The Bull Case For Belden (BDC) Could Change Following $400M Credit Facility Extension Learn Why

Reviewed by Simply Wall St

- On July 18, 2025, Belden Inc. and several of its U.S. and international subsidiaries entered into a Third Amended and Restated Credit Agreement, extending its multicurrency asset-based revolving credit facility to July 2030 and increasing commitments from US$300.0 million to US$400.0 million.

- This expanded and extended financing arrangement provides Belden with greater liquidity and longer-term financial flexibility to support ongoing operational and investment initiatives.

- We will now examine how the increased credit facility could impact Belden's investment narrative by enhancing its financial flexibility and growth capacity.

Belden Investment Narrative Recap

To be a shareholder in Belden, you need to believe the company can sustain its transformation toward higher-margin solutions, capitalize on industry trends like IT/OT convergence, and overcome any near-term volatility in market demand. The newly expanded and extended credit facility supports Belden’s financial flexibility, but its impact on the most important short-term catalyst, recovery in Smart Infrastructure demand, appears incremental rather than material. Still, this greater financial headroom could help mitigate some immediate risks associated with liquidity and capital allocation.

One recent announcement relevant to the credit facility news is Belden’s continued commitment to stock buybacks, with almost 20% of shares repurchased under its active plan. This buyback program aligns with the company’s capital allocation priorities and is made more feasible with the enhanced liquidity from the credit extension, reinforcing the narrative of shareholder returns as a consistent catalyst for sentiment and valuation. In contrast, as Belden’s financial flexibility improves, investors should also be aware that...

Read the full narrative on Belden (it's free!)

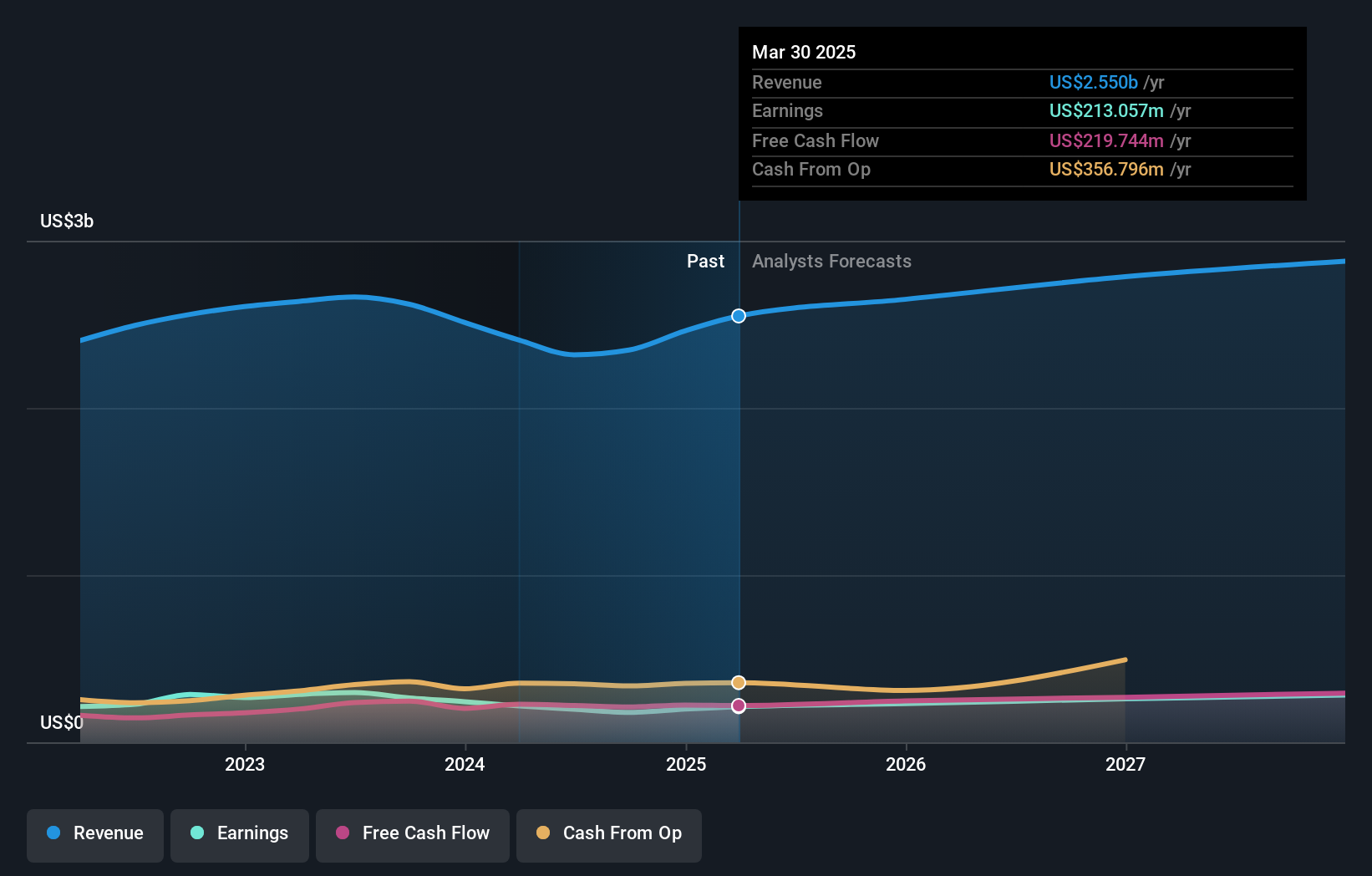

Belden's narrative projects $2.9 billion revenue and $289.1 million earnings by 2028. This requires 4.6% yearly revenue growth and a $76 million earnings increase from $213.1 million.

Uncover how Belden's forecasts yield a $132.83 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members value Belden shares anywhere from US$80.69 to US$148.26, with three different perspectives represented. As you weigh this broad spread, consider how ongoing uncertainty in Smart Infrastructure demand could influence future performance and explore the varied viewpoints now available.

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDC

Belden

Provides connection solutions to bring data infrastructure into alignment to unlock new possibilities for its customers.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives