- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Is There Opportunity in Western Digital After 51% Rally and Toshiba Merger Progress in 2025?

Reviewed by Simply Wall St

If you are weighing whether to buy, hold, or sell Western Digital stock right now, you are not alone. This storied data storage giant has been on a bit of a rollercoaster lately, capturing the attention of both risk-tolerant growth seekers and valuation-minded investors. Over the last three months, Western Digital shares have surged over 51%, and the stock price is up an impressive 54% over the past year. If you zoom out to three or five years, returns have more than doubled and nearly tripled, respectively, despite the ups and downs that come with cyclical tech businesses.

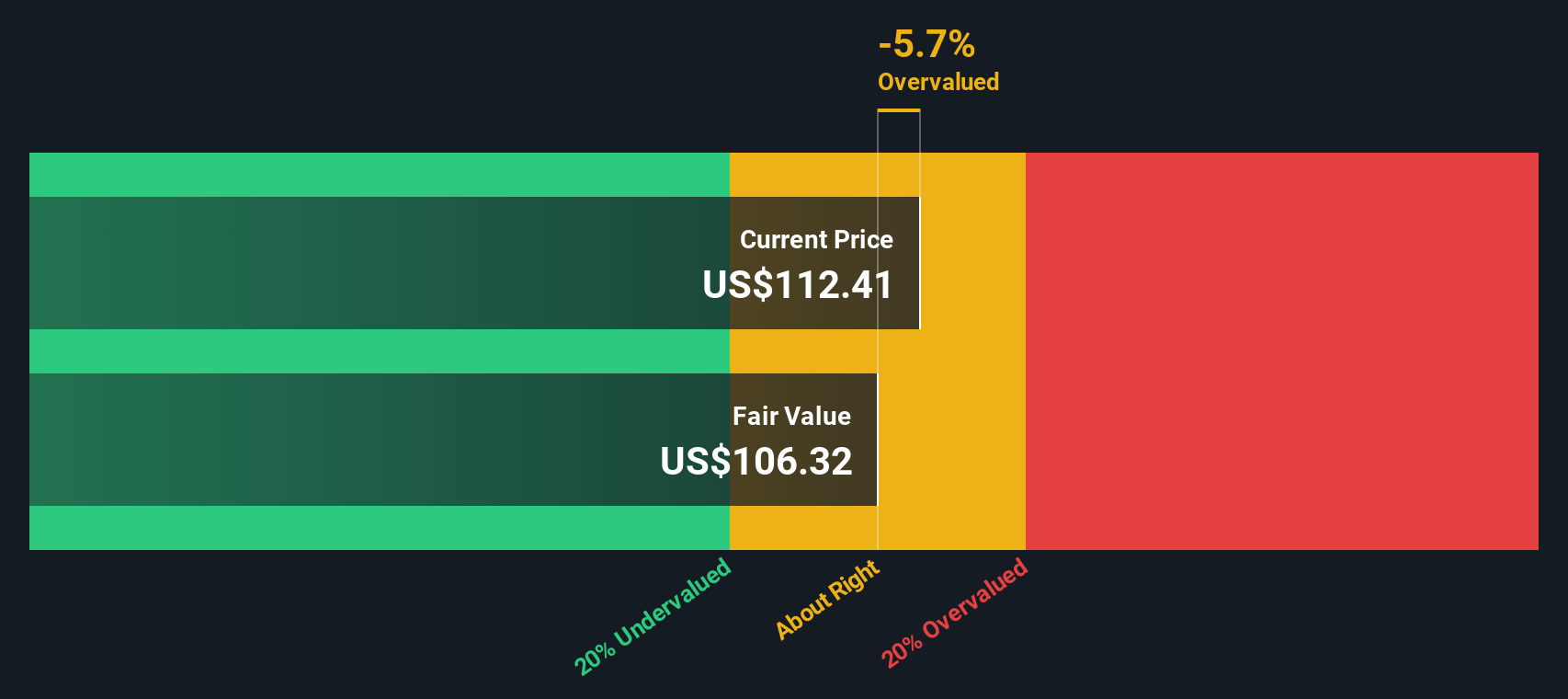

Driving these moves are shifting market dynamics in data storage, alongside improving fundamentals for Western Digital itself. Analyst price targets now sit about 16% above the most recent close, and some fair value estimates point to a 24% intrinsic discount. Revenue and net income are both growing at a healthy pace year-over-year, which powers optimism around further gains if the market’s risk appetite holds steady.

But what about valuation? That is where things get interesting. On a composite score that checks six measures of how undervalued a company is, Western Digital comes in at 5 out of 6, which suggests significant room for upside. In the next section, we will dig into these valuation methods one by one. Stick around for a unique perspective at the end that could help you rethink how to spot truly compelling value buys.

Western Digital delivered 54.2% returns over the last year. See how this stacks up to the rest of the Tech industry.Approach 1: Western Digital Cash Flows

The Discounted Cash Flow (DCF) model is a tool investors use to estimate what a company is truly worth by projecting its future cash flows and then discounting them back to today's value. This approach cuts through market noise and bases valuation on the money Western Digital is expected to generate.

Western Digital’s most recent Free Cash Flow was $956.4 million, putting it just shy of the billion-dollar mark. Analysts and models project this figure to rise steadily, with forecasts calling for Free Cash Flow to reach $2.29 billion by 2030. These projections show consistent growth, reflecting expectations of ongoing demand for data storage and operational improvements.

Bringing together all those future cash flows and discounting appropriately, the DCF model estimates Western Digital’s fair intrinsic value at $99.18 per share. With this calculation, the stock appears 23.7% undervalued compared to its latest market price, an attractive margin for value-focused investors.

Result: UNDERVALUED

Approach 2: Western Digital Price vs Earnings

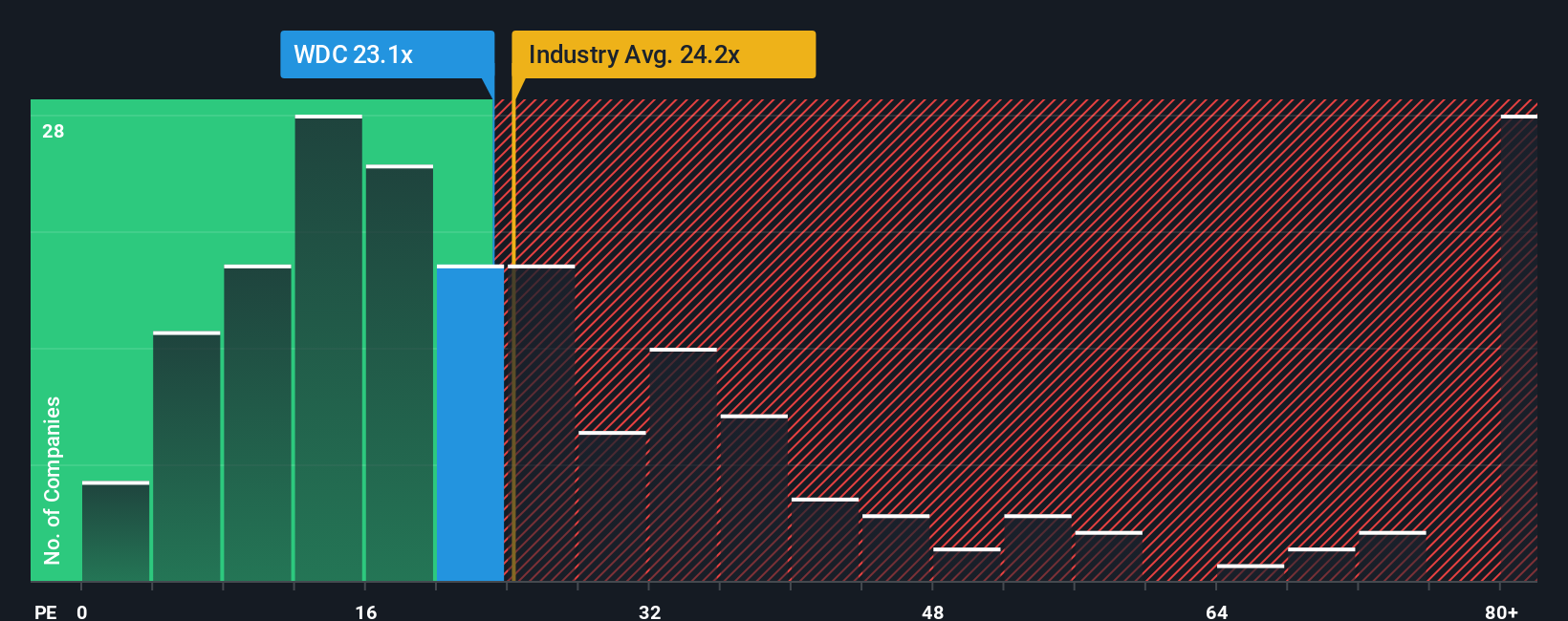

The Price-to-Earnings (PE) ratio is often the favored valuation metric for consistently profitable companies like Western Digital. It offers a quick snapshot of how much investors are willing to pay for each dollar of earnings. Since the company is posting strong and steadily growing profits, the PE ratio provides a meaningful benchmark for valuation.

A fair PE ratio is influenced by several factors, including a company's future earnings growth prospects, its risk profile, and how it compares to industry peers. Higher expected growth and lower risks usually support a higher PE. Companies with uncertain prospects or more volatility tend to receive a discount.

Western Digital currently trades at a PE ratio of 16.42x. For context, tech sector peers are at an average of 17.81x, while the broader industry average is 24.02x. Simply Wall St’s proprietary Fair Ratio, which accounts for Western Digital’s profitability, growth trajectory, and market position, is higher at 27.11x. This spread suggests the stock is trading well below what would be expected for a company of its quality and outlook.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Western Digital Narrative

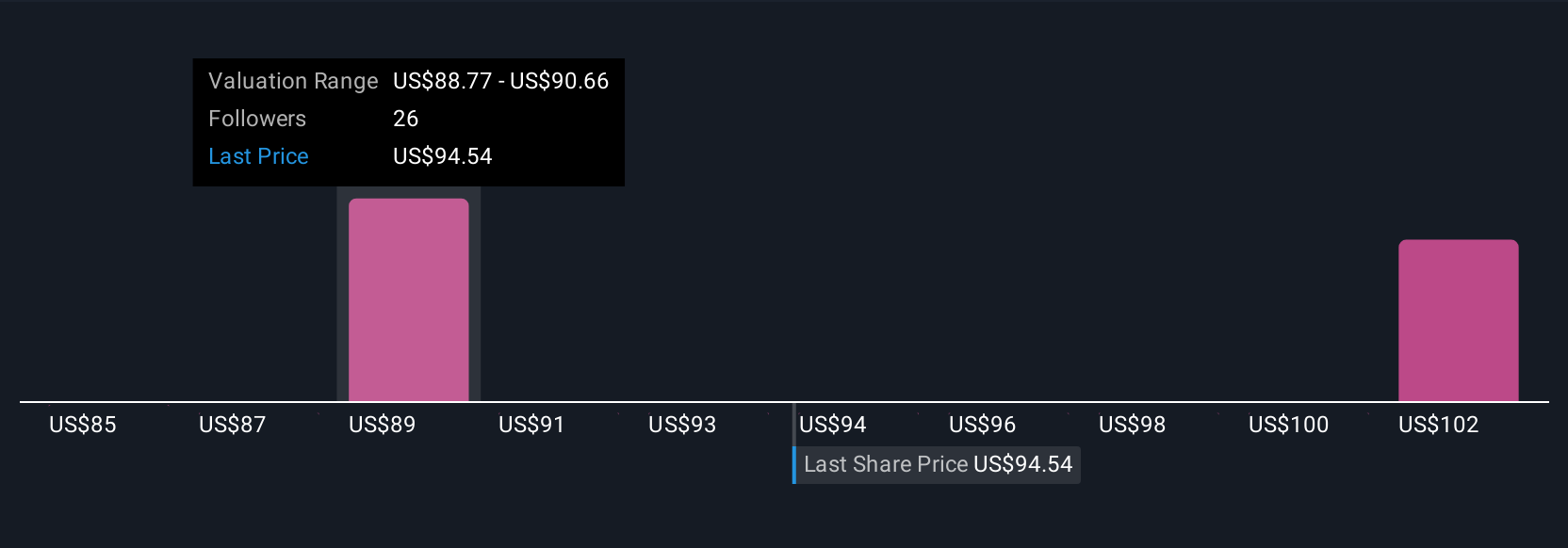

A Narrative is simply your story about a company, combining what you believe about Western Digital’s future with the numbers behind it, such as fair value and estimates for revenue, earnings, and margins.

Unlike traditional analysis that focuses just on ratios or price targets, Narratives connect the company’s unique journey and its future outlook directly to your financial forecasts and a fair value. This approach lets you see the real “why” behind the numbers.

On Simply Wall St, Narratives are accessible tools designed for everyone, not just experts. Thousands of investors use them every day to compare their perspectives in a dynamic, chart-driven community.

Narratives help you decide when to buy or sell by comparing your fair value (driven by your assumptions) against the latest price. Because they update in real time with news or earnings releases, you are always working with the latest story.

For example, while some see Western Digital as riding a long-term wave of AI-powered storage growth with a fair value of $100 per share, others foresee industry risks and lower estimates, with fair values as low as $62. This proves there is more than one credible story for any stock.

Do you think there's more to the story for Western Digital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives