- United States

- /

- Communications

- /

- NasdaqGS:VSAT

The Bull Case For Viasat (VSAT) Could Change Following Major U.S. Space Force Satellite Contract Win

Reviewed by Sasha Jovanovic

- Earlier this month, Viasat announced it had been selected by the U.S. Space Force for a prime contract award under the Protected Tactical SATCOM-Global (PTS-G) program, making it one of five companies tasked with developing a secure, resilient geosynchronous satellite constellation serving government users, with the first launch planned for 2028.

- This selection highlights Viasat's growing prominence as a potential end-to-end satellite manufacturer for critical defense communications, underscoring its role in advancing secure and resilient satellite communications for U.S. military missions.

- We'll explore how being chosen for the PTS-G satellite program could influence Viasat's positioning in the defense communications market.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Viasat Investment Narrative Recap

Owning Viasat stock means believing the company can capitalize on rising demand for secure, resilient satellite communications despite heavy competition and ongoing pressures from capital expenditures. The recent U.S. Space Force contract highlights progress in its Defense segment, but the contract's initial phase does not remove the risks related to high leverage and delayed cash flow improvement, which remain the most important near-term considerations for investors.

Another development relevant to this military win is Viasat's upcoming launch of the ViaSat-3 Flight 2 satellite. Set for October 2025, this launch is expected to boost overall bandwidth and coverage, supporting both government and commercial services, and may reinforce Viasat's competitive positioning as the company pursues new government contracts.

By contrast, investors should recognize that while contract wins are critical, elevated capital expenses and persistent net losses could continue to weigh on free cash flow and earnings in the near future, so...

Read the full narrative on Viasat (it's free!)

Viasat's projections anticipate $5.0 billion in revenue and $534.2 million in earnings by 2028. This requires a 2.9% annual revenue growth rate and an earnings increase of $1.13 billion from current earnings of -$598.5 million.

Uncover how Viasat's forecasts yield a $26.14 fair value, a 20% downside to its current price.

Exploring Other Perspectives

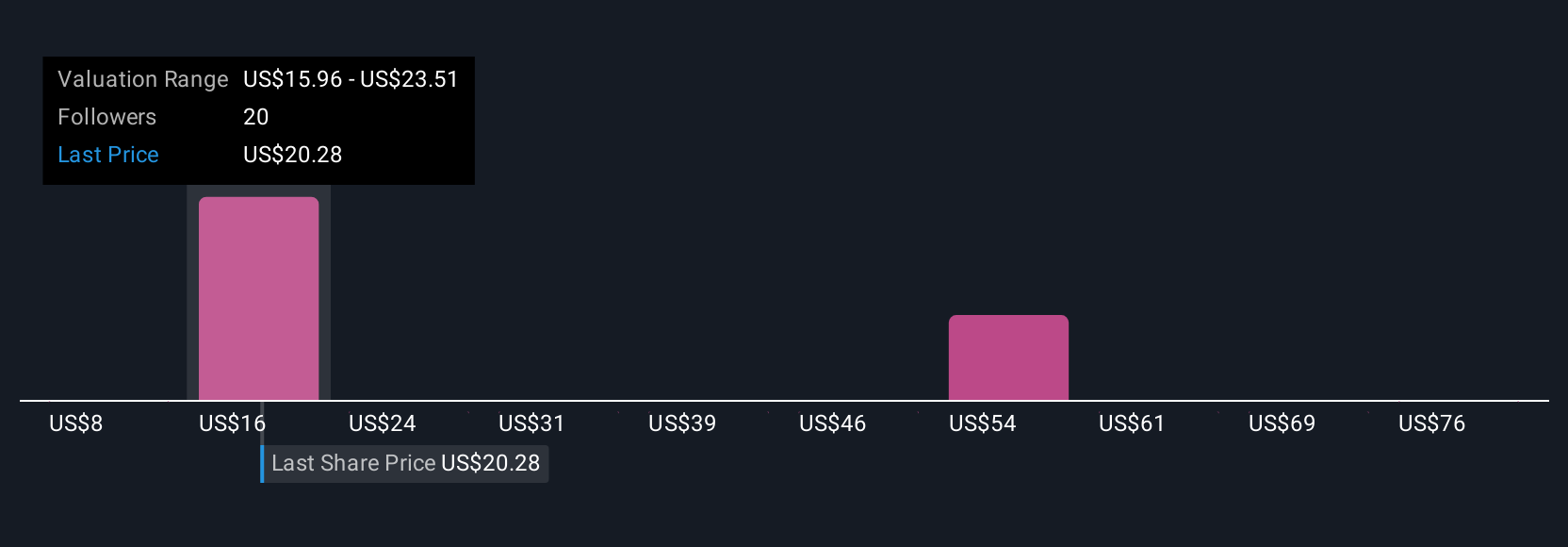

Ten fair value estimates from the Simply Wall St Community range from as low as US$8.40 to as high as US$115.49. With optimism about defense growth, participants should also consider how ongoing high capital requirements might impact future returns and risk.

Explore 10 other fair value estimates on Viasat - why the stock might be worth over 3x more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viasat research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viasat's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSAT

Viasat

Provides broadband and communications products and services in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives