- United States

- /

- Communications

- /

- NYSE:ANET

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, with key indices like the Nasdaq and S&P 500 posting significant gains, investors are closely monitoring high-growth tech stocks that continue to capture attention amid economic uncertainties such as a prolonged government shutdown and fluctuating inflation data. In this dynamic environment, identifying promising tech stocks involves evaluating their potential for innovation and growth within sectors that are resilient to market volatility and capable of capitalizing on technological advancements.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 10.52% | 20.78% | ★★★★★☆ |

| ADMA Biologics | 20.61% | 23.30% | ★★★★★☆ |

| Palantir Technologies | 25.19% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| Circle Internet Group | 27.59% | 82.06% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Vericel (VCEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on developing, manufacturing, and distributing cellular therapies and specialty biologic products for sports medicine and severe burn care markets in North America, with a market cap of $1.82 billion.

Operations: Vericel focuses on cellular therapies and specialty biologics, generating $249.12 million in revenue from its biotechnology segment.

Vericel, a player in the biotech sector, has demonstrated robust financial performance with an impressive annual revenue growth of 19.5% and even more striking earnings growth at 46.3% per annum. This growth trajectory surpasses the broader U.S market averages significantly, highlighting its potential within high-growth sectors. Recent presentations at industry conferences and reaffirmed financial guidance for 2025 suggest a sustained focus on innovation and market expansion. Notably, Vericel's commitment to R&D is evident from its strategic allocation of resources towards enhancing product offerings and operational efficiencies, which could further solidify its position in the competitive biotech landscape.

- Navigate through the intricacies of Vericel with our comprehensive health report here.

Evaluate Vericel's historical performance by accessing our past performance report.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. is a company that offers enterprise cloud applications both in the United States and internationally, with a market capitalization of $64.40 billion.

Operations: Workday generates revenue primarily through its cloud applications, totaling $8.96 billion. The company's focus on enterprise solutions positions it as a key player in the global market for cloud-based services.

Workday's strategic integrations and partnerships, notably with Flywire and Lattice, underscore its commitment to enhancing operational efficiencies through technological innovation. The company's recent certification as a Workday Global Payroll Connect partner reflects its capability to deliver robust multi-country payroll solutions, reinforcing its position in the tech landscape. With a substantial $4 billion share repurchase program announced, Workday is signaling confidence in its financial health and future prospects. These moves not only enhance Workday's service offerings but also solidify its role in transforming enterprise operations globally.

- Delve into the full analysis health report here for a deeper understanding of Workday.

Assess Workday's past performance with our detailed historical performance reports.

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arista Networks Inc specializes in creating and selling data-driven networking solutions for AI, data centers, campuses, and routing environments across various global regions with a market cap of $184.11 billion.

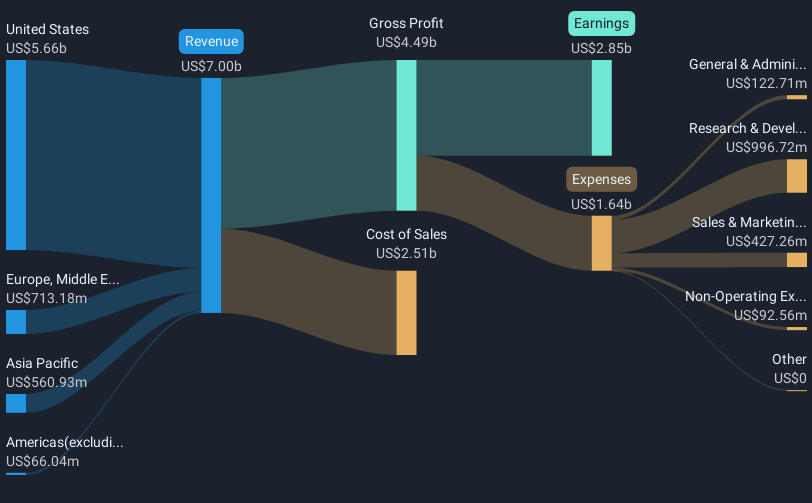

Operations: Arista Networks Inc generates revenue primarily from its computer networks segment, which amounts to $7.95 billion. The company focuses on providing advanced networking solutions across multiple regions including the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

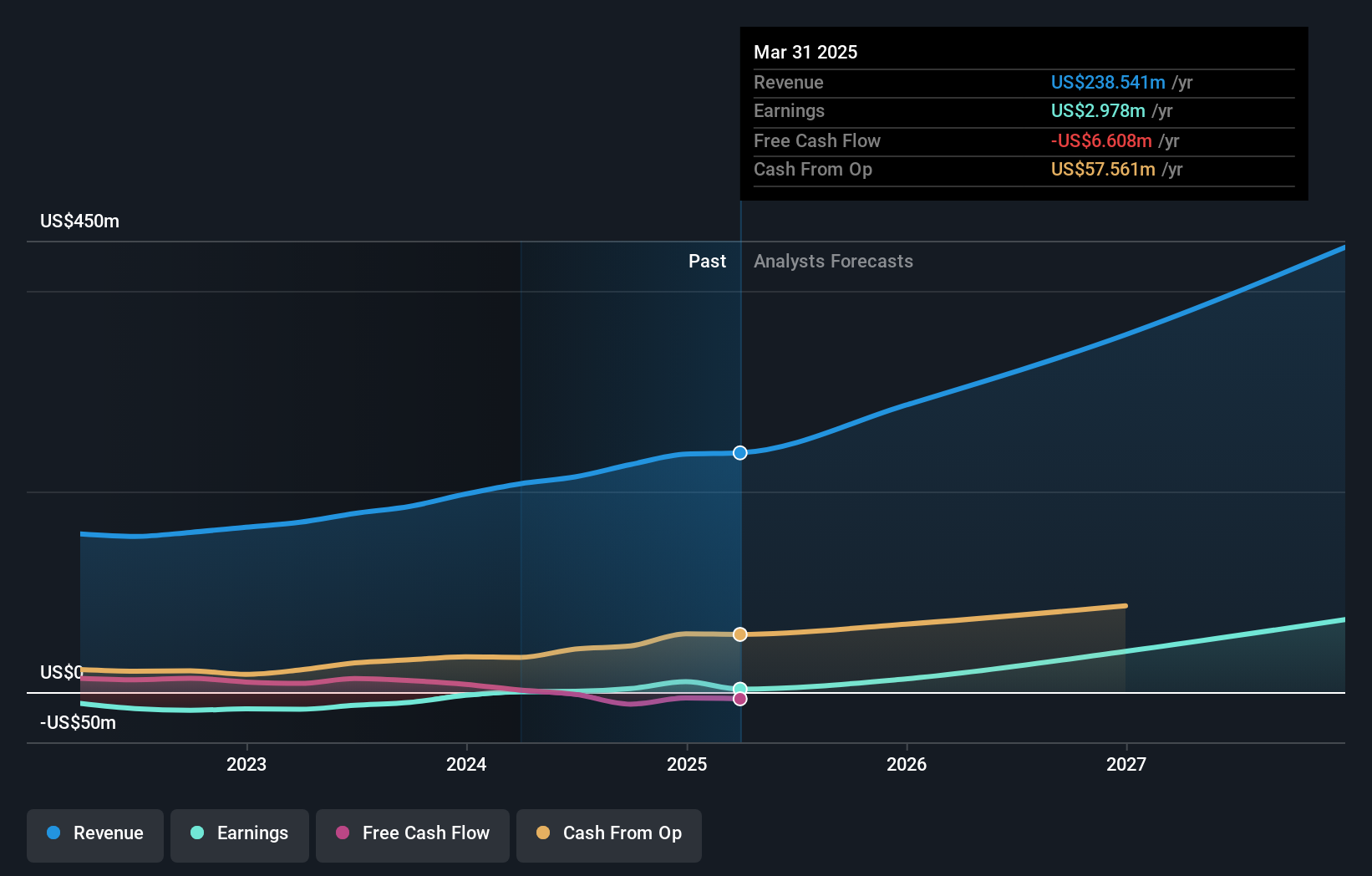

Arista Networks, a key player in the tech sector, has demonstrated robust financial health with a notable 16.5% annual revenue growth and 16% earnings growth, outpacing the US market average. In recent strategic moves, the company appointed Kenneth Duda as President and CTO to enhance its focus on cloud and AI systems engineering, signaling a deeper dive into innovation-driven sectors. Furthermore, Arista's commitment to shareholder returns is evident from its recent repurchase of shares worth $1.2 billion, underscoring confidence in sustained growth driven by advancements in AI and cloud technologies.

- Click to explore a detailed breakdown of our findings in Arista Networks' health report.

Understand Arista Networks' track record by examining our Past report.

Summing It All Up

- Click here to access our complete index of 72 US High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives