- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Could Seagate’s (STX) AI Partnerships Reveal a New Chapter in Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, Seagate Technology Holdings has been the focus of heightened analyst optimism and collaboration initiatives amid rapid advances in data storage and AI technologies.

- A real-time demonstration with ZeroPoint Technologies at the OCP Global Summit spotlighted innovations poised to address efficiency and performance needs for hyperscale workloads.

- We'll examine how mounting analyst optimism about Seagate's AI-driven growth prospects influences its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Seagate Technology Holdings Investment Narrative Recap

To own Seagate Technology Holdings stock, you need to believe in the company's ability to benefit from rising demand for data storage amid rapid AI adoption and cloud infrastructure growth. The recent analyst optimism and breakthroughs in memory compression technology may influence sentiment, but near-term performance will still hinge on Seagate’s ability to ramp up and monetize its latest storage solutions. The most important short-term catalyst remains execution on its HAMR-based Mozaic drive strategy, while a high level of debt continues to be an important risk. The immediate impact of the latest analyst upgrades and technology demonstration is positive for momentum, but does not materially change the profile of these critical factors. Among the key recent announcements, Seagate’s partnership with ZeroPoint Technologies at the OCP Global Summit stands out. The real-time demonstration of hardware-accelerated memory compression, targeting hyperscale workloads, is directly related to the central catalyst: gaining share and boosting efficiency in high-demand data center environments. This alignment with large-scale cloud and AI trends highlights how product innovation may play a role in shaping Seagate’s next revenue cycle. Yet, investors should also keep in mind the risk that, even amid technological innovation and strong analyst backing, Seagate’s high debt load means any cash flow shortfalls could affect both its financial flexibility and future shareholder returns...

Read the full narrative on Seagate Technology Holdings (it's free!)

Seagate Technology Holdings' outlook anticipates $12.0 billion in revenue and $2.5 billion in earnings by 2028. This is based on a 9.5% annual revenue growth rate and a $1.0 billion increase in earnings from the current $1.5 billion.

Uncover how Seagate Technology Holdings' forecasts yield a $204.35 fair value, a 3% downside to its current price.

Exploring Other Perspectives

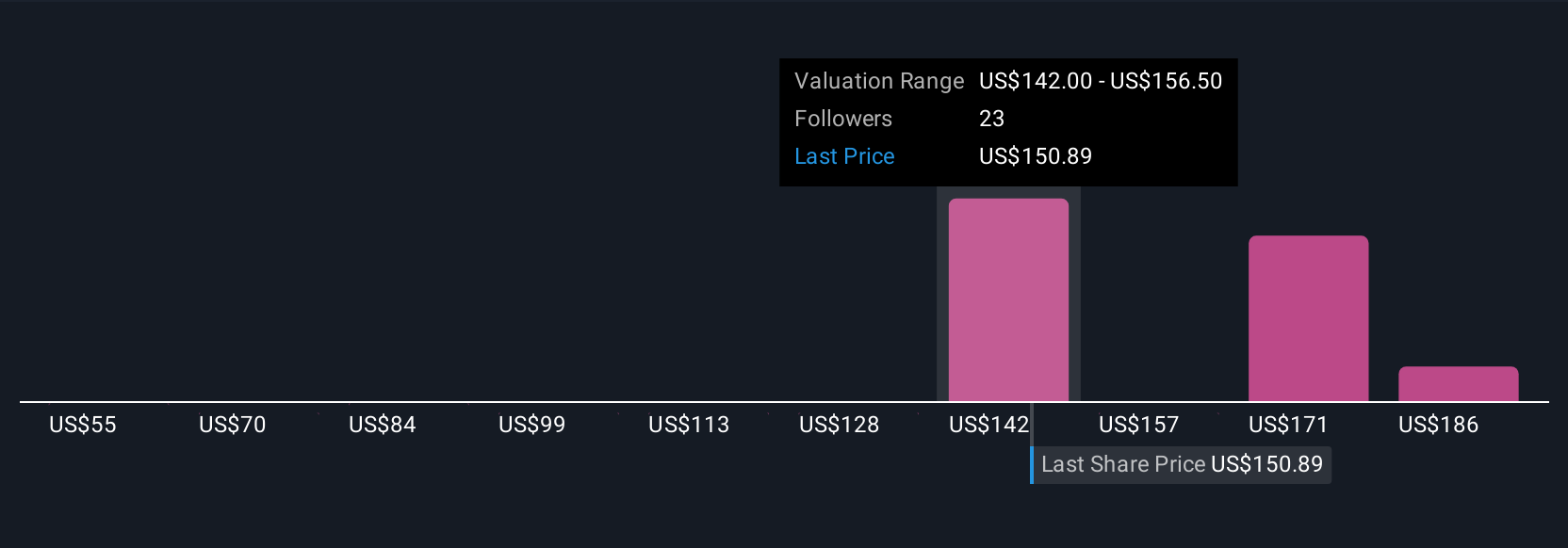

Fair value estimates from the Simply Wall St Community range from as low as US$55 to as high as US$231, with five distinct perspectives represented. With nearline exabyte demand and cloud build-outs seen as a core catalyst, you can explore very different opinions on how much future growth is worth.

Explore 5 other fair value estimates on Seagate Technology Holdings - why the stock might be worth as much as 9% more than the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Seagate Technology Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seagate Technology Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives