Amphenol (NYSE:APH) Exits Multiple Russell Value Indices In 2025 Index Reconstitution

Reviewed by Simply Wall St

Amphenol (NYSE:APH) recently experienced a significant price movement, with its stock appreciating by 49% over the last quarter, a period characterized by its removal from major indices like the Russell 1000 Value Index. Financial results showed a substantial increase in sales and net income, complemented by a dividend declaration and ongoing stock buyback program. These factors likely contributed to the price move, alongside broader market trends such as the S&P 500 and Nasdaq's rise to new highs. The Q1 earnings, predictions of strong Q2 results, and strategic financial maneuvers could have bolstered investor confidence amid bullish market conditions.

You should learn about the 1 weakness we've spotted with Amphenol.

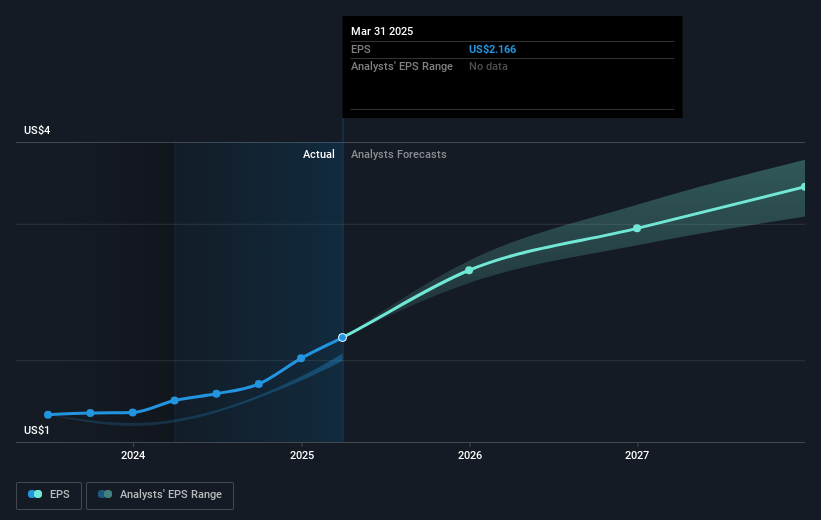

The significant 49% share price appreciation for Amphenol in the past quarter may carry implications for its revenue and earnings forecasts. The market's positive response to Amphenol's financial results, dividend declaration, and stock buyback activity suggests increased investor confidence. This confidence aligns with analyst expectations of 12.5% annual revenue growth and a 1.5% increase in profit margins over three years. However, with the share price at US$79.71, it's currently trading approximately 6.5% below the analyst consensus target of US$85.26. This underscores a perceived undervaluation relative to forecasted financial performance.

Over a longer term, the company's total shareholder return, including share price increases and dividends, stood at approximately 327.30% over the past five years. This impressive performance contrasts with its recent one-year return, which exceeded both the broader US market's 13.7% and the US Electronic industry's 22.9%. Such longer-term returns reflect the company's robust operational execution and effective financial strategies. As Amphenol continues to capitalize on IT datacom and AI-powered growth, these developments could bolster the company's future revenue and earnings trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion