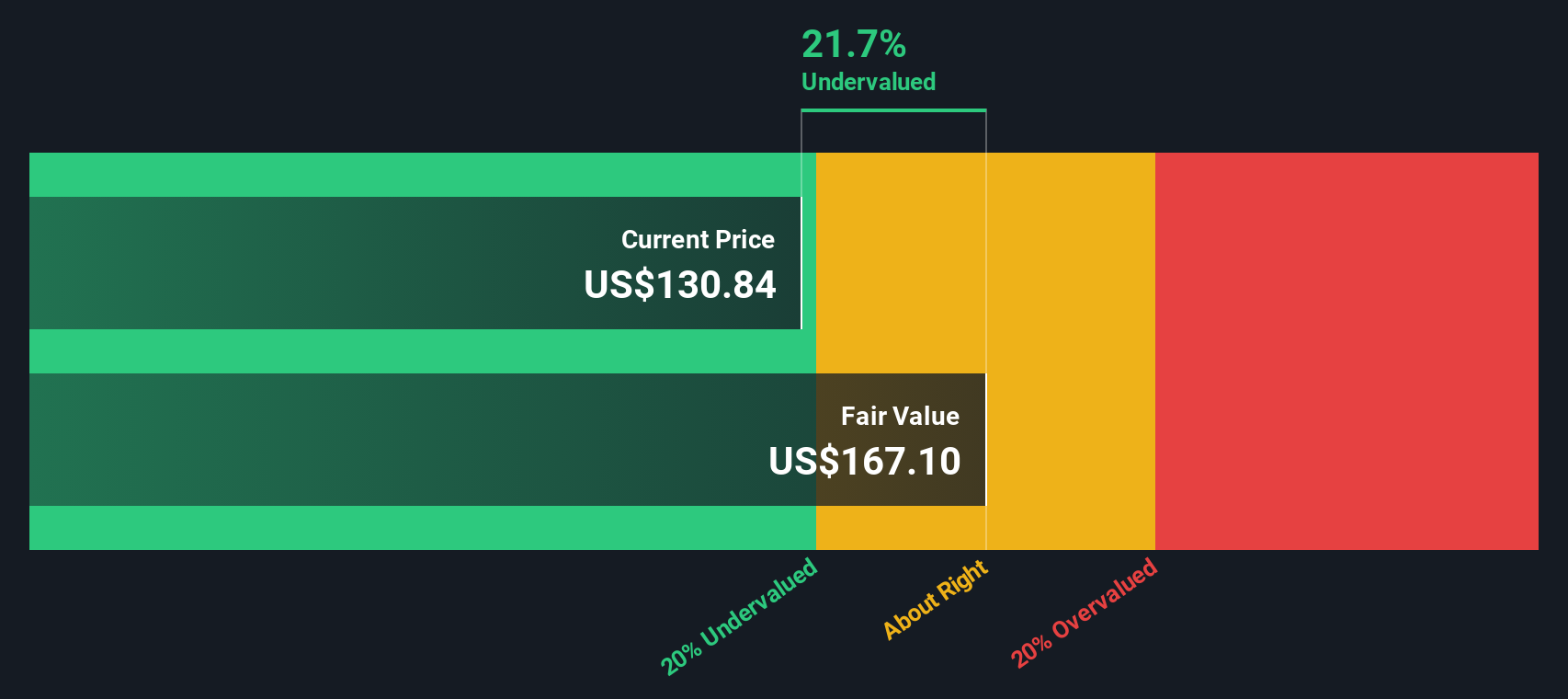

Based on these forecasts, the DCF model estimates Dell’s intrinsic value at $192.47 per share. Compared to the latest closing price of $148.77, this suggests the stock is approximately 22.7% undervalued according to current cash flow projections and discount rates.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dell Technologies is undervalued by 22.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Dell Technologies Price vs Earnings

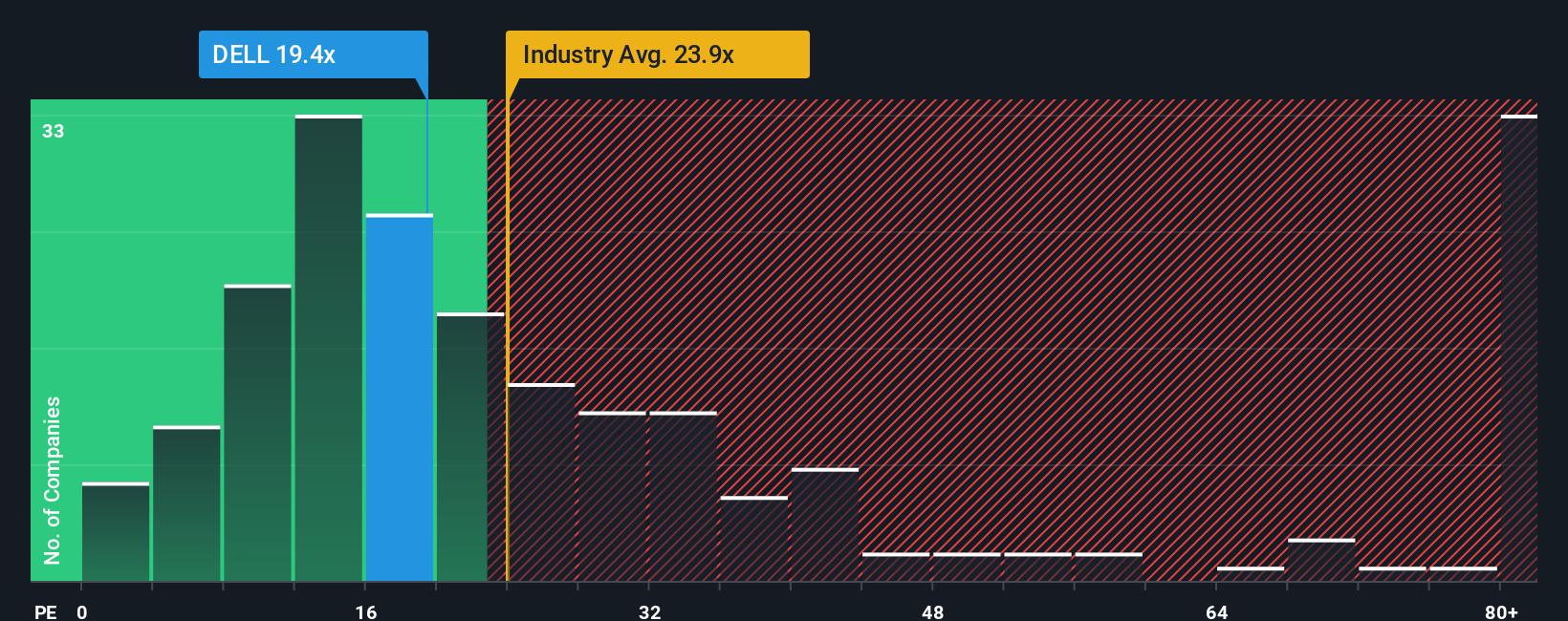

For companies generating consistent profits like Dell Technologies, the Price-to-Earnings (PE) ratio is a particularly useful way to gauge valuation. It captures how much investors are willing to pay for each dollar of current earnings and is a popular metric because it balances both present profitability and future expectations.

The “right” PE ratio for a company is influenced by growth forecasts, risk profile, and the stability of earnings. Fast-growing or more stable companies often justify higher PE ratios, while those facing more uncertainty typically command lower ones. Looking at Dell, its current PE ratio stands at 20.6x. That is below the Tech industry average of 23.5x and its peer group’s average of 23.5x, suggesting potential value relative to other tech stocks.

However, rather than relying solely on these broad benchmarks, Simply Wall St’s proprietary “Fair Ratio” extends a deeper analysis. This metric considers Dell’s earnings growth potential, risk factors, profit margins, and company size to estimate what a truly fair multiple should be for Dell right now. For Dell, the Fair Ratio is calculated at 38.8x. Because this fair value multiple is substantially higher than the current PE ratio, it indicates that the stock has not yet fully priced in its relative advantages and growth prospects, making it look undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective, a story that weaves together what you believe about a company’s opportunities and risks, your estimates for its future revenue, earnings, and profit margins, and the fair value you think is reasonable as a result. Narratives link a company’s unique story to the numbers behind a financial forecast, making it much easier to see how your assumptions lead to a specific fair value.

This approach does not require years of investing experience; millions of investors already use Narratives as an accessible tool in the Simply Wall St Community page. With Narratives, you can check whether your fair value points to a buy or sell by quickly comparing it to the current price. Even better, Narratives update automatically whenever important news or fresh results come out, keeping your story grounded in reality. For example, some investors on the platform use bullish forecasts for Dell’s AI-driven growth, producing fair values as high as $180, while more conservative users focus on potential margin pressure, resulting in values as low as $104. The power of Narratives lies in making your own investment decisions more transparent and dynamic, based on how you see Dell’s future taking shape.

Do you think there's more to the story for Dell Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success