- United States

- /

- Metals and Mining

- /

- NYSE:MUX

US Undiscovered Gems to Watch in March 2025

Reviewed by Simply Wall St

The United States market has experienced a slight dip of 1.7% over the past week, yet it has shown resilience with a 12% rise over the last year and an anticipated annual earnings growth of 14%. In such dynamic conditions, identifying stocks that are not only underappreciated but also poised for potential growth can offer intriguing opportunities for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

NVE (NasdaqCM:NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation specializes in developing and selling spintronics-based devices for information acquisition, storage, and transmission, with a market capitalization of $326.07 million.

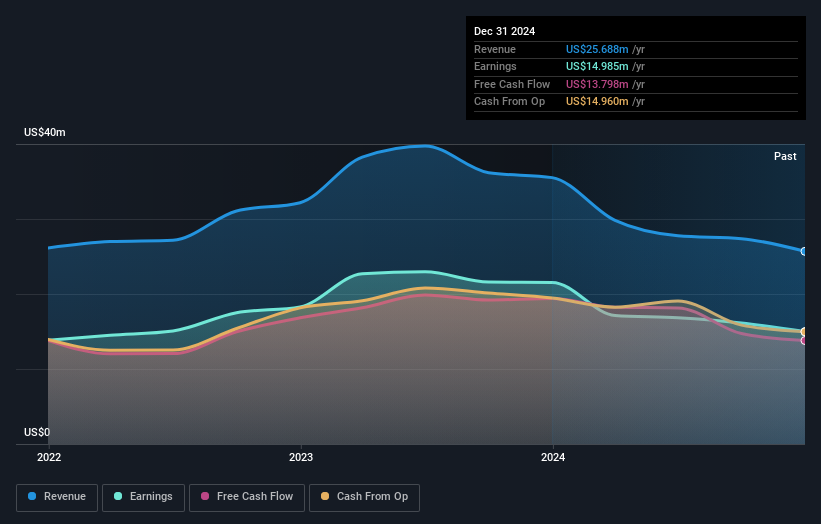

Operations: NVE Corporation generates revenue primarily from its electronic components and parts segment, amounting to $25.69 million. The company operates with a market capitalization of approximately $326.07 million, reflecting its position in the spintronics technology sector.

With no debt on its books for the past five years, NVE Corporation stands out in the semiconductor space, though it faces challenges with a -30.4% earnings growth compared to the industry’s -5.9%. Its price-to-earnings ratio of 21.8x is notably below the sector average of 30.1x, suggesting potential value for investors. Despite recent revenue and net income declines—US$5.06 million and US$3.05 million respectively in Q3 2024—the company maintains high-quality earnings and continues to reward shareholders with dividends, recently affirming a US$1 per share payout for February 2025.

Benchmark Electronics (NYSE:BHE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Benchmark Electronics, Inc. provides product design, engineering services, technology solutions, and manufacturing services across the Americas, Asia, and Europe with a market capitalization of approximately $1.38 billion.

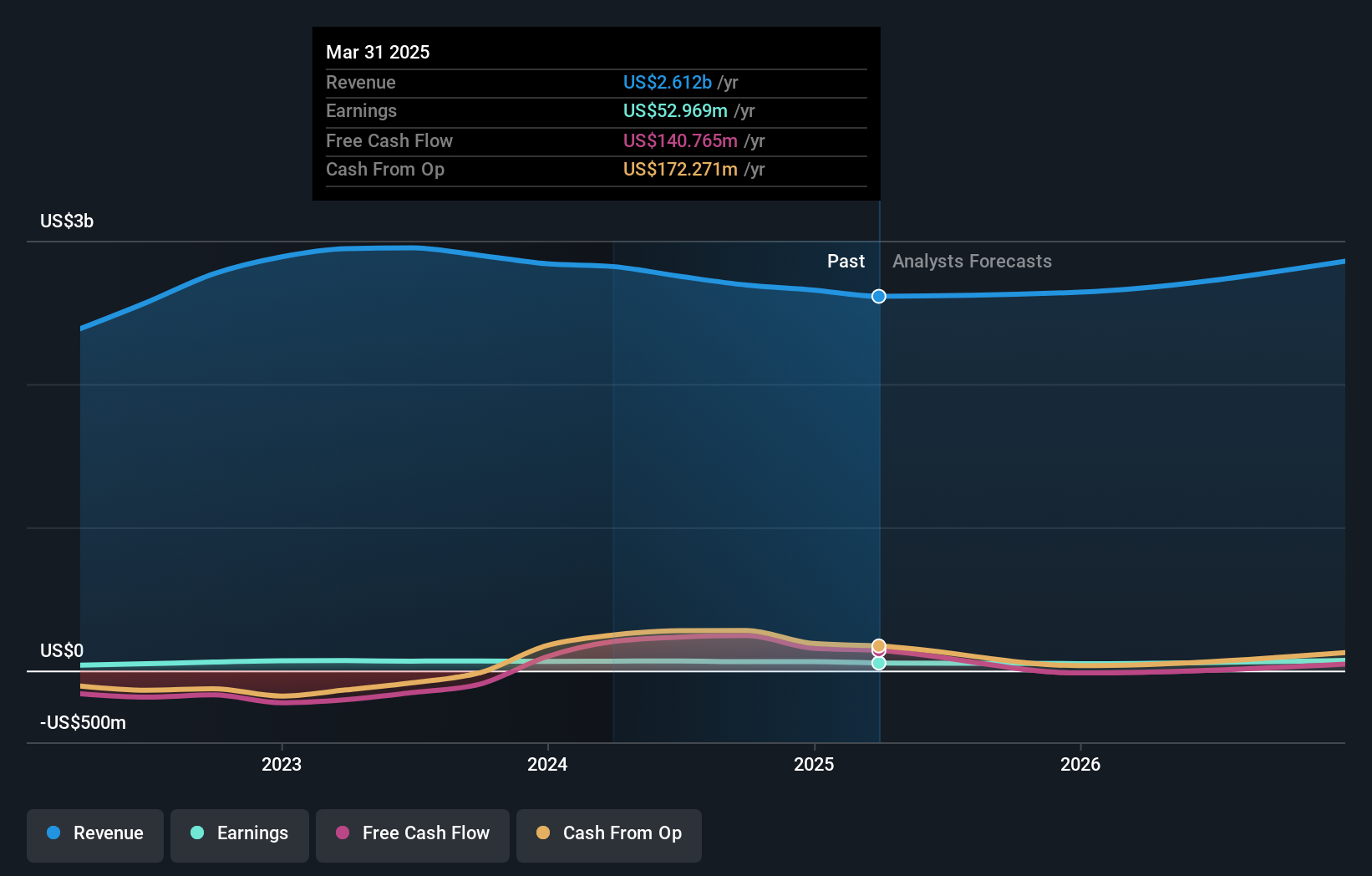

Operations: Benchmark Electronics generates revenue from its operations in Asia ($1.09 billion), Europe ($339.34 million), and the Americas ($1.33 billion).

Benchmark Electronics, a nimble player in the electronics manufacturing services sector, is navigating its path with strategic expansions like the new Penang facility aimed at capturing future semiconductor and defense demand. Despite facing challenges from soft end markets and macroeconomic pressures, the company maintains a solid financial footing with cash exceeding total debt and interest payments well covered by EBIT at 6.9x. Over five years, its debt-to-equity ratio rose from 14.7% to 23.1%, yet it remains profitable with high-quality earnings and positive free cash flow. Earnings are expected to grow annually by 11.27%, reflecting potential for long-term value despite current market headwinds.

McEwen Mining (NYSE:MUX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: McEwen Mining Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market capitalization of $379.33 million.

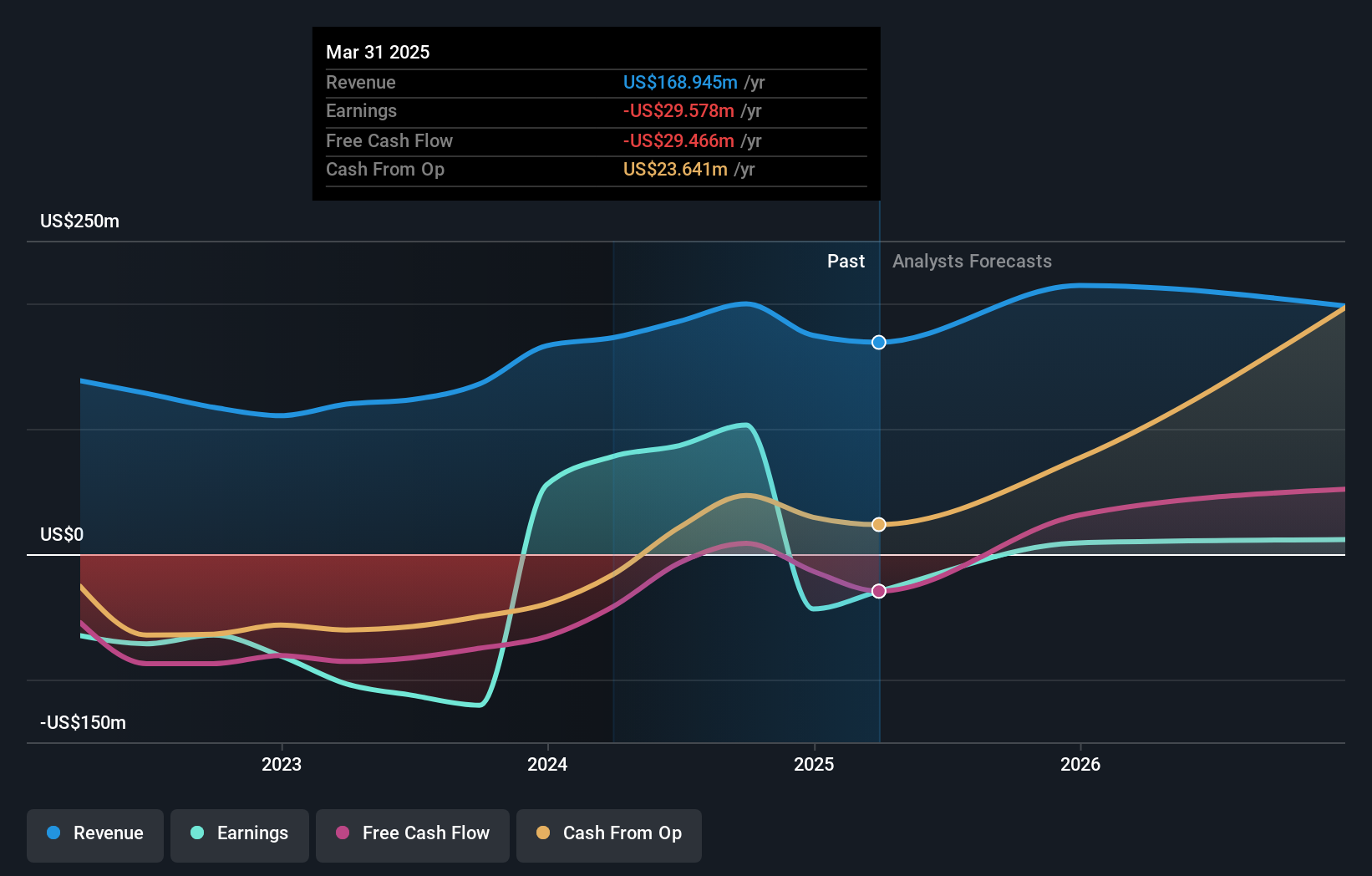

Operations: Revenue is primarily generated from operations in the USA and Canada, contributing $126.10 million and $70.99 million respectively, while Mexico accounts for $2.55 million.

McEwen Mining, a nimble player in the mining sector, has recently turned profitable, with a satisfactory net debt to equity ratio of 1.9%. Trading at nearly half its estimated fair value, it showcases potential for value seekers. The company reported an impressive increase in gold resources at its Grey Fox deposit—over 1.5 million ounces of indicated gold and more than 450,000 ounces inferred—bolstered by strategic exploration and favorable market conditions. However, challenges loom with legal issues concerning environmental compliance at the Black Fox Mine and anticipated earnings decline by an average of 67.7% annually over the next three years.

- Take a closer look at McEwen Mining's potential here in our health report.

Review our historical performance report to gain insights into McEwen Mining's's past performance.

Next Steps

- Dive into all 285 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen Mining

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives