- United States

- /

- Communications

- /

- NYSE:ANET

Arista Networks (NYSE:ANET) Appoints Greg Lavender To Board Of Directors

Reviewed by Simply Wall St

Arista Networks (NYSE:ANET) has seen a notable price move of 13% over the past week, coinciding with recent changes in its executive ranks and board composition. The appointment of Greg Lavender to its Board of Directors and the forthcoming transition of Chief Platform Officer John McCool to a senior advisory role may have added weight to the company's upward movement, aligning with the broader market's 5% climb. These strategic leadership shifts underline a focus on strengthening technical oversight and maintaining stability, potentially supporting the company's trajectory amid a positive market environment.

Be aware that Arista Networks is showing 1 risk in our investment analysis.

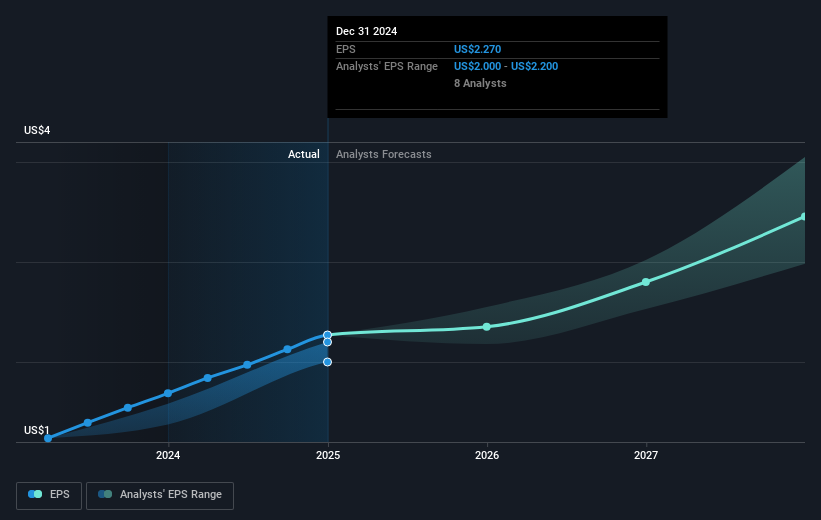

The recent executive changes at Arista Networks, including Greg Lavender's board appointment and John McCool's transition to an advisory role, could enhance the company's technical oversight, potentially influencing its revenue and earnings forecasts positively. These leadership shifts may provide Arista with strengthened capabilities in guiding its expansion in Ethernet technology and AI-driven solutions. As the company eyes increased revenues from 800-gigabit Ethernet technology and AI centers, the leadership changes may bolster its strategic initiatives amid a competitive and rapidly evolving market landscape.

Over the past five years, Arista Networks achieved a total shareholder return of nearly 454%, reflecting substantial long-term growth, notably in the data-driven networking sector. This impressive performance contrasts with its recent 1-year underperformance against the US Communications industry, which returned 18.4%. Despite the short-term lag, the stock's long-term gains signify its robust position in the market.

With the stock price at US$68.17, Arista Networks trades at a discount to its optimistic price target of US$133.37, which suggests a potential for price appreciation. Additionally, strong deferred revenue and active stock repurchase programs indicate a focus on enhancing shareholder value. However, challenges such as competitive pressures, tariff impacts, and potential delays in AI switch rollouts could influence earnings and revenue projections. Meanwhile, bullish analysts project revenue to reach US$14.30 billion by 2028, requiring a higher PE ratio compared to its current level, posing both opportunities and risks for investors to consider.

Review our growth performance report to gain insights into Arista Networks' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)