Amphenol (NYSE:APH) Shareholders Approve Increase In Authorized Shares To 5 Billion

Reviewed by Simply Wall St

Amphenol (NYSE:APH) recently gained attention as its stock price surged by 34% over the last month. The company's approval of a Charter Amendment, which increased authorized shares of Class A Common Stock from 2 billion to 5 billion, likely provided the company with greater flexibility for future financing, adding weight to this price move. Additionally, Amphenol's solid earnings report for Q1 2025 and a consistent dividend announcement further contributed positively. While the broader market rose by 5% over the last seven days and has been generally positive, Amphenol's specific developments likely bolstered investor confidence, driving its stock performance significantly above broader market trends.

Be aware that Amphenol is showing 1 risk in our investment analysis.

Amphenol's recent approval to expand its authorized shares reflects strategic foresight, potentially boosting its future financing capability. This move coincides with a significant 34% share price increase in the past month, emphasizing market confidence. Over the past five years, Amphenol's total return, including dividends, reached approximately 301.67%, showcasing significant long-term value creation for shareholders.

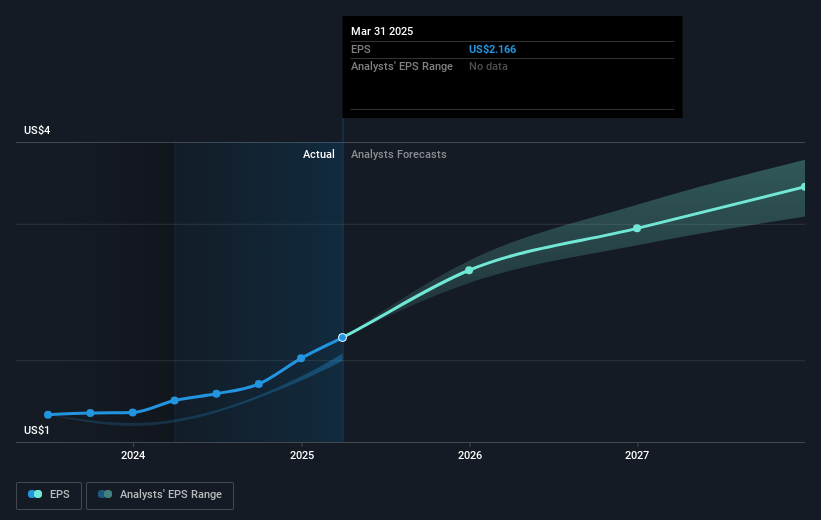

Comparatively, Amphenol's stock has outperformed the broader US electronic industry and market with a 28.3% earnings growth over the past year against the industry's 2.2% decline. The company's diversified market exposure and demand in IT datacom suggest robust forecasted revenue and earnings. Analysts project a 12.5% annual revenue increase over the next three years, bolstered by substantial IT datacom demand and recent acquisitions. The stock trades slightly below the analyst consensus price target of US$85.26, indicating a 6.5% potential upside. This aligns the stock closely with market valuation expectations, although Amphenol's Price-To-Earnings Ratio remains higher than the industry average.

Explore historical data to track Amphenol's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives