Analysts Are Optimistic We'll See A Profit From Arlo Technologies, Inc. (NYSE:ARLO)

With the business potentially at an important milestone, we thought we'd take a closer look at Arlo Technologies, Inc.'s (NYSE:ARLO) future prospects. Arlo Technologies, Inc., together with its subsidiaries, provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions. The US$1.7b market-cap company posted a loss in its most recent financial year of US$31m and a latest trailing-twelve-month loss of US$22m shrinking the gap between loss and breakeven. The most pressing concern for investors is Arlo Technologies' path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

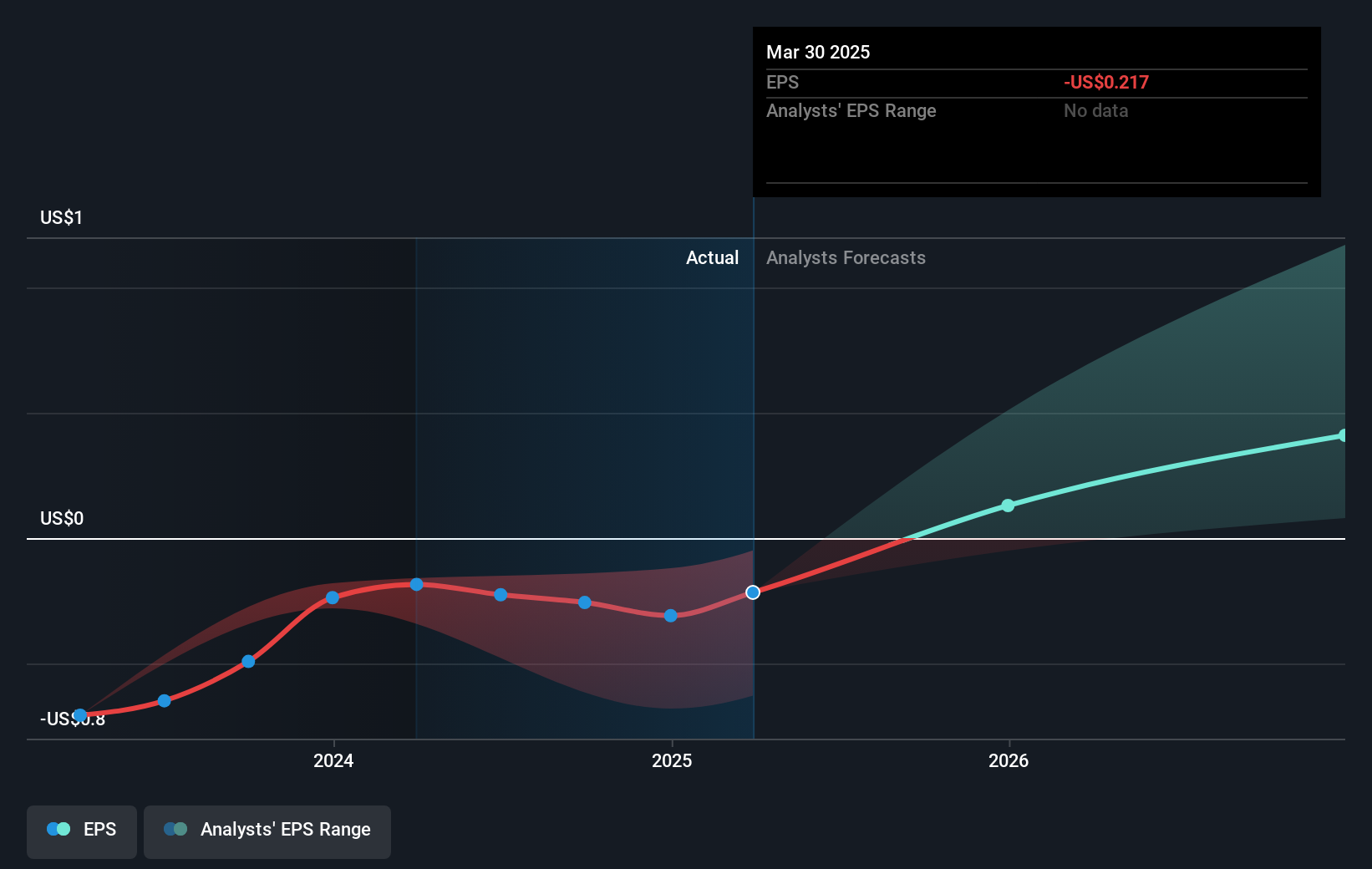

According to the 5 industry analysts covering Arlo Technologies, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2024, before generating positive profits of US$20m in 2025. The company is therefore projected to breakeven around 12 months from now or less. How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2025? Working backwards from analyst estimates, it turns out that they expect the company to grow 134% year-on-year, on average, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

We're not going to go through company-specific developments for Arlo Technologies given that this is a high-level summary, however, bear in mind that typically a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Check out our latest analysis for Arlo Technologies

Before we wrap up, there’s one aspect worth mentioning. Arlo Technologies currently has no debt on its balance sheet, which is quite unusual for a cash-burning growth company, which usually has a high level of debt relative to its equity. The company currently operates purely off its shareholder funding and has no debt obligation, reducing concerns around repayments and making it a less risky investment.

Next Steps:

There are key fundamentals of Arlo Technologies which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Arlo Technologies, take a look at Arlo Technologies' company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further examine:

- Valuation: What is Arlo Technologies worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Arlo Technologies is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Arlo Technologies’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ARLO

Arlo Technologies

Provides cloud-based platform services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>