- United States

- /

- Communications

- /

- NYSE:CIEN

Does Ciena’s Soaring 2025 Share Price Signal Caution After Recent Earnings Surge?

Reviewed by Bailey Pemberton

If you’ve been watching Ciena’s stock, you might be wondering whether this incredible rally still has room to run or if things are getting a little overheated. With a share price that just closed at 153.25, Ciena has been on an astonishing upward trend: up 6.3% over the past week, 31.3% in the last month, and a jaw-dropping 84.1% already this year. Stretch that out to a year and it’s up by 141.0%. Over the last three years, the return is a staggering 285.0%, with the five-year figure at 258.6%. These numbers aren’t just blips; they’re the result of ongoing shifts in tech infrastructure demand and investor optimism about future connectivity solutions, all accentuated by a series of market-wide moves in the communications sector.

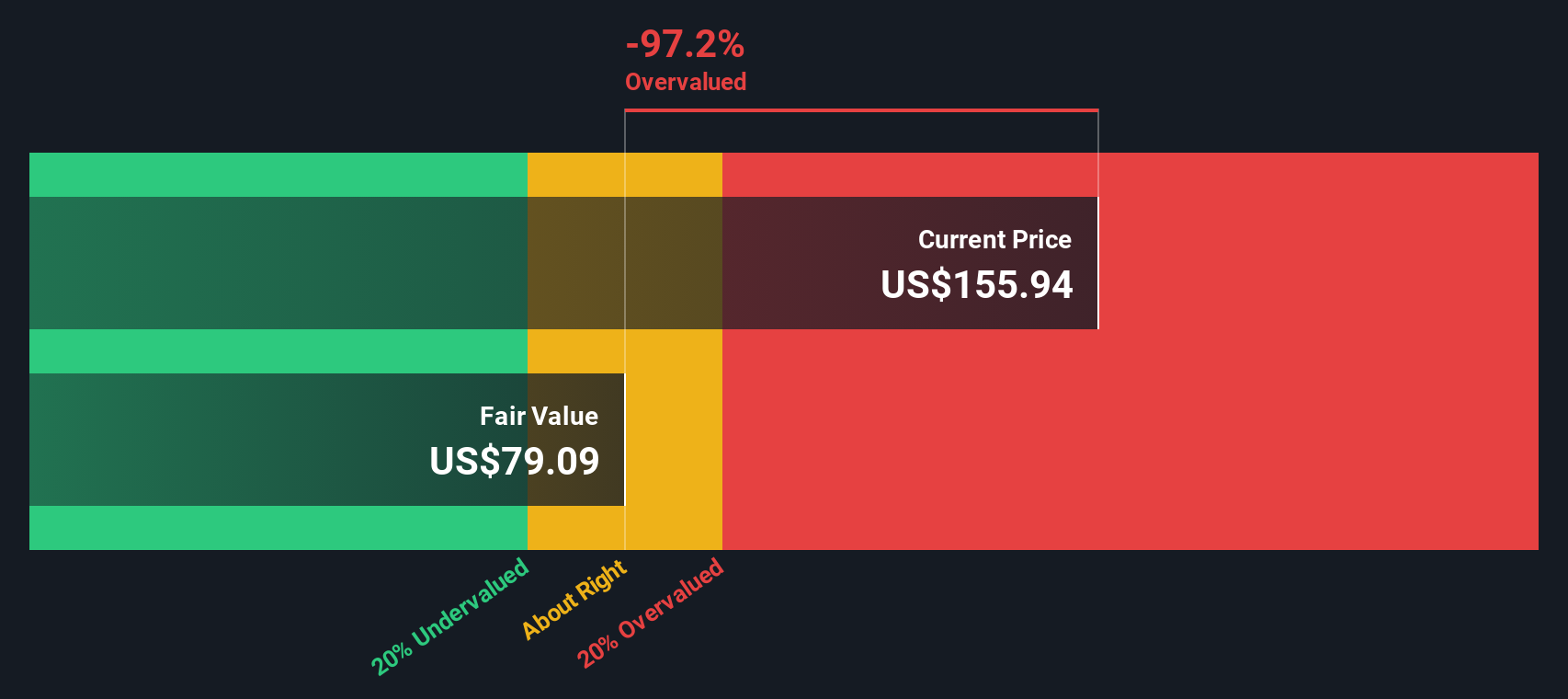

But great momentum like this also raises a tough question: is Ciena getting expensive, or does the stock still have a hidden upside for disciplined investors? Our valuation check gives Ciena a score of 1 out of 6 for being undervalued, suggesting that by traditional methods, the stock isn’t exactly a bargain right now. Of course, six valuation methods provide a lot to consider, and each tells a slightly different story about risk and opportunity.

In the next section, we’ll dig into those valuation approaches to see what’s driving this score. And for readers looking for something beyond the usual numbers, stick around because we’ll introduce a smarter way to get at the heart of what Ciena is really worth.

Ciena scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ciena Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and bringing them back to present value using a discount rate. The idea is to capture what Ciena’s business is really worth, based on its ability to generate cash for shareholders over time.

For Ciena, the latest trailing twelve months Free Cash Flow comes in at $654.6 Million. Looking forward, analyst estimates and trend-based projections suggest that Ciena’s Free Cash Flow could reach $725.4 Million in ten years. The next five years are based on explicit analyst estimates, and subsequent years are extrapolated by Simply Wall St’s algorithms. This projection incorporates expectations for growth tapering off, reflecting a realistic and comprehensive forecast of Ciena’s financial engine.

After discounting these future cash flows back to today, the intrinsic value per share from this DCF analysis is $79.24. Compared to the current share price of $153.25, this model indicates that Ciena is trading at a sizeable premium, with the stock 93.4% above its calculated fair value. In short, the DCF approach sees Ciena as notably overvalued at this point in time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ciena may be overvalued by 93.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ciena Price vs Sales

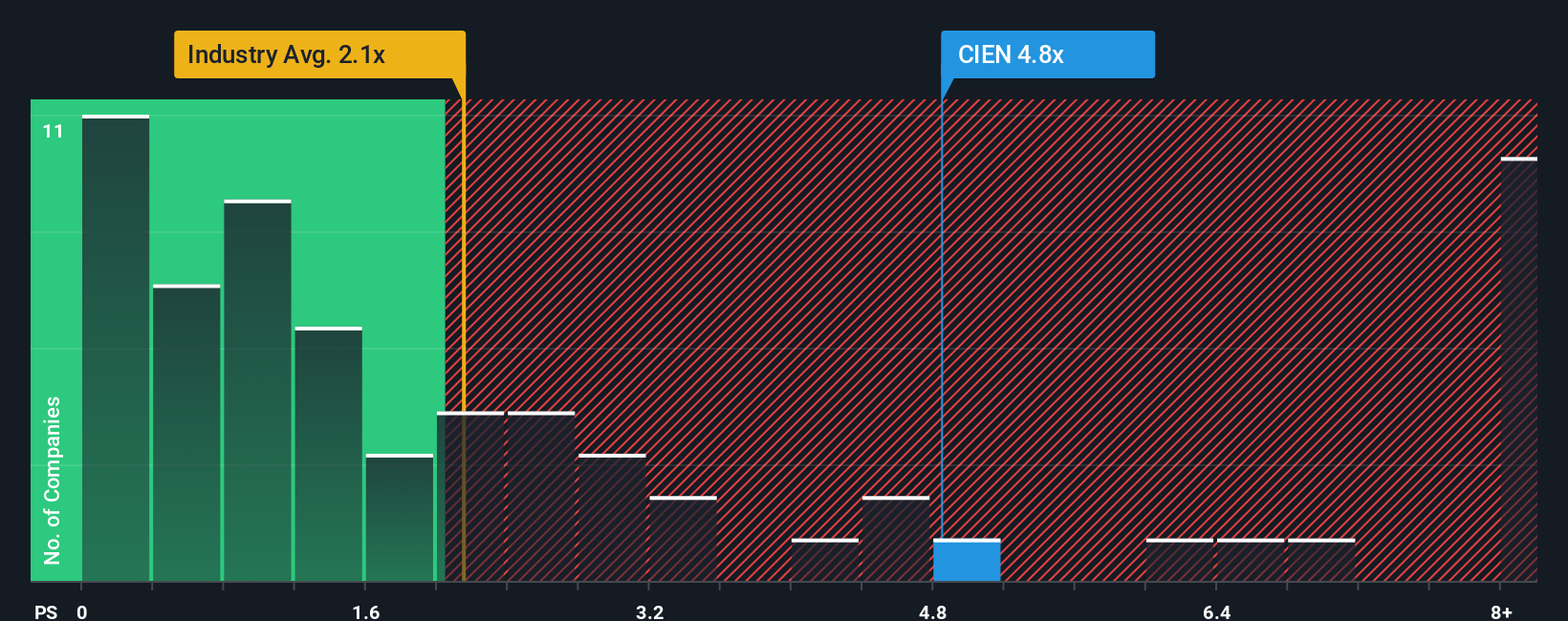

For companies like Ciena that generate steady revenues but may have variable earnings, the Price-to-Sales (P/S) ratio is a widely used and effective valuation tool. It works well for profitable technology businesses, especially when comparing across the communications sector, where margins and growth rates can vary significantly between firms.

Typically, growth expectations and risk profiles shape what is considered a fair or “normal” P/S ratio. Companies with stronger revenue growth can trade at higher multiples, while greater risks might warrant a discount. When we look at Ciena’s current P/S ratio, it stands at 4.76x. This is more than double the communications industry average of 2.22x and also well below the peer average of 8.89x, suggesting the market is pricing in above-average optimism about Ciena’s top line, but not to an extreme degree compared to closest rivals.

Rather than simply stacking Ciena’s valuation up against the industry and peer averages, Simply Wall St provides a “Fair Ratio” for each company. For Ciena, this Fair Ratio is 4.22x, calculated by weighing up company-specific factors such as profit margin, revenue growth, market cap and risk profile. This makes it a more tailored and accurate benchmark than broad sector comparisons alone.

With Ciena’s actual P/S ratio (4.76x) just above the Fair Ratio (4.22x), the company is trading at a slight premium. This difference, however, is moderate, meaning by this measure the stock is only modestly overvalued relative to its fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ciena Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a straightforward tool that helps you go beyond the numbers by telling the story behind Ciena’s valuation, including your assumptions about future revenue, earnings, margins, and fair value, all grounded in your own perspective on the company.

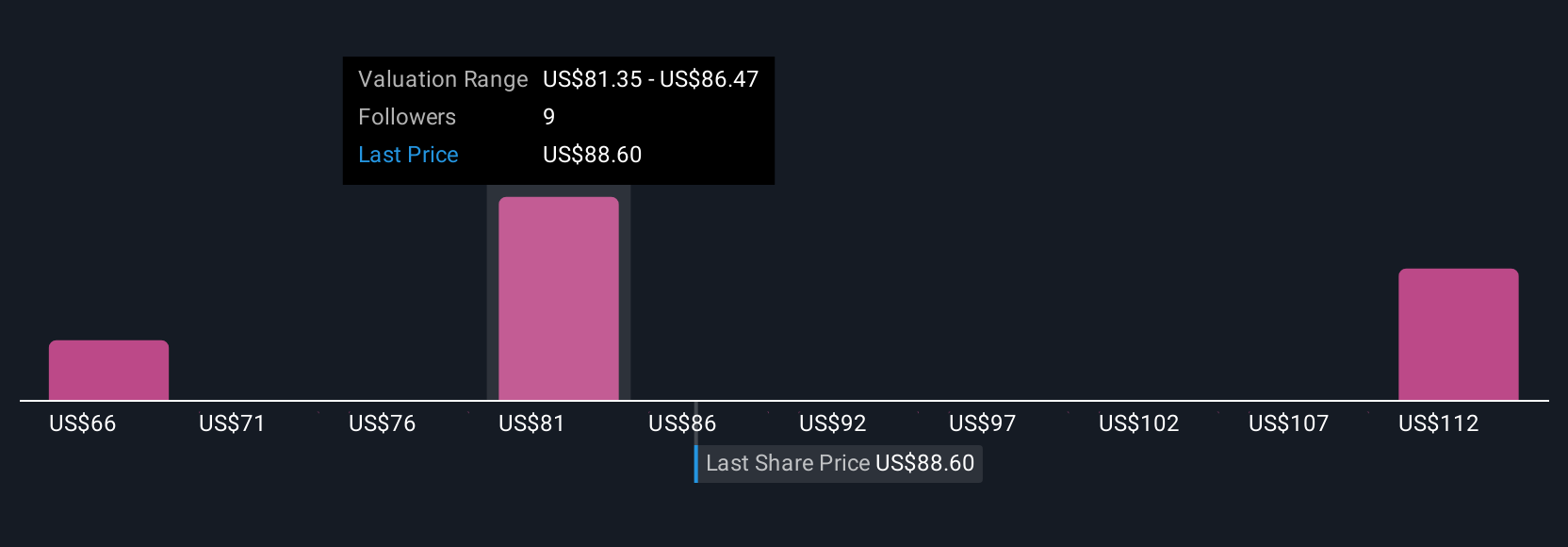

With Narratives, you connect a company’s story—what is driving its growth, its risks, and its potential—to a financial forecast, ultimately arriving at your version of fair value. This method is built into the Simply Wall St Community page, and its intuitive interface makes it easy for anyone (millions of investors are already using it) to shape and update their views as new information or events are released.

What makes Narratives powerful is how they help you decide when to buy or sell. You simply compare your calculated Fair Value with the current market Price and see where your view lines up with others. Best of all, whenever news or earnings are released, narratives update in real time, so your story and fair value always reflect the latest facts.

For example, some investors see Ciena’s deepening partnerships and AI-driven network demand justifying the highest price target at $150. Others emphasize customer concentration risks and rapid tech shifts, leading to the lowest target at $79.

Do you think there's more to the story for Ciena? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives