- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

Will Mary Holt’s CFO Appointment Shift CompoSecure's (CMPO) Finance Strategy and Growth Outlook?

Reviewed by Sasha Jovanovic

- On October 9, 2025, CompoSecure announced that Mary Holt was appointed as Chief Financial Officer, succeeding retiring CFO Tim Fitzsimmons and taking charge of the company’s finance organization.

- Holt's extensive background in financial leadership at Warren Equity Partners and Honeywell brings substantial operational expertise to CompoSecure as it continues to grow in premium card and digital security markets.

- We'll explore how Mary Holt's appointment as CFO and her experience could influence the company's investment narrative and outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CompoSecure Investment Narrative Recap

To be a shareholder in CompoSecure, you need confidence in the long-term relevance of premium physical card products and the company's ability to innovate amid digital payment shifts. The appointment of Mary Holt as CFO brings valuable operational expertise, but her arrival is unlikely to materially change the near-term catalyst of expanding premium card market share or offset the current risk from rising digital wallet adoption. Investors may view this leadership transition as supportive but not transformative for the company’s core growth trajectory.

One recent announcement closely connected to this news is the report of a significant net loss in Q2 2025, highlighting the company’s present financial volatility. Mary Holt’s background in financial planning and operational efficiency at large, complex organizations could position CompoSecure to better manage such volatility, a critical consideration as the firm tackles both expansion and technology-driven threats. Her experience will be tested against the same headwinds that have challenged the business in preceding quarters.

Yet, despite these leadership updates, investors should also be mindful of...

Read the full narrative on CompoSecure (it's free!)

CompoSecure's outlook forecasts $642.6 million in revenue and $508.0 million in earnings by 2028. Analysts expect this will require 33.9% annual revenue growth and a $583.4 million increase in earnings from the current -$75.4 million.

Uncover how CompoSecure's forecasts yield a $19.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

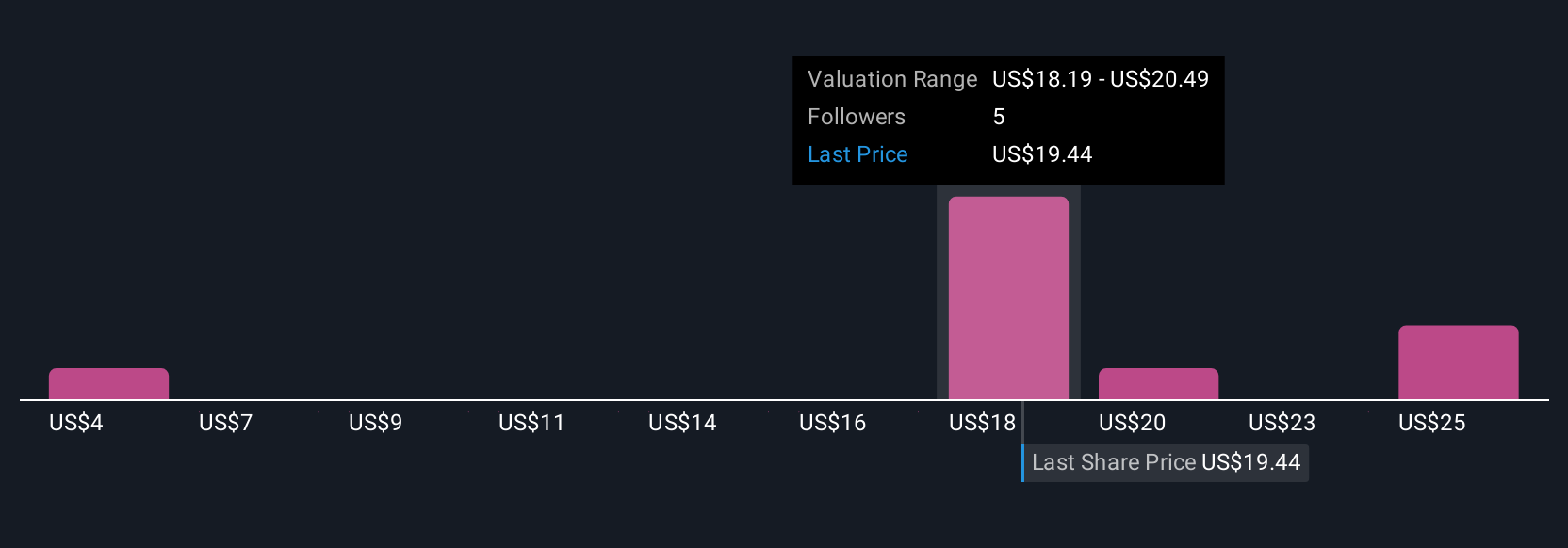

Four fair value estimates from the Simply Wall St Community span from US$4.38 to US$26.40, reflecting a broad range of views on CompoSecure’s outlook. Consider that accelerating digital wallet adoption remains a key challenge, influencing both financial performance and sentiment among market participants with sharply differing opinions.

Explore 4 other fair value estimates on CompoSecure - why the stock might be worth as much as 35% more than the current price!

Build Your Own CompoSecure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CompoSecure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CompoSecure's overall financial health at a glance.

No Opportunity In CompoSecure?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion