- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Does Viavi’s (VIAV) Partnership With CrowdStrike Signal a Strategic Shift Toward Cybersecurity Leadership?

Reviewed by Simply Wall St

- On September 10, 2025, Viavi Solutions announced a partnership with CrowdStrike to integrate its Observer network observability platform with the CrowdStrike Falcon Next-Gen SIEM, enhancing joint customers' ability to gain actionable insights into both network performance and security operations.

- This collaboration expands Viavi's reach in cybersecurity by merging high-fidelity network data with AI-driven threat intelligence, creating a more holistic approach to IT operations management for enterprise customers.

- We'll explore how integrating Viavi's Observer platform with CrowdStrike enhances the company's role in the growing intersection of network performance and cybersecurity.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Viavi Solutions Investment Narrative Recap

For investors considering Viavi Solutions, the key story is its focus on capitalizing on rising demand in the data center and network performance sectors, while expanding into cybersecurity. The recent partnership with CrowdStrike strengthens Viavi’s positioning at the intersection of observability and security, but does not materially alter the near-term catalyst: sustained growth in data center-related test solutions, nor does it significantly reduce the most pressing risk of ongoing weakness and unpredictability in its wireless infrastructure test business.

Among the company’s recent announcements, the June 2025 collaboration with Netomnia stands out for investors following Viavi’s exposure to fiber network upgrades. This deal highlights Viavi’s participation in the multi-year wave of fiber broadband deployments, a catalyst that supports its potential for continued structural revenue growth and underpins optimism surrounding the shares. However, it is important to consider that…

Read the full narrative on Viavi Solutions (it's free!)

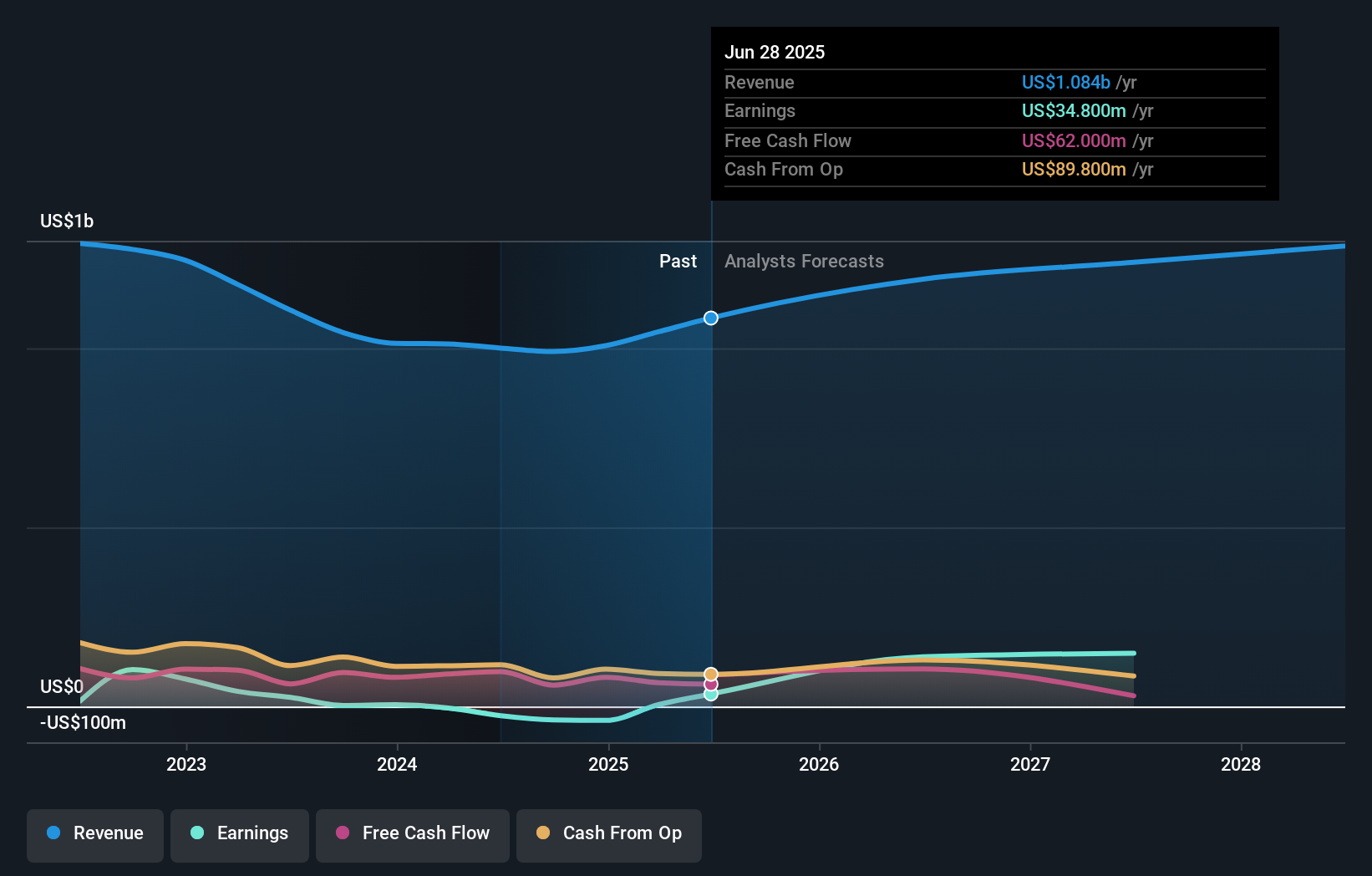

Viavi Solutions' outlook anticipates $1.3 billion in revenue and $227.3 million in earnings by 2028. This implies a 5.8% annual revenue growth rate and a $192.5 million increase in earnings from the current $34.8 million.

Uncover how Viavi Solutions' forecasts yield a $14.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have valued Viavi as low as US$1.79 and as high as US$19,112.07. While these opinions span an extraordinary range, ongoing unpredictability in core wireless end-markets remains a critical factor that could affect future earnings and stability so you’ll want to weigh all sides before making your own conclusion.

Explore 3 other fair value estimates on Viavi Solutions - why the stock might be a potential multi-bagger!

Build Your Own Viavi Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viavi Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viavi Solutions' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for telecommunications, cloud, enterprises, first responders, military, aerospace, and critical infrastructures in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives