- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TTMI

A Fresh Look at TTM Technologies (TTMI) Valuation Following Trade War Worries and Recent Analyst Upgrades

Reviewed by Kshitija Bhandaru

TTM Technologies (TTMI) shares slipped after renewed trade war concerns hit the broader market. President Donald Trump’s threat to sharply increase tariffs on Chinese imports put fresh pressure on companies with global supply chains such as TTM.

See our latest analysis for TTM Technologies.

Even with the trade war headlines sparking short-term volatility, TTM Technologies has delivered an impressive year-to-date share price return of 125.92%. In fact, total shareholder return for the past twelve months has soared to 189.67%, reflecting building momentum supported by new product launches and a CEO transition. While the share price can react sharply to global headlines, the longer-term performance story remains hard to ignore.

If today's market swings have you thinking about what else is trending, this could be a fitting moment to expand your universe and discover fast growing stocks with high insider ownership

With TTM Technologies rallying over the past year and analysts lifting price targets, investors may be wondering if shares are still undervalued given all the growth headlines, or if the market is already pricing in the next chapter.

Most Popular Narrative: 11.5% Undervalued

At a recent close of $55.53, the narrative views TTM Technologies as trading below its fair value of $62.75. This notable gap reflects analyst optimism around upcoming catalysts and robust performance trends. This sets the stage for a closer look at the story behind these numbers.

Large-scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure. This directly supports revenue growth and long-term customer relationships.

Curious how this valuation gets its uptick? The backbone of this bullish outlook is a blend of hyper-growth assumptions, margin optimism, and bold industry bets. Which projections drive this big fair value leap? Hit the full narrative to see what could send expectations even higher.

Result: Fair Value of $62.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hiccups at TTM's Penang facility or weaker than anticipated demand for new U.S. manufacturing sites could pressure future earnings growth.

Find out about the key risks to this TTM Technologies narrative.

Another View: What Do the Ratios Say?

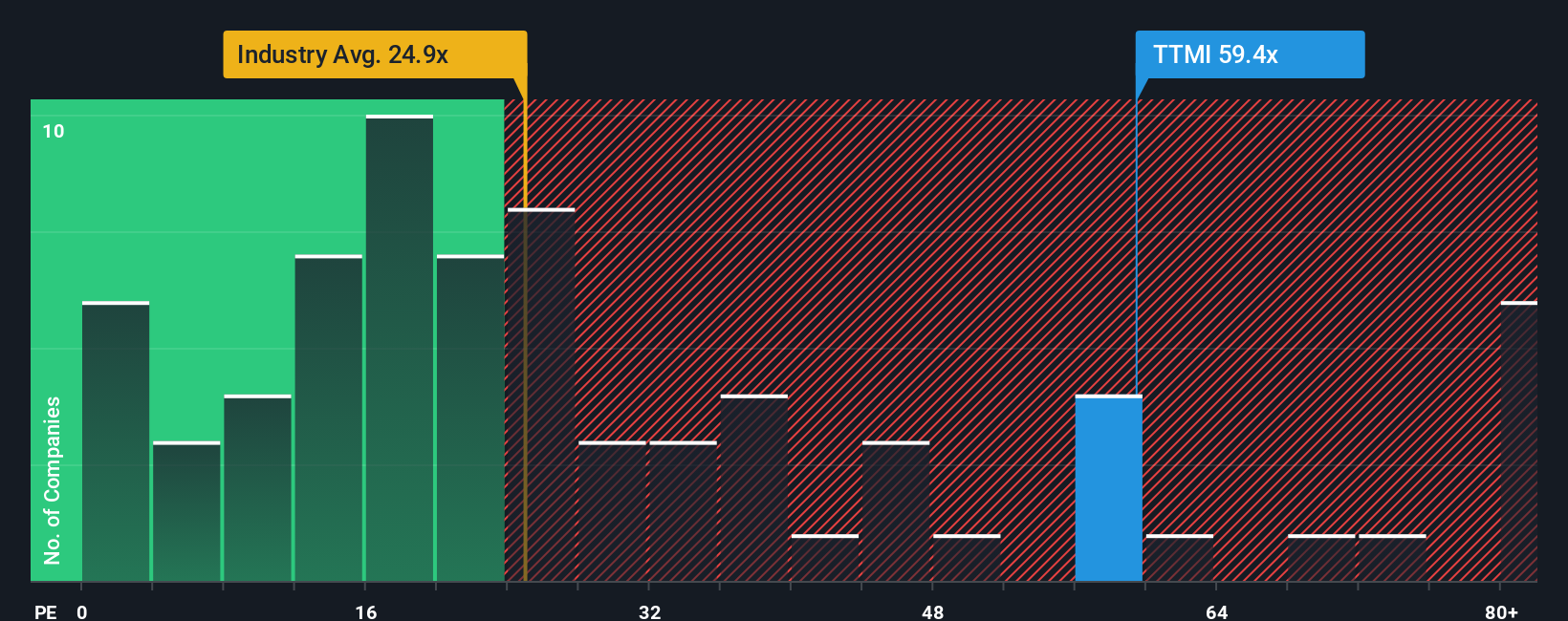

Looking at price-to-earnings, TTM Technologies trades at 61.6 times earnings, which is much higher than both its direct peers (28.6x) and the broader US Electronic industry (24.9x). The market’s current appetite far outpaces our fair ratio estimate of 38.9x, which points to heightened valuation risk if growth stalls. Will investor optimism stand up to the next round of results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TTM Technologies Narrative

If you think the story could play out differently, or want to dig into the numbers on your own, you can build your own view in under three minutes. Do it your way

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investors always keep an eye on what’s next. Don’t let opportunity pass you by. These promising ideas could be what your strategy needs now.

- Uncover strong potential with these 893 undervalued stocks based on cash flows for stocks currently priced below their cash flow, before the crowd catches on.

- Capitalize on unstoppable innovation by scanning these 25 AI penny stocks, which are transforming everything from automation to analytics and reshaping entire industries overnight.

- Secure consistent income through these 18 dividend stocks with yields > 3%, with yields over 3% and a track record of robust payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TTM Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTMI

TTM Technologies

Manufactures and sells mission systems, radio frequency (RF) components and RF microwave/microelectronic assemblies, and printed circuit boards (PCB) in the United States, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives