- United States

- /

- Chemicals

- /

- OTCPK:GLGI

US Penny Stocks To Watch: 3 Picks With Market Caps Under $80M

Reviewed by Simply Wall St

As the U.S. stock market experiences a mix of rising indices and record highs, investors are keenly watching for opportunities amid ongoing economic shifts and Federal Reserve decisions. Penny stocks, though often considered a relic of past speculative markets, continue to offer intriguing prospects for growth at accessible price points. These smaller or newer companies can present unique investment opportunities when backed by robust financials, making them worthy of attention in today's dynamic market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.63 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8695 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.96 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.224099 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.755 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8405 | $75.59M | ★★★★★☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sono-Tek (NasdaqCM:SOTK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sono-Tek Corporation designs and manufactures ultrasonic coating systems for various industries globally, with a market cap of $76.08 million.

Operations: The company's revenue is derived from four geographical segments: United States & Canada ($11.90 million), Europe, Middle East, Asia (EMEA) ($5.13 million), Asia Pacific (APAC) ($3.04 million), and Latin America ($0.58 million).

Market Cap: $76.08M

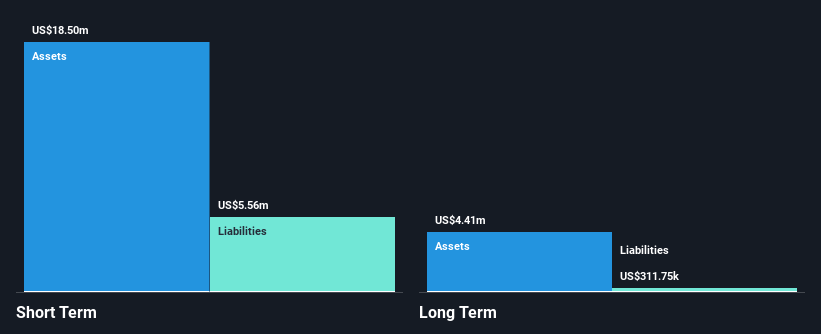

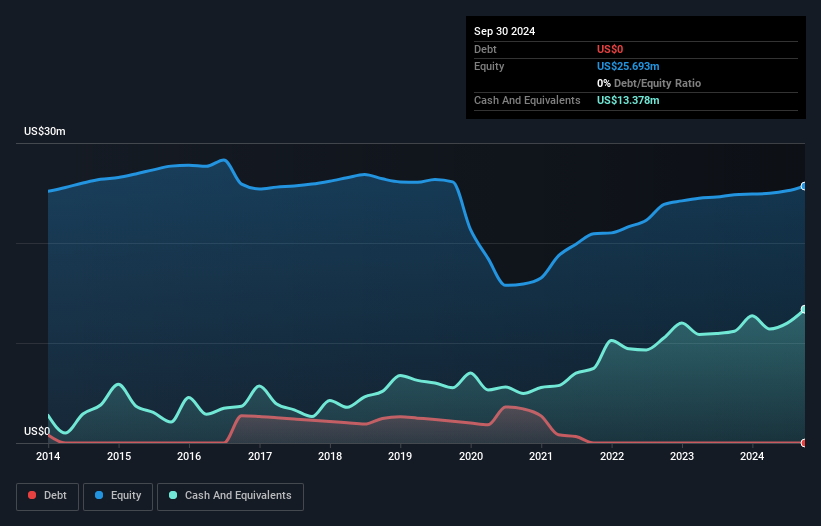

Sono-Tek Corporation, with a market cap of US$76.08 million, has shown stable financial health and growth potential in the penny stock sector. The company is debt-free, with short-term assets of US$18.5 million comfortably covering both short and long-term liabilities. Earnings have grown significantly by 99% over the past year, outpacing its five-year average growth rate and industry performance. Despite a slight decline in recent quarterly sales to US$5.16 million from US$5.64 million year-on-year, Sono-Tek remains focused on shareholder value through a recently announced share repurchase program worth up to US$2 million funded by existing cash reserves and future cash flows.

- Dive into the specifics of Sono-Tek here with our thorough balance sheet health report.

- Examine Sono-Tek's earnings growth report to understand how analysts expect it to perform.

Wilhelmina International (NasdaqCM:WHLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wilhelmina International, Inc. is primarily involved in the fashion model management business and has a market cap of $21.35 million.

Operations: The company's revenue is derived entirely from management consulting services, totaling $17.09 million.

Market Cap: $21.35M

Wilhelmina International, Inc., with a market cap of US$21.35 million, demonstrates financial stability and modest growth within the penny stock sector. The company is debt-free, with short-term assets of US$22.7 million exceeding both short and long-term liabilities. Its earnings have grown by 18.7% over the past year, surpassing industry averages, though this growth is slower than its five-year average of 45.1%. Recent earnings results show slight revenue increases to US$4.57 million for Q3 2024 compared to last year, while net income slightly declined to US$0.31 million from US$0.359 million a year ago.

- Click here to discover the nuances of Wilhelmina International with our detailed analytical financial health report.

- Learn about Wilhelmina International's historical performance here.

Greystone Logistics (OTCPK:GLGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greystone Logistics, Inc. manufactures and markets plastic pallets and pelletized recycled plastic resins in the United States, with a market cap of $28.28 million.

Operations: The company generates revenue of $57.83 million from its plastic pallets segment.

Market Cap: $28.28M

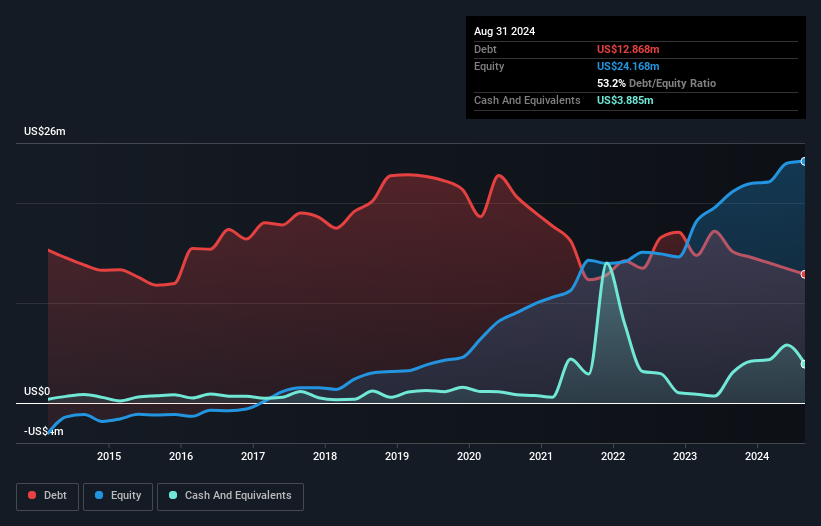

Greystone Logistics, Inc., with a market cap of US$28.28 million, faces challenges in the penny stock arena due to declining financial performance. Recent earnings show a drop in sales to US$13.46 million for Q1 2025 from US$17.41 million a year prior, and net income fell significantly to US$0.34 million from US$1.74 million last year. Despite stable weekly volatility and satisfactory debt levels with a net debt-to-equity ratio of 37.2%, the company's profit margins have contracted, and long-term liabilities exceed short-term assets by US$6.8M, raising concerns about its financial resilience amidst executive changes and delayed SEC filings.

- Take a closer look at Greystone Logistics' potential here in our financial health report.

- Understand Greystone Logistics' track record by examining our performance history report.

Where To Now?

- Gain an insight into the universe of 720 US Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:GLGI

Greystone Logistics

Through its subsidiaries, manufactures and markets plastic pallets and pelletized recycled plastic resins in the United States.

Adequate balance sheet low.