Coherent (COHR) Is Up 11.0% After Advancing 300mm Silicon Carbide Platform For AI Datacenters

Reviewed by Sasha Jovanovic

- In early December 2025, Coherent Corp. announced a major milestone in its next-generation 300mm silicon carbide platform, targeting higher thermal efficiency and scalability for AI datacenter infrastructure while also supporting AR/VR and power electronics applications.

- This shift to larger-diameter, conductive SiC wafers is important because it can improve energy efficiency, thermal performance, and cost per chip across multiple high-growth technology markets.

- Next, we’ll examine how Coherent’s 300mm silicon carbide platform for AI datacenters could influence the company’s investment narrative and outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Coherent Investment Narrative Recap

To own Coherent, you need to believe its materials and photonics portfolio can keep earning a premium in fast-evolving markets like AI datacenters. The new 300mm silicon carbide platform strengthens that story by tying Coherent more directly to datacenter thermal and power efficiency, but it does not remove near term risks around heavy capital spending and potential volatility if silicon carbide demand softens again.

Among recent announcements, the planned exhibit at NVIDIA GTC DC 2025 showcasing co packaged optics for AI infrastructure fits neatly with this silicon carbide milestone. Together, they underline how Coherent is positioning across both the compute interconnect and power efficiency sides of AI infrastructure, which many investors currently see as a key catalyst for orders and capacity utilization across its communications and materials businesses.

Yet while the AI datacenter opportunity is exciting, investors should also be aware of the risk that ongoing heavy capital investment could strain returns if demand or margins fall...

Read the full narrative on Coherent (it's free!)

Coherent's narrative projects $7.7 billion revenue and $732.0 million earnings by 2028. This requires 9.8% yearly revenue growth and a $812.6 million earnings increase from -$80.6 million today.

Uncover how Coherent's forecasts yield a $168.74 fair value, in line with its current price.

Exploring Other Perspectives

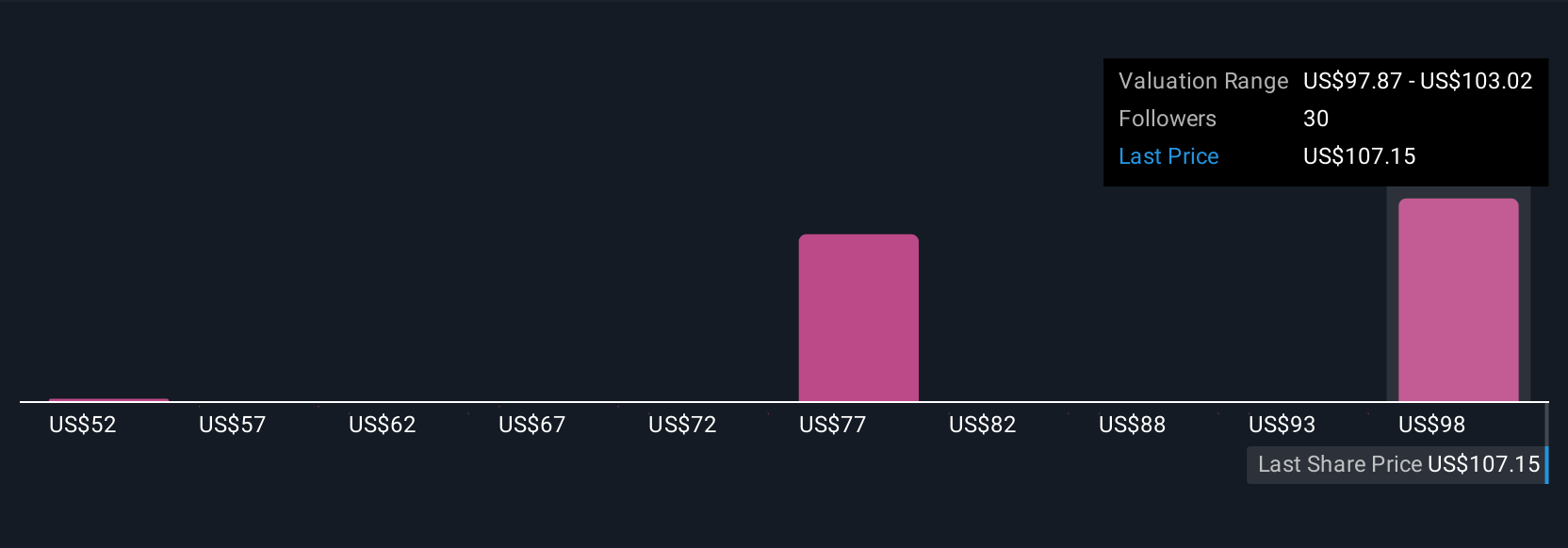

Five fair value estimates from the Simply Wall St Community span US$53.70 to US$168.74, showing how far apart individual views on Coherent can be. When you set those opinions against the heavy capital investments and demand cyclicality discussed above, it becomes even more important to compare several perspectives before deciding how Coherent might fit into your portfolio.

Explore 5 other fair value estimates on Coherent - why the stock might be worth as much as $168.74!

Build Your Own Coherent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coherent research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coherent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coherent's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026