- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

Will TTM Technologies’ New CEO Shape a Stronger Innovation Strategy for TTMI Investors?

Reviewed by Simply Wall St

- On August 14, 2025, TTM Technologies announced the appointment of Dr. Edwin Roks as its new President and CEO, effective September 2, 2025, following Thomas T. Edman’s retirement and transition to an advisory and board role.

- Dr. Roks brings extensive leadership experience from his tenure as CEO of Teledyne Technologies, with a background in advancing technology integration and expanding capabilities across aerospace, defense, and industrial electronics sectors.

- We’ll review how Dr. Roks’ industry track record may shape TTM’s leadership transition and the broader investment narrative going forward.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TTM Technologies Investment Narrative Recap

The core investment case for TTM Technologies centers on the company’s ability to profitably scale advanced manufacturing for data center, aerospace, and defense electronics while managing cost, customer concentration, and geopolitical risks. The recent appointment of Dr. Edwin Roks as CEO is unlikely to materially alter the immediate catalyst for investors, resolution of operational growing pains and margin pressure related to the Penang, Malaysia facility, and does not change the most pressing short-term risk tied to margin recovery. Among recent announcements, the acquisition of the new Wisconsin facility stands out, directly boosting TTM’s positioning for surging demand in AI and cloud infrastructure. This expansion remains highly relevant to revenue growth ambitions, yet also amplifies the risk of underutilized capacity if long-term customer commitments don’t meet elevated cost structures. However, investors should also be aware of the contrast posed by the drag on margins from ongoing operational challenges in Malaysia…

Read the full narrative on TTM Technologies (it's free!)

TTM Technologies' narrative projects $3.2 billion revenue and $251.1 million earnings by 2028. This requires 6.4% yearly revenue growth and a $157.9 million earnings increase from the current $93.2 million.

Uncover how TTM Technologies' forecasts yield a $56.75 fair value, a 28% upside to its current price.

Exploring Other Perspectives

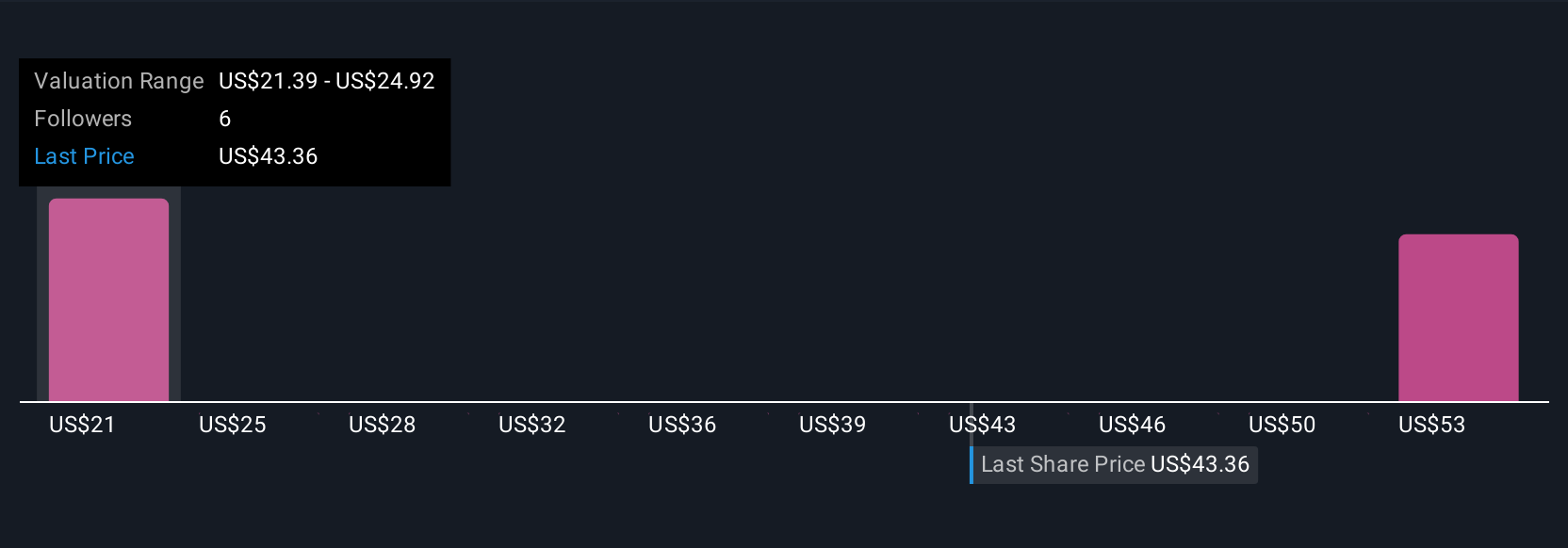

Simply Wall St Community members estimate TTM’s fair value between US$21.29 and US$56.75, reflecting two sharply contrasting forecasts. With expansion initiatives underway, capital allocation choices remain central to broader financial outcomes and deserve closer attention from all sides.

Explore 2 other fair value estimates on TTM Technologies - why the stock might be worth less than half the current price!

Build Your Own TTM Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TTM Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TTM Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TTM Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives