- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:TRMB

Trimble (TRMB): Is the Recent Valuation Discount an Opportunity for Investors?

Reviewed by Simply Wall St

See our latest analysis for Trimble.

Trimble's share price has quietly built steady momentum, with a 17.16% gain year-to-date reflecting renewed optimism in its technology-driven business model. Looking back, a 10.44% total shareholder return over the last year hints at improving sentiment and a track record of long-term value creation despite occasional market volatility.

If you’re exploring technology leaders showing sustained progress, it’s a great time to check out the full list of opportunities waiting in our tech and AI stocks screener. See the full list for free.

With shares trading at a notable discount to analyst price targets and robust fundamentals fueling recent gains, investors may wonder whether Trimble is truly undervalued or if the market has already accounted for its future growth potential. Is now a genuine buy opportunity?

Most Popular Narrative: 17% Undervalued

Trimble’s most widely followed valuation narrative puts its fair value well above the recent share price, suggesting upside is embedded in the numbers. This stage is set by expectations tied to recurring software revenue growth and ambitious improvements in profitability.

*The migration from hardware-focused, CapEx models to bundled, subscription-based offerings, even in traditionally hardware-oriented segments, expands the addressable market, improves revenue visibility, and increases recurring revenue mix. This drives greater predictability and enhanced long-term earnings.*

What quantitative leaps must happen for this valuation to stick? The key factors here are bold top-line and margin assumptions, along with surprisingly aggressive targets for future earnings. Want the inside story on how these growth bets justify the price target? Dig into the full narrative and see what really drives the upside case.

Result: Fair Value of $98.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macroeconomic pressures and slower than expected customer adoption of new software models could present real challenges to Trimble’s upbeat valuation story.

Find out about the key risks to this Trimble narrative.

Another View: Market Compares with a Much Higher Price-to-Earnings Ratio

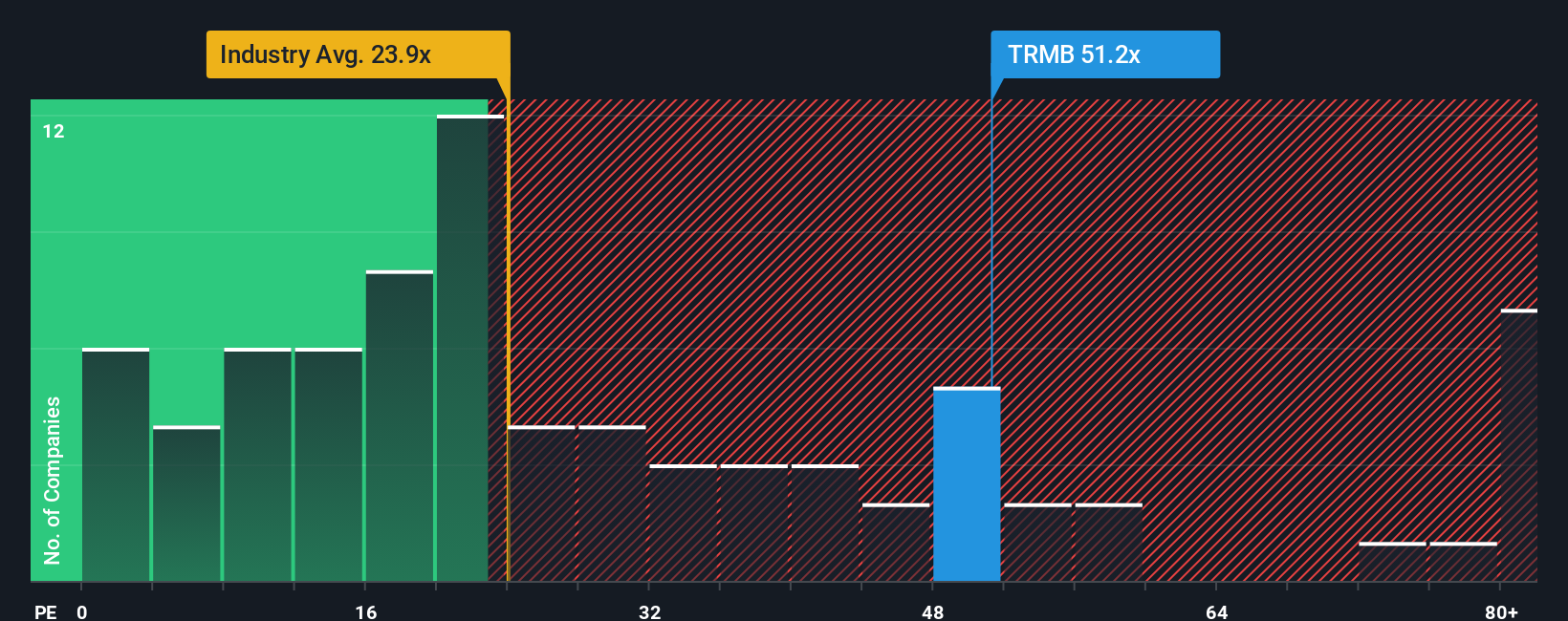

Looking at valuation through the lens of price-to-earnings, Trimble stands out as costly. Its ratio of 54.3x is far above both the US Electronic industry average of 23.9x and the peer average of 36.5x. It is also well above the fair ratio of 31.5x, suggesting the market is factoring in a significant level of optimism, which means investors may be accepting higher valuation risk. Could these high multiples signal overheating, or is it justified by future earnings growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trimble Narrative

Curious to see if a different story emerges from the data? Dive in, run your own analysis, and shape a narrative that fits your perspective. You can build one yourself in just a few minutes. Do it your way

A great starting point for your Trimble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the moment and uncover fresh investing angles using the Simply Wall Street Screener. Don’t let unique growth stories and hidden opportunities slip away.

- Uncover potential with dividend powerhouses and unlock consistent income streams by checking out these 14 dividend stocks with yields > 3% offering yields above 3%.

- Accelerate your portfolio with tomorrow’s tech standouts by scanning these 25 AI penny stocks making real strides at the cutting edge of artificial intelligence.

- Tap into emerging financial trends as you assess these 81 cryptocurrency and blockchain stocks leading transformative change in blockchain and digital currency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRMB

Trimble

Provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026