- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

SanDisk (SNDK): Reassessing Valuation After a 500% Year-to-Date Share Price Surge

Reviewed by Simply Wall St

Sandisk (SNDK) has been on a wild ride lately, with the stock slipping about 3% in the past day but still sitting on a strong gain over the past 3 months.

See our latest analysis for Sandisk.

Zooming out, Sandisk’s latest $219.46 share price comes after a sharp run, with its year to date share price return above 500% and a powerful 90 day share price return near 200%, signaling strong momentum as investors reassess its growth and risk profile.

If Sandisk’s surge has your attention, it could be a good moment to explore other high growth tech and AI names using high growth tech and AI stocks.

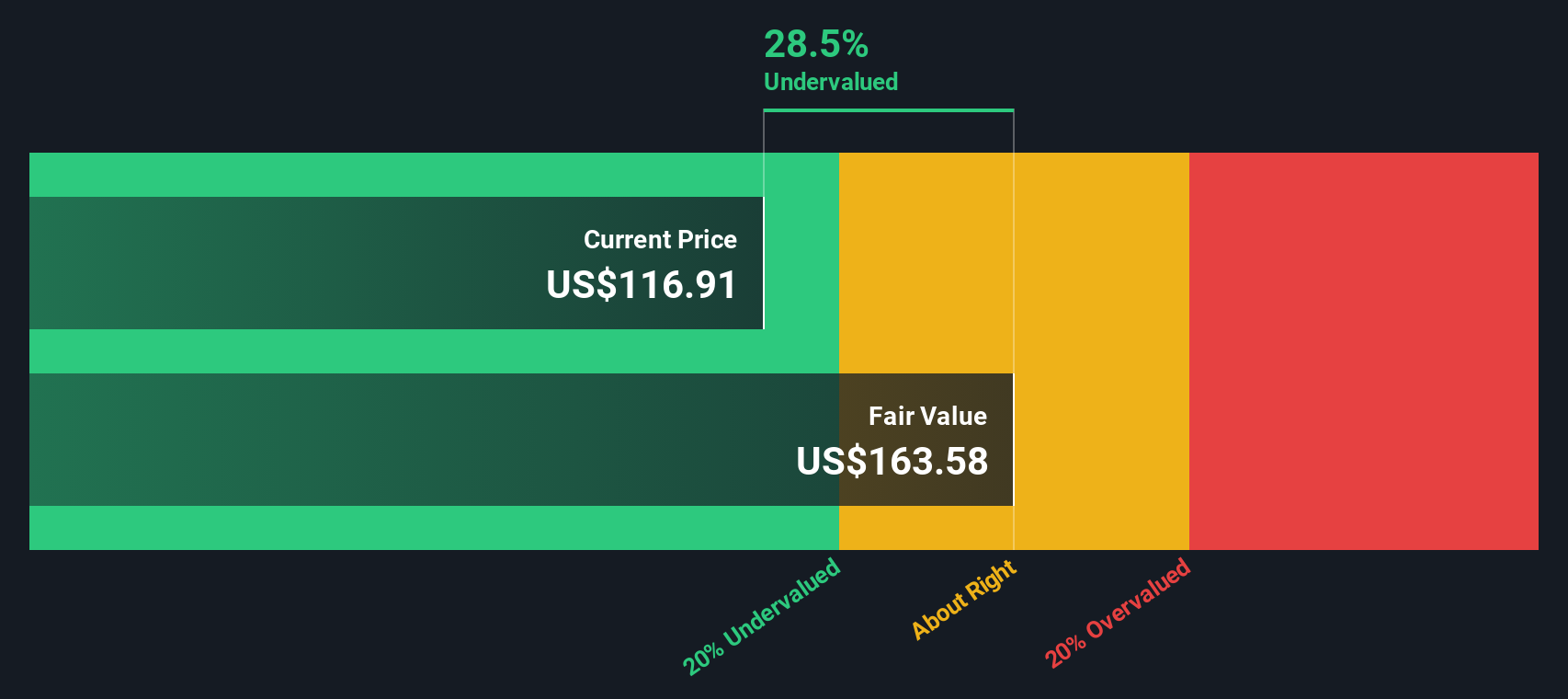

With shares still trading at a hefty discount to analyst targets despite eye catching gains, investors now face a crucial question: is Sandisk still undervalued, or is the market already pricing in all that future growth?

Price-to-Sales of 4.1x: Is it justified?

On a price-to-sales basis, Sandisk trades around 4.1 times revenue, a premium level that suggests investors are paying up for future growth versus today’s fundamentals.

The price-to-sales multiple compares the company’s market value to the revenue it currently generates, a common yardstick for high growth, often unprofitable, tech and semiconductor names where earnings are still negative or volatile.

In Sandisk’s case, the market is assigning a richer valuation than several benchmarks, implying strong confidence that forecast revenue and earnings growth will materialise, even though the company is currently loss making and has yet to prove a sustained path to profitability.

That optimism looks stretched when set against peers and the estimated fair ratio, with Sandisk’s 4.1 times sales sitting above both the US Tech industry average of 1.6 times and the SWS fair price-to-sales estimate of 3.4 times, a level the market could eventually gravitate toward if expectations cool.

Explore the SWS fair ratio for Sandisk

Result: Price-to-Sales of 4.1x (OVERVALUED)

However, Sandisk still faces key risks, including persistent losses despite rapid revenue growth and the possibility that tech sentiment or analyst expectations could reverse sharply.

Find out about the key risks to this Sandisk narrative.

Another View: DCF Points to Deep Undervaluation

While the 4.1 times sales tag looks rich versus peers, our DCF model paints a very different picture. It suggests Sandisk is trading about 52.6% below its fair value of $463.24 and raises the question of whether the market is underestimating its long term cash generation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandisk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandisk Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Sandisk research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Do not stop at one opportunity when you can quickly scan focused stock ideas on Simply Wall Street that match your strategy, risk appetite, and return goals.

- Capitalize on overlooked value by targeting companies trading below intrinsic worth using these 903 undervalued stocks based on cash flows before the market catches up.

- Harness rapid innovation by tapping into cutting edge names in these 27 AI penny stocks positioned to benefit from accelerating demand for intelligent software and automation.

- Strengthen your income stream by zeroing in on reliable payers with these 15 dividend stocks with yields > 3% that offer attractive yields alongside solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion