- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

Assessing TTM Technologies (TTMI) Valuation After Analyst Upgrades Highlight AI And Malaysia Growth Potential

Reviewed by Simply Wall St

What triggered the sharp move in TTM Technologies (TTMI)?

TTM Technologies (TTMI) drew fresh attention after its share price reacted strongly to upbeat analyst commentary. The commentary highlighted the company’s ties to AI demand, its Malaysian production ramp up, and recent earnings and revenue momentum versus sector peers.

See our latest analysis for TTM Technologies.

Those bullish analyst calls came on top of already strong momentum, with a 40.9% 30 day share price return and a 71% 90 day share price return. The 1 year total shareholder return is very large, suggesting that enthusiasm around AI and defense exposure has been building rather than fading.

If TTM Technologies’ surge has you thinking about what else is moving in tech, it could be a good moment to scan high growth tech and AI stocks for other AI linked opportunities.

With TTMI now trading around US$99.87 after a very strong run and sitting above an average analyst price target of US$92.75, the key question is whether any upside remains or if the market already reflects expectations for future growth.

Price-to-Earnings of 78.2x: Is it justified?

TTM Technologies currently trades on a P/E of 78.2x, which is well above both peer and industry benchmarks, even after the recent share price jump.

The P/E ratio compares the share price to earnings per share, so a higher multiple usually reflects higher expectations for future profit growth. For a company like TTM Technologies, with exposure to aerospace, defense and AI linked electronics, a rich multiple suggests the market is willing to pay up for that earnings profile.

Here, the premium is sizable. The current 78.2x P/E is far above the US Electronic industry average of 28.1x and also well ahead of the peer average of 36.6x. It also sits meaningfully above an estimated fair P/E of 44.2x, a level the market could move toward if enthusiasm cools or earnings do not keep pace with expectations.

Explore the SWS fair ratio for TTM Technologies

Result: Price-to-Earnings of 78.2x (OVERVALUED)

However, you also need to weigh risks like sentiment cooling on AI and defense exposed names, or earnings growth falling short of what a 78.2x P/E implies.

Find out about the key risks to this TTM Technologies narrative.

Another way of looking at value

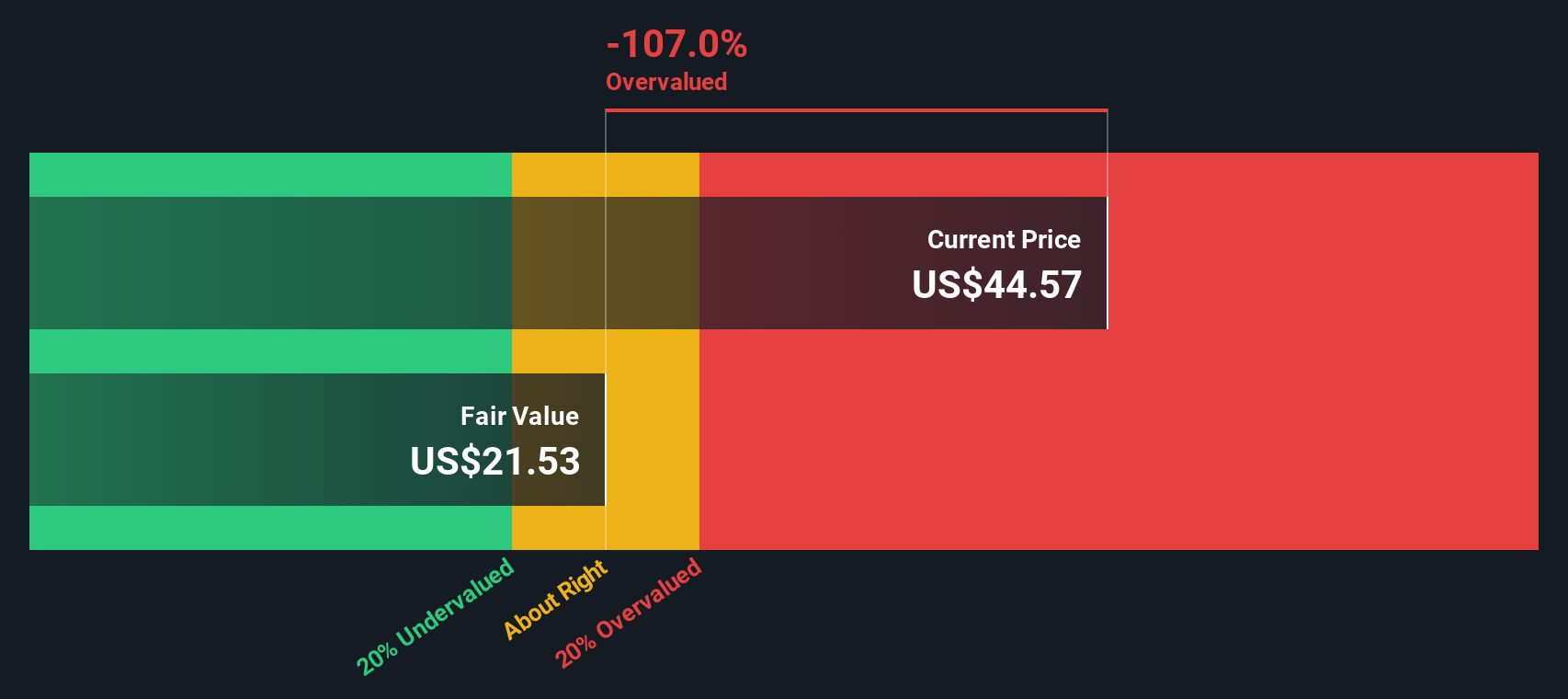

On top of the rich 78.2x P/E, our DCF model points to a future cash flow value of US$30.32 per share, well below the current US$99.87 price. That gap suggests expectations baked into the share price are very high. The question is whether you are comfortable paying that kind of premium.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TTM Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TTM Technologies Narrative

If you look at this and feel differently, or just prefer to work from your own numbers, you can build a custom view in minutes with Do it your way.

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If TTMI has caught your eye, do not stop here. Broaden your watchlist with other focused ideas that could sharpen how you think about risk and opportunity.

- Spot potential value plays early by checking out these 877 undervalued stocks based on cash flows that line up prices with underlying cash flows.

- Zero in on fast movers in artificial intelligence using these 23 AI penny stocks that concentrate on companies linked to this theme.

- Strengthen your income shortlist by reviewing these 13 dividend stocks with yields > 3% that combine yield above 3% with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!