Arrow Electronics (ARW) Margin Compression Reinforces Value Narrative Despite Low P/E

Reviewed by Simply Wall St

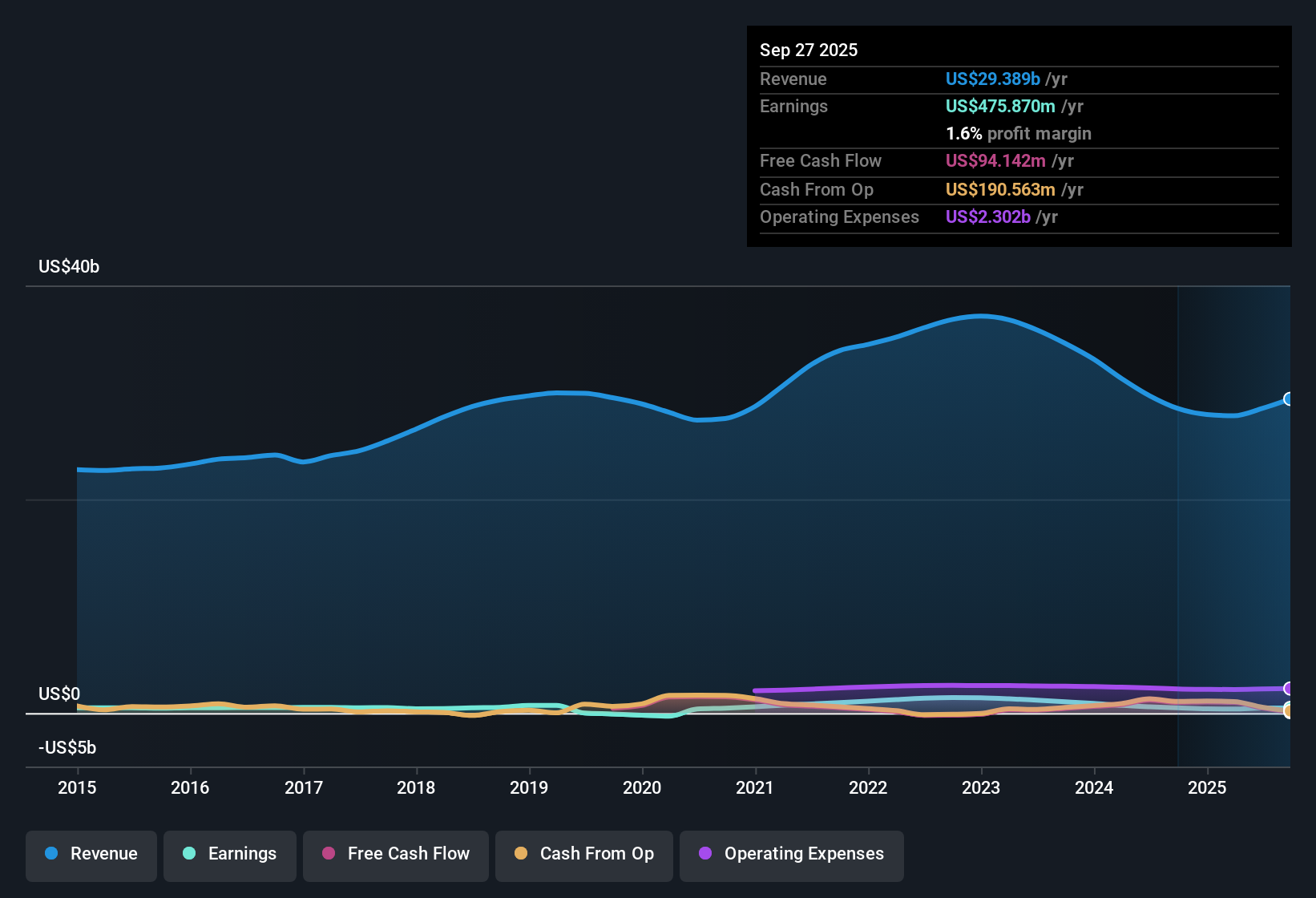

Arrow Electronics (ARW) recorded net profit margins of 1.6%, just below last year’s 1.7%, highlighting continued pressure on profitability. Over the past five years, earnings have declined by 10.2% per year. While forecasts call for 1.7% annual earnings growth and 4.7% revenue growth going forward, both metrics are expected to trail the wider US market. These numbers present a mixed picture for investors, with persistent declines in profit offset by the prospect of steady, if modest, growth.

See our full analysis for Arrow Electronics.Next, we will see how these numbers compare to the broader narratives investors follow, highlighting where expectations meet reality and where surprises might challenge the consensus.

See what the community is saying about Arrow Electronics

Margin Stability Amidst Sector Shifts

- Arrow's profit margins are projected to rise from the current 1.6% to 2.1% by 2028, reflecting analyst expectations for gradual improvement despite industry competition and cost pressures.

- According to the analysts' consensus, margin gains are closely tied to a mix of efficiency initiatives and a shift toward higher-margin, recurring revenue streams.

- Consensus narrative notes that value-added services and the adoption of cloud and software offerings are key drivers. These are expected to bolster margin resilience even as the customer base and market dynamics evolve.

- However, consensus cautions that global uncertainties and supply chain pressures could still challenge margin progress. This demands continued focus on operational discipline.

- Eager to see whether Arrow's push for higher margins can outpace emerging risks? Dive into the full consensus narrative for deeper insights. 📊 Read the full Arrow Electronics Consensus Narrative.

P/E Discount versus Industry Peers

- Arrow's price-to-earnings ratio stands at 12.1x, significantly below the US electronics industry average of 25x and the peer average of 19x. This positions its shares as comparatively undervalued.

- The analysts' consensus narrative highlights that this lower P/E may reflect investor caution around Arrow's profitability trends, but also leaves room for upside if the company delivers on long-term earnings growth.

- Consensus notes that continued traction in recurring software revenues and improved margin stability could help close the valuation gap, especially if earnings forecasts are met or exceeded.

- Consensus also points out that in the event of weaker profit recovery or sustained margin headwinds, the current discount could persist or deepen. This emphasizes the importance of execution on efficiency measures.

Profit Trends Outpace Share Reduction

- Analysts expect Arrow's shares outstanding to decrease by 2.07% per year over the next three years, a trend that can amplify earnings per share growth if net income stabilizes or rises.

- Based on the consensus narrative, analysts agree that while buybacks and stable share counts improve per-share metrics, the core challenge remains reversing a historic 10.2% annual earnings decline, which has overshadowed the benefit of fewer shares.

- Consensus flags that even as operational improvements unlock some upside, sustainability depends on sector recovery and Arrow's ability to diversify beyond distribution, particularly into software and value-added services.

- Consensus underscores that the ultimate impact of these trends hinges on Arrow’s ability to capture margin expansion without getting caught by ongoing customer and supply chain shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arrow Electronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Viewing the data from a different angle? Consider shaping your perspective into a narrative of your own in just a few minutes. Do it your way

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Arrow’s declining earnings and only modest growth outlook leave investors facing uncertainty about sustained profitability and sector outperformance.

If you’re seeking steadier performers, use stable growth stocks screener (2101 results) to find companies that consistently expand revenue and earnings regardless of shifting industry conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion