- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Is Western Digital’s Nasdaq 100 Inclusion Reframing The AI Storage Investment Case For WDC?

Reviewed by Sasha Jovanovic

- Earlier in December, Nasdaq announced that Western Digital would join the Nasdaq 100 index, reflecting the company’s growing role in large‑cap technology hardware and infrastructure.

- This index inclusion follows Western Digital’s post-separation focus on hard disk drives, AI-driven data center demand, and expansion into quantum computing-related technologies.

- We’ll now examine how Western Digital’s addition to the Nasdaq 100 potentially reshapes its AI-focused storage investment narrative and growth profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Western Digital Investment Narrative Recap

To own Western Digital today, you need to believe that AI-driven data growth and high-capacity HDD adoption can offset customer concentration and technology transition risks. Joining the Nasdaq 100 may amplify short term volatility and liquidity, but it does not materially change the core near term catalyst, which remains hyperscaler demand for next generation drives, nor the biggest risk, which is reliance on a handful of cloud customers for the vast majority of revenue.

The recent investment in quantum hardware firm Qolab feels particularly relevant here, as it links Western Digital’s storage expertise to emerging compute architectures that will also generate and process massive datasets. While this initiative is early compared with the AI storage cycle, it adds another potential growth vector on top of upcoming ePMR and HAMR ramps that many shareholders already see as central to the thesis.

Yet while enthusiasm is high, Western Digital’s heavy dependence on a few hyperscale customers is a risk investors should be aware of if...

Read the full narrative on Western Digital (it's free!)

Western Digital’s narrative projects $11.9 billion revenue and $2.2 billion earnings by 2028. This requires 7.6% yearly revenue growth and a roughly $0.6 billion earnings increase from $1.6 billion today.

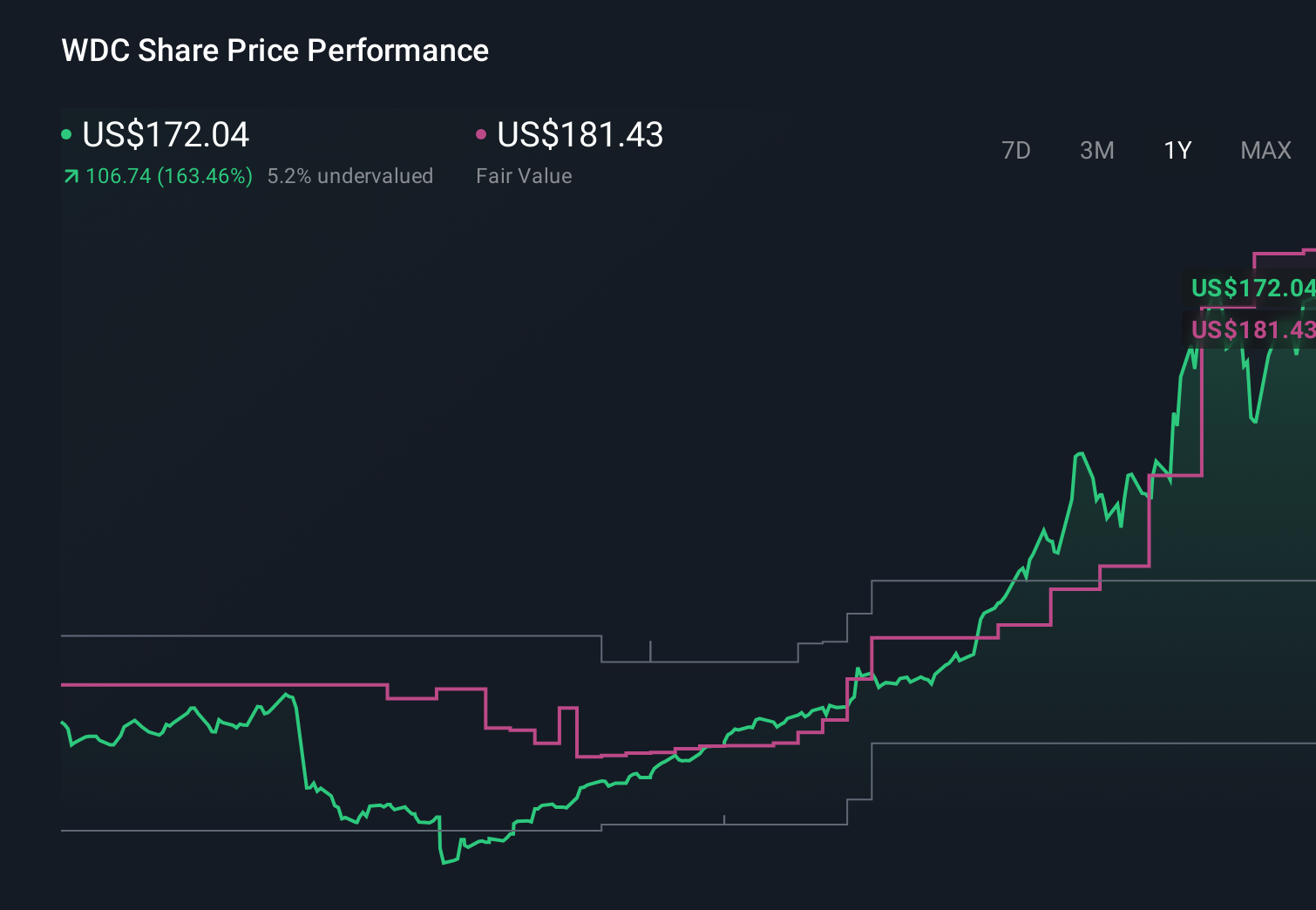

Uncover how Western Digital's forecasts yield a $181.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community valuations for Western Digital range from US$85 to about US$231 per share, reflecting very different expectations. Against that spread, the concentration risk in hyperscale customers could materially change how each of those views plays out over time, so it is worth comparing several of them.

Explore 4 other fair value estimates on Western Digital - why the stock might be worth as much as 33% more than the current price!

Build Your Own Western Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)