- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:VRME

Rock star Growth Puts VerifyMe (NASDAQ:VRME) In A Position To Use Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies VerifyMe, Inc. (NASDAQ:VRME) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for VerifyMe

What Is VerifyMe's Debt?

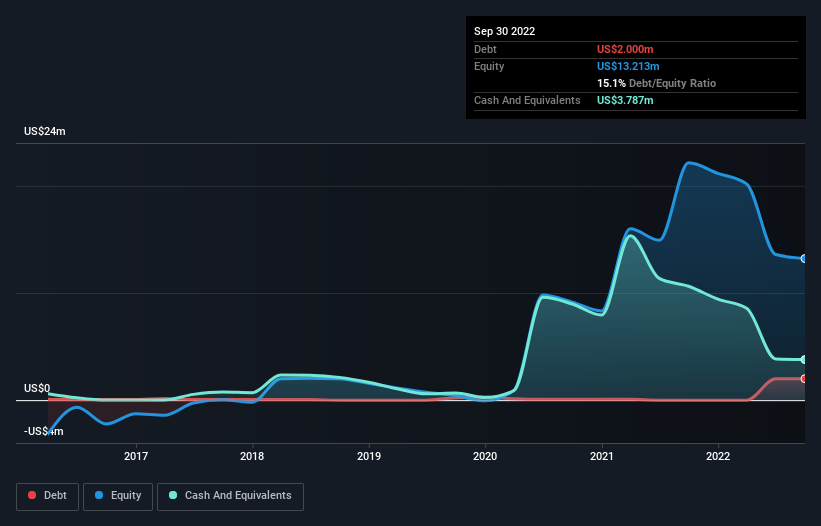

As you can see below, at the end of September 2022, VerifyMe had US$2.00m of debt, up from none a year ago. Click the image for more detail. However, it does have US$3.79m in cash offsetting this, leading to net cash of US$1.79m.

How Healthy Is VerifyMe's Balance Sheet?

We can see from the most recent balance sheet that VerifyMe had liabilities of US$2.32m falling due within a year, and liabilities of US$1.89m due beyond that. On the other hand, it had cash of US$3.79m and US$1.88m worth of receivables due within a year. So it can boast US$1.46m more liquid assets than total liabilities.

This surplus suggests that VerifyMe has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, VerifyMe boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if VerifyMe can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year VerifyMe wasn't profitable at an EBIT level, but managed to grow its revenue by 1,374%, to US$10m. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is VerifyMe?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year VerifyMe had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$3.8m of cash and made a loss of US$16m. With only US$1.79m on the balance sheet, it would appear that its going to need to raise capital again soon. The good news for shareholders is that VerifyMe has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for VerifyMe that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VRME

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026