Has Amphenol’s 101% Surge in 2025 Pushed Its Valuation Too Far?

Reviewed by Bailey Pemberton

- If you are wondering whether Amphenol is still a smart buy after its huge run, or if you are late to the party, this breakdown will help you assess whether the current price makes sense.

- The stock has paused recently, remaining flat over the last week and down about 3.6% over the past month. That follows a climb of roughly 101% year to date and 90.1% over the last year.

- These gains have been supported by steady demand for Amphenol's connectivity and sensor solutions across data centers, automotive, and industrial applications, as investors continue to back long term infrastructure and electronics trends. At the same time, the market narrative has shifted toward companies enabling digital transformation and higher bandwidth networks, which keeps Amphenol on many growth focused investors' radar.

- Despite that backdrop, Amphenol only scores a 1 out of 6 on our simple undervaluation checks. We will therefore explore how different valuation methods compare, and then finish with a broader framework for judging whether the stock is appropriately priced.

Amphenol scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amphenol Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today to reflect risk and the time value of money.

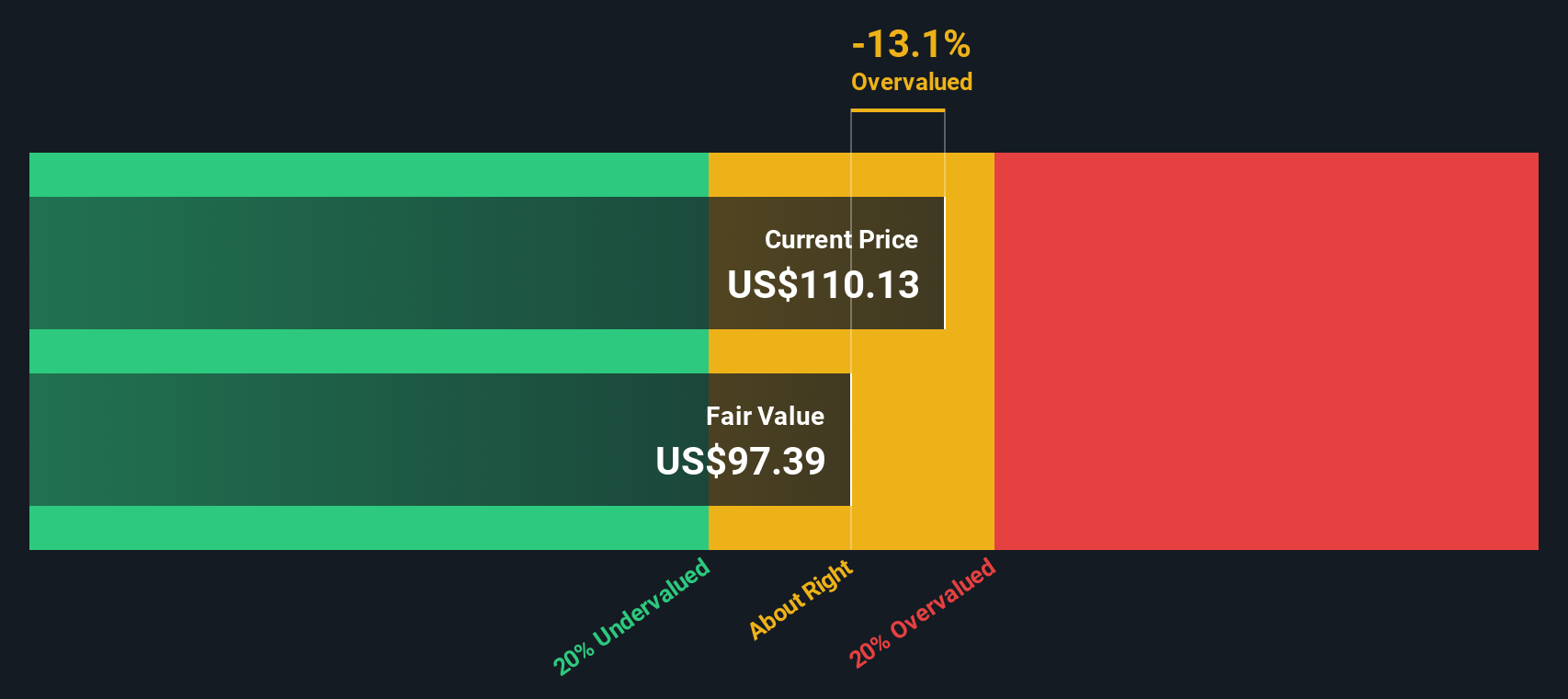

For Amphenol, the latest twelve month free cash flow is about $3.67 billion. Analysts provide explicit forecasts for the next several years, and these are then extended by Simply Wall St to build a longer term path. Under this 2 stage Free Cash Flow to Equity model, free cash flow is projected to rise to roughly $6.85 billion by 2029, with further growth extrapolated out to 2035.

When all these future cash flows are discounted back to today, the model suggests an intrinsic value of about $103.34 per share. Compared with the current share price, this implies the stock is roughly 34.2% overvalued on a DCF basis. In other words, investors are paying a premium to the value suggested by long term cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amphenol may be overvalued by 34.2%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amphenol Price vs Earnings

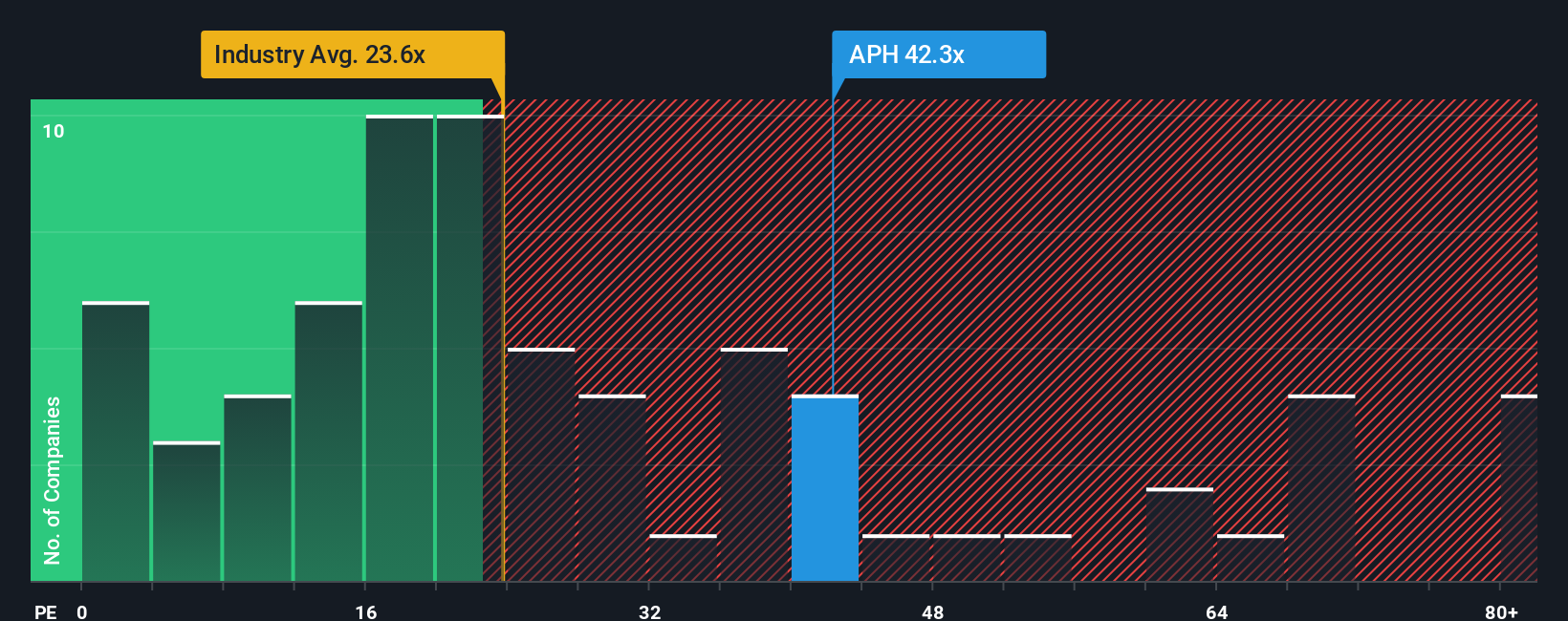

For a profitable, mature business like Amphenol, the price to earnings (PE) ratio is a useful yardstick because it links what investors pay today directly to the company earnings that support the share price. In general, companies with faster, more reliable earnings growth and lower risk deserve a higher, or more generous, PE multiple, while slower growing or riskier firms should trade on a lower multiple.

Amphenol currently trades on a PE of about 44.43x. That is well above the broader Electronic industry average of roughly 25.38x, but slightly below the peer group average of around 46.53x. This suggests the market already recognizes its quality and growth profile. Simply Wall St goes a step further by calculating a proprietary Fair Ratio, which estimates what PE the company should trade on given its earnings growth outlook, profit margins, industry, market cap and risk profile. For Amphenol, this Fair Ratio is 34.98x.

Because this Fair Ratio is meaningfully lower than the current 44.43x PE, the multiple based view points to the shares trading at a premium to what fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amphenol Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about a company that link your view of its future revenue, earnings and margins to a financial forecast and, ultimately, to a fair value estimate you can compare with today’s price.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy and accessible by letting you spell out your assumptions, automatically translate them into forward-looking numbers and a fair value, and then show you whether your view suggests Amphenol is a buy, hold or sell at the current market price.

Because Narratives update dynamically as new earnings, news and guidance arrive, they help you keep your thesis current and avoid relying on stale back of the envelope calculations.

For example, one Amphenol Narrative on the platform might assume rapid AI driven demand, robust margins and a fair value near $163. Another more cautious view might focus on cyclicality and acquisition risk and land closer to $85. By seeing both, you can decide which story you believe and how to act on it.

Do you think there's more to the story for Amphenol? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026