- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

How Investors Are Reacting To TTM Technologies (TTMI) High-Profile AI And Leveraged Finance Conference Appearances

Reviewed by Sasha Jovanovic

- In late November 2025, TTM Technologies announced that its executives would present at the UBS Global Technology and AI Conference and the Bank of America Leveraged Finance Conference, highlighting its role in AI infrastructure and capital markets discussions.

- These back-to-back appearances by the CEO and CFO give investors fresh insight into how TTM’s operational progress and capital plans align with its longer-term growth ambitions.

- We’ll now explore how TTM’s high-profile AI and leveraged finance conference appearances may influence the company’s investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TTM Technologies Investment Narrative Recap

To own TTM Technologies, you need to believe it can translate its printed circuit board position into durable earnings growth from AI infrastructure and high‑reliability electronics. The recent UBS and Bank of America conference appearances help clarify management’s growth and capital allocation story, but they do not materially change the key near term catalyst, which remains execution on capacity ramp‑ups, or the biggest risk, that high fixed cost facilities underperform expectations.

The most relevant recent development here is TTM’s strong Q3 2025 earnings, with US$752.74 million in sales and higher profitability year on year. That financial backdrop makes the company’s AI and leveraged finance messaging more impactful, since investors can weigh ambitious capacity plans against current margins, capital intensity and valuation, rather than treating the conference commentary as purely aspirational.

Yet behind the AI growth story, investors should be aware that TTM’s heavy capital spending could...

Read the full narrative on TTM Technologies (it's free!)

TTM Technologies' narrative projects $3.2 billion revenue and $251.1 million earnings by 2028. This requires 6.4% yearly revenue growth and an earnings increase of about $158 million from $93.2 million today.

Uncover how TTM Technologies' forecasts yield a $76.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

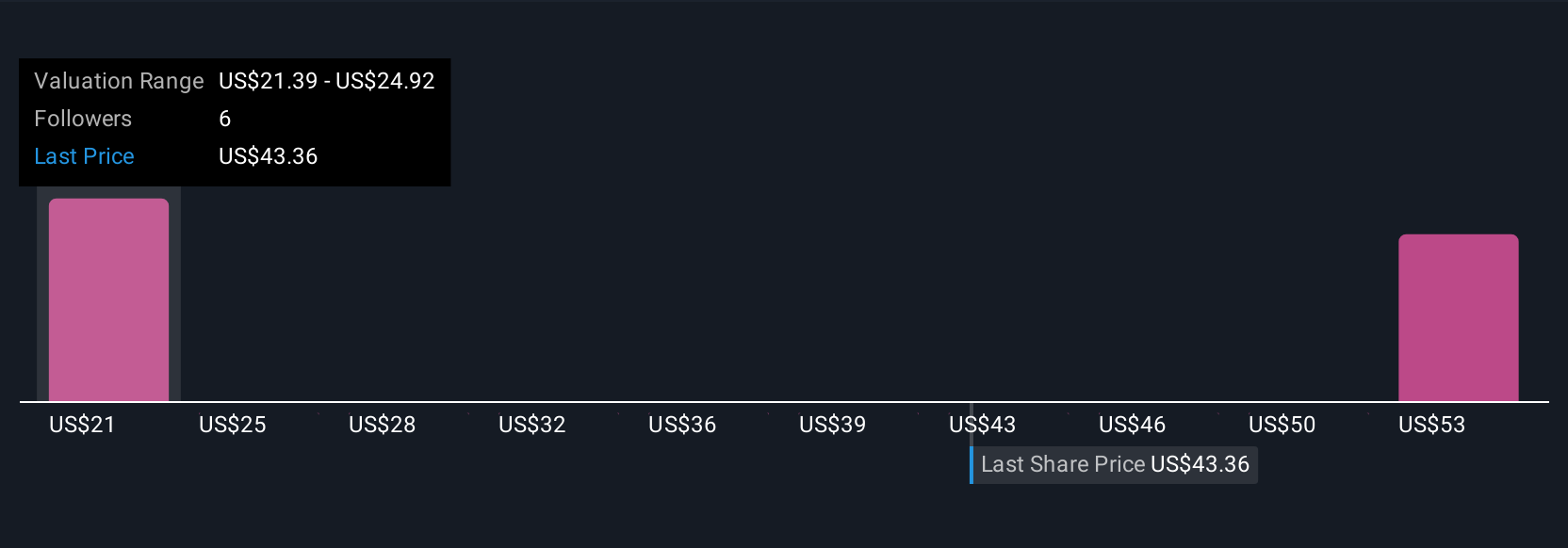

Simply Wall St Community members see fair value for TTM spanning roughly US$28.29 to US$76 across 3 independent views, so you are not short of alternative opinions. Set against that wide range, the execution risk around new high cost facilities and capacity ramp ups can materially influence how sustainably TTM converts its AI exposure into long term returns.

Explore 3 other fair value estimates on TTM Technologies - why the stock might be worth as much as 14% more than the current price!

Build Your Own TTM Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TTM Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TTM Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026