- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

CompoSecure (CMPO) Plunges on Steep Q3 Losses and Sales Drop—Is the Investment Thesis at Risk?

Reviewed by Sasha Jovanovic

- CompoSecure reported its third quarter 2025 earnings, revealing a net loss of US$174.7 million alongside a substantial drop in sales for both the quarter and the nine months ended September 30, 2025, compared to a year earlier; the company also announced two board additions and a company executive's participation at the General Counsel Conference East.

- The scale of operational challenges is exceptional, with losses and sales declines far exceeding the prior year's results, highlighting a sharp deterioration in financial performance.

- We'll explore how the steep year-over-year sales and earnings declines impact CompoSecure's investment narrative and future trajectory.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CompoSecure Investment Narrative Recap

To continue holding CompoSecure stock, investors need confidence in a turnaround story where premium metal card growth and digital security offerings offset an unprecedented drop in revenue and widening losses. The latest earnings report materially undermines this catalyst, as steep declines in sales and profitability intensify the near-term risk of ongoing financial strain and market share loss, raising questions about the company’s ability to benefit from any future demand recovery.

Among the recent developments, the addition of Delara Zarrabi to the Board of Directors stands out. Strengthening corporate governance and board experience is particularly relevant during periods of operational stress, yet it may take time for such changes to influence core business performance or address the central demand risks facing the company.

Yet, amid board refreshes and product innovation, investors should be especially aware of revenue concentration risk if a major client were to...

Read the full narrative on CompoSecure (it's free!)

CompoSecure's outlook anticipates $642.6 million in revenue and $508.0 million in earnings by 2028. This scenario assumes a 33.9% annual revenue growth rate and a $583.4 million increase in earnings from the current $-75.4 million.

Uncover how CompoSecure's forecasts yield a $25.17 fair value, a 27% upside to its current price.

Exploring Other Perspectives

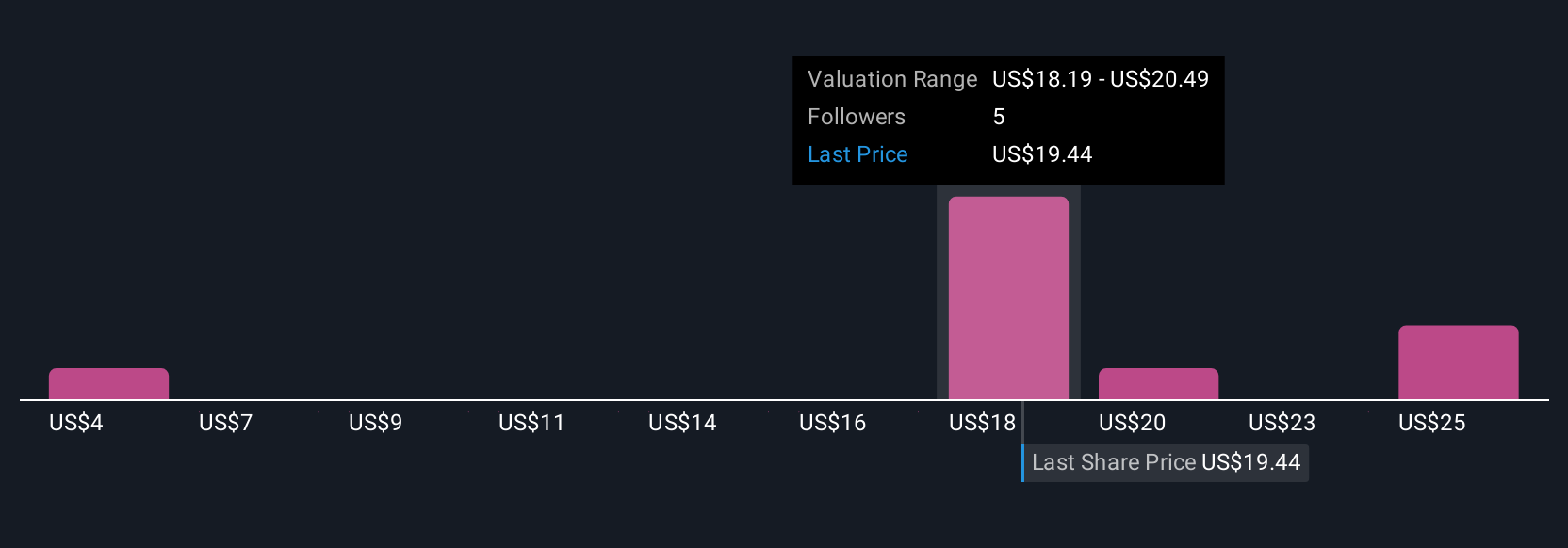

Four Simply Wall St Community members have issued fair value targets ranging from as low as US$4.38 to US$25.17 per share. Views vary significantly, and with sales falling sharply, it becomes even more important to study how each perspective weighs future demand for physical cards versus the risk of revenue loss.

Explore 4 other fair value estimates on CompoSecure - why the stock might be worth less than half the current price!

Build Your Own CompoSecure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CompoSecure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CompoSecure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CompoSecure's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives