- United States

- /

- Communications

- /

- NYSE:ANET

Arista Networks (NYSE:ANET) 10% Dip Despite Robust Full-Year Revenue Increase

Reviewed by Simply Wall St

Arista Networks (NYSE:ANET) saw a 10% decline in its share price over the past week despite reporting a robust increase in its full-year revenue and net income. The company's significant buyback activity and positive guidance for the first quarter of 2025 did not prevent the downturn. This sharp decline aligns with broader market trends, as the Nasdaq Composite registered a third consecutive weekly decline, falling 3.5%. The overall market turbulence was influenced by investor concerns over economic slowdown and ongoing tariff implications, which may have affected tech stocks like Arista Networks. Despite Jerome Powell’s statement that the economy remains in good shape, broader market indices, including the S&P 500, also suffered losses. The company's recent financial performance and planned buybacks highlight its operational strengths, yet these were overshadowed by external market dynamics pushing tech shares lower across the board.

Click here to discover the nuances of Arista Networks with our detailed analytical report.

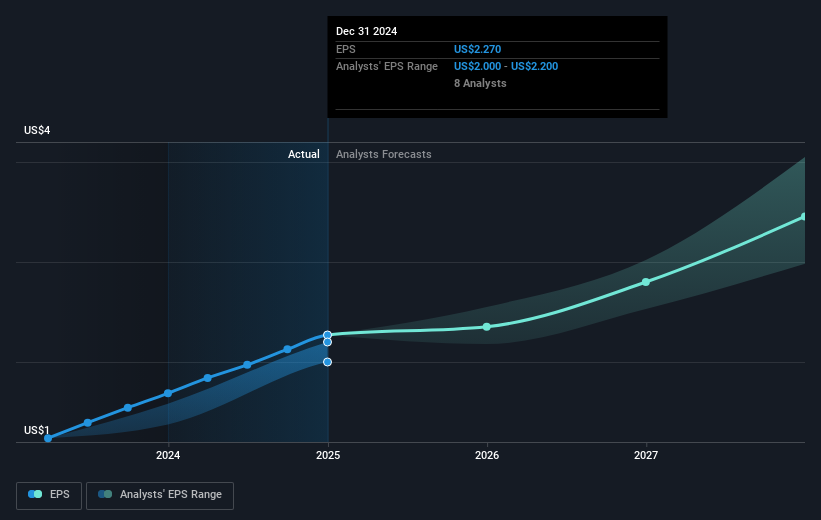

The recent decline in Arista Networks' share price contrasts sharply with its very large total return of 654.56% over the past five years. During this period, the company significantly outperformed the US market in the past year, which saw gains of 11.9%. Key contributors to Arista's impressive long-term performance include its ability to maintain high earnings growth, with its earnings growing by an average of 31.7% per year over the last five years. Furthermore, the company showed high profitability, evidenced by a Return on Equity of 28.5%, considered high by industry standards.

Arista's strategic buybacks also played a role, with substantial repurchases completed since its buyback program announcement on November 1, 2021. By November 2024, the firm had invested US$1 billion in repurchasing 2.77% of its shares. Despite a recent challenge, these aspects suggest that Arista's long-term trajectory remains promising, buoyed by its operational strengths and financial discipline.

- Discover whether Arista Networks is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Discover the key vulnerabilities in Arista Networks' business with our detailed risk assessment.

- Hold shares in Arista Networks? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.