- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Will Zebra Technologies' (ZBRA) Logistics Automation Bet Reshape Its Edge in Warehouse Innovation?

Reviewed by Sasha Jovanovic

- ODW Logistics recently announced its adoption of Zebra Technologies' Symmetry™ Fulfillment solution, deploying automation, autonomous mobile robots, and cart-based workflows to improve efficiency and cut fulfillment costs.

- This partnership reflects a growing industry trend, as logistics and manufacturing firms increasingly invest in automated technologies to boost productivity and optimize operations.

- We'll explore how ODW Logistics' adoption of Zebra's fulfillment automation could influence the company's investment narrative and growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zebra Technologies Investment Narrative Recap

To consider Zebra Technologies as a compelling investment, an investor must believe in the ongoing demand for workflow automation across logistics and manufacturing. The recent ODW Logistics adoption of Zebra Symmetry™ Fulfillment reinforces the short-term catalyst of accelerating automation demand. However, this news does not materially impact the most significant current risk: the company’s continued reliance on hardware sales, which could lead to earnings volatility if the transition to software and services remains slower than anticipated.

Among recent developments, Zebra’s partnership with Tulip stands out for its relevance. It supports the broader theme of digitizing frontline operations, a key catalyst underlying Zebra’s strategy to drive recurring revenue growth and embed its offerings deeper within customer workflows.

But even as automation gains momentum, Zebra’s dependence on hardware sales means investors should be aware of the risk that...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies' outlook anticipates $6.2 billion in revenue and $855.4 million in earnings by 2028. This implies a 6.0% annual revenue growth rate and a $307.4 million increase in earnings from the current $548.0 million.

Uncover how Zebra Technologies' forecasts yield a $369.60 fair value, a 20% upside to its current price.

Exploring Other Perspectives

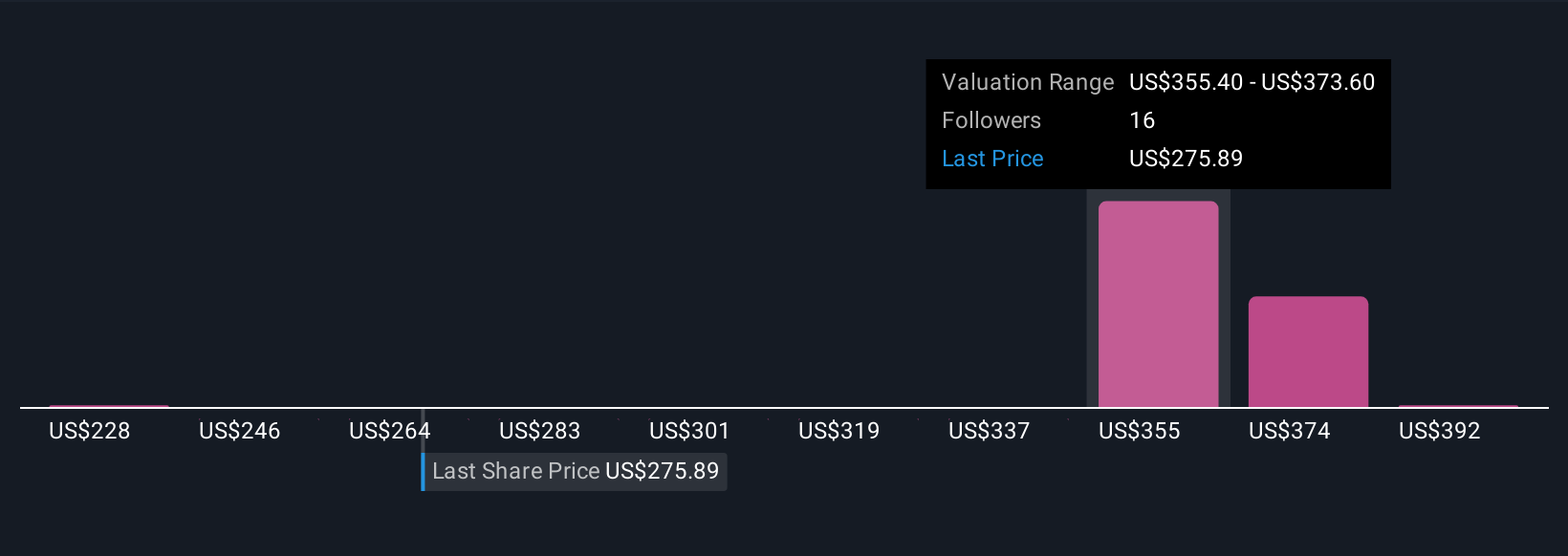

Simply Wall St Community members estimate Zebra’s fair value from US$228 to US$410 across four analyses. While recent automation wins support growth catalysts, opinions vary widely on longer-term earnings stability.

Explore 4 other fair value estimates on Zebra Technologies - why the stock might be worth as much as 33% more than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives