- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Assessing Dell Stock After AI Chip Tracking News and Recent Price Surge

Reviewed by Simply Wall St

Thinking about Dell Technologies stock? You are not alone. Whether you are deciding whether to add more to your position or just looking to understand why this company is such a hot topic, it is hard to ignore Dell’s recent momentum. Shares have bounced around a bit in the last month, dipping about 0.4%, but if you zoom out the picture gets a lot rosier. Over the past three months, Dell Technologies has surged nearly 15%, and over the last year, the stock is up roughly 17%. This does not even include a notable 195% gain over the last three years.

This kind of performance tends to attract both fans and skeptics, especially after headlines about AI chip tracking and high-profile security hiccups. Negative news sometimes shakes confidence in the short term, but so far Dell seems to be riding out these storms surprisingly well. Perhaps this is because the company continues growing, with annual revenue up 6% and net income climbing by more than 11% year-over-year.

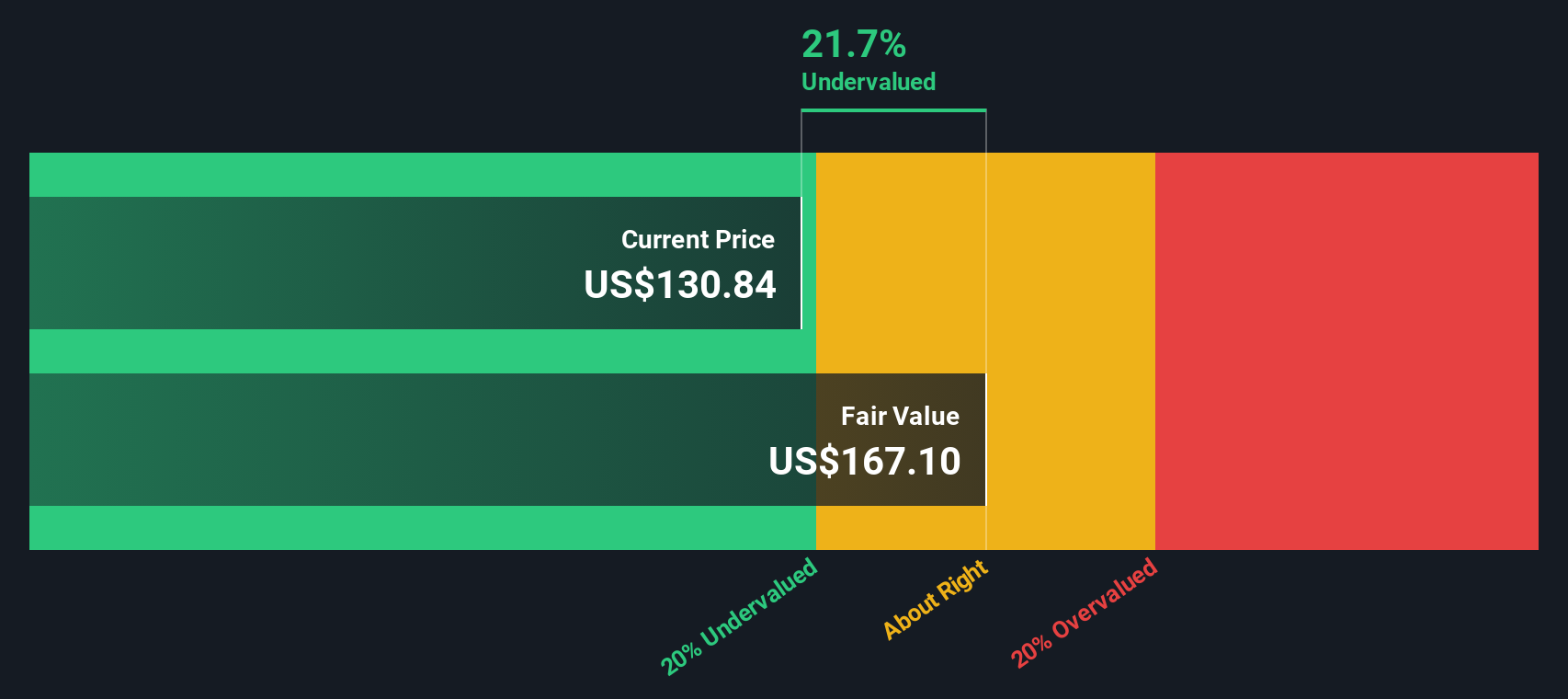

If you are considering Dell’s future, there is one essential question: Is the stock still undervalued, or has the rally priced in all the good news? By traditional metrics, Dell holds a valuation score of 4 out of 6, meaning it passes two-thirds of key undervaluation checks. That suggests there may be value remaining, but how do those individual checks actually work? Up next, we review how these valuation methods stack up and discuss an approach that could provide a more comprehensive answer than any single number alone.

Dell Technologies delivered 17.1% returns over the last year. See how this stacks up to the rest of the Tech industry.Approach 1: Dell Technologies Cash Flows

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those figures back to the present. This approach gives investors a sense of what the business should be worth today.

For Dell Technologies, the latest trailing twelve months Free Cash Flow stands at roughly $3.45 billion. Analysts project this figure growing healthily over the next decade, with anticipated Free Cash Flow reaching about $7.86 billion by 2030.

Based on these forecasts and the two-stage Free Cash Flow to Equity model, the DCF approach estimates Dell’s intrinsic value at approximately $168.47 per share. When compared to the current stock price, this suggests the stock is trading at a 23.7% discount to its projected fair value. According to this method, Dell may be significantly undervalued.

Result: UNDERVALUED

Approach 2: Dell Technologies Price vs Earnings

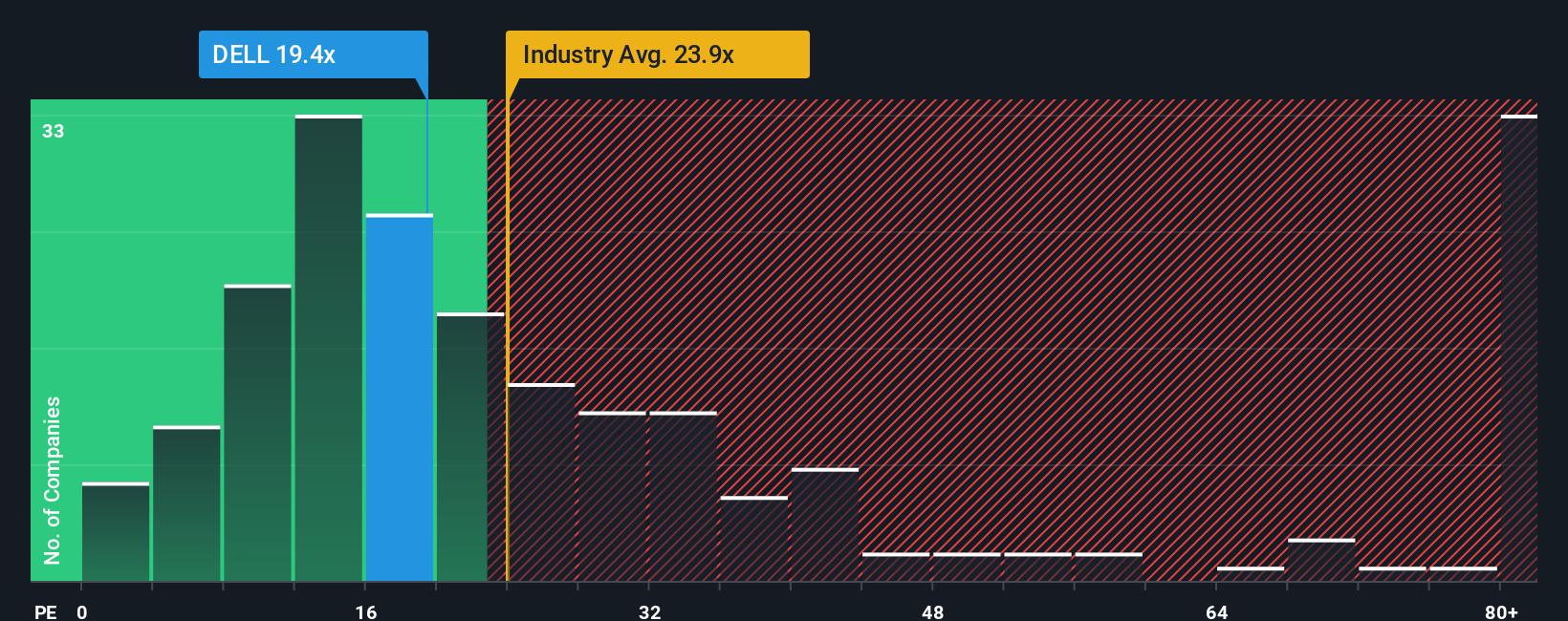

The Price-to-Earnings (PE) ratio is widely used to value profitable companies, as it allows investors to weigh the price of a stock against its actual earnings. For companies like Dell Technologies, consistent profitability means the PE ratio gives a straightforward snapshot of how much investors are willing to pay for each dollar of earnings.

Growth expectations and risk play a key role in determining what is a typical or “fair” PE ratio. Companies in industries with faster expected growth or lower perceived risk tend to command higher PE multiples. In contrast, slower-growth or riskier businesses usually trade at lower multiples.

Dell Technologies currently trades at a PE ratio of 19.06x. This is slightly higher than its close peer average of 17.34x but remains below the broader tech industry average of 24.02x. Simply Wall St’s proprietary Fair Ratio for Dell is 31.23x, which takes into account Dell's growth prospects, profit margins, and risk profile. Compared to this Fair Ratio, Dell's actual multiple suggests the market is valuing Dell more conservatively than its fundamentals might indicate.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

While financial models and ratios give us valuable signals, Narratives offer a new, more intuitive way to invest by connecting Dell Technologies’ story to its expected financial future. In simple terms, a Narrative is your personal viewpoint: the set of assumptions and forecasts you believe about Dell’s growth, margins, and fair value, all grounded in how you interpret news, industry changes, and company strategy.

Within the Simply Wall St platform, Narratives make it easy for anyone, whether new or experienced, to build and track these perspectives, compare them with millions of others, and see how their own story matches up. Instead of focusing only on historical numbers, Narratives help you decide if today’s price offers an opportunity by letting you visualize the path from company events to financial forecasts and fair value. As fresh news or earnings are released, your Narrative updates automatically to reflect the latest information, so your investment thesis stays up to date.

For Dell Technologies, investors using Narratives may see things quite differently. Some believe strong AI-driven growth and capital returns justify a $180 price target, while others expect risks from competition or demand softness to cap fair value at $104. Narratives empower you to back your story with data and respond quickly as the real story unfolds.

Do you think there's more to the story for Dell Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.