- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

SanDisk (SNDK): Assessing Valuation After Recent Momentum and Rapid Gains

Reviewed by Kshitija Bhandaru

Sandisk (SNDK) stock has caught the attention of investors, with shares moving this week. There is a mix of forces at play here, including recent trading action and shifts in market sentiment, making it worth a closer look.

See our latest analysis for Sandisk.

Sandisk's 1-day share price return dropped 5.4%. However, this follows a remarkable 47.8% gain over the past month and an even more impressive 207.8% return over the last 90 days. Momentum has been building, as recent price moves indicate renewed investor optimism about the business and its prospects.

If you're curious about other tech movers riding the same surge in momentum, now is an excellent time to check out the latest opportunities in See the full list for free.

With such rapid gains and a swing in sentiment, investors may be wondering whether Sandisk’s current price reflects an undervalued opportunity, or if the market has already factored in all future growth potential.

Price-to-Sales Ratio of 2.5x: Is it Justified?

Sandisk is trading at a price-to-sales (P/S) ratio of 2.5x, which signals that the market is valuing each dollar of the company’s revenue lower than many of its peers. With a last close price of $127.29 and recent momentum, this metric points to a potential valuation gap.

The price-to-sales ratio is a critical tool when assessing companies that are currently unprofitable, such as Sandisk. It helps investors see how much the market is willing to pay for each dollar of sales. This is especially relevant in sectors where profitability can be cyclical or delayed. Given that Sandisk is still unprofitable but growing revenue, this ratio provides a clearer lens on current market sentiment than profit-based multiples.

Compared to its US tech industry peers, which trade at an average P/S of 2.6x, Sandisk appears attractively priced. Its ratio is also just below the estimated fair value multiple of 2.7x. These competitive benchmarks suggest the market has yet to fully price in Sandisk’s growth profile.

Explore the SWS fair ratio for Sandisk

Result: Price-to-Sales of 2.5x (UNDERVALUED)

However, Sandisk’s discounted trading price comes with risks, including a recent price below analysts’ targets and continued annual net losses. These factors may impact long-term sustainability.

Find out about the key risks to this Sandisk narrative.

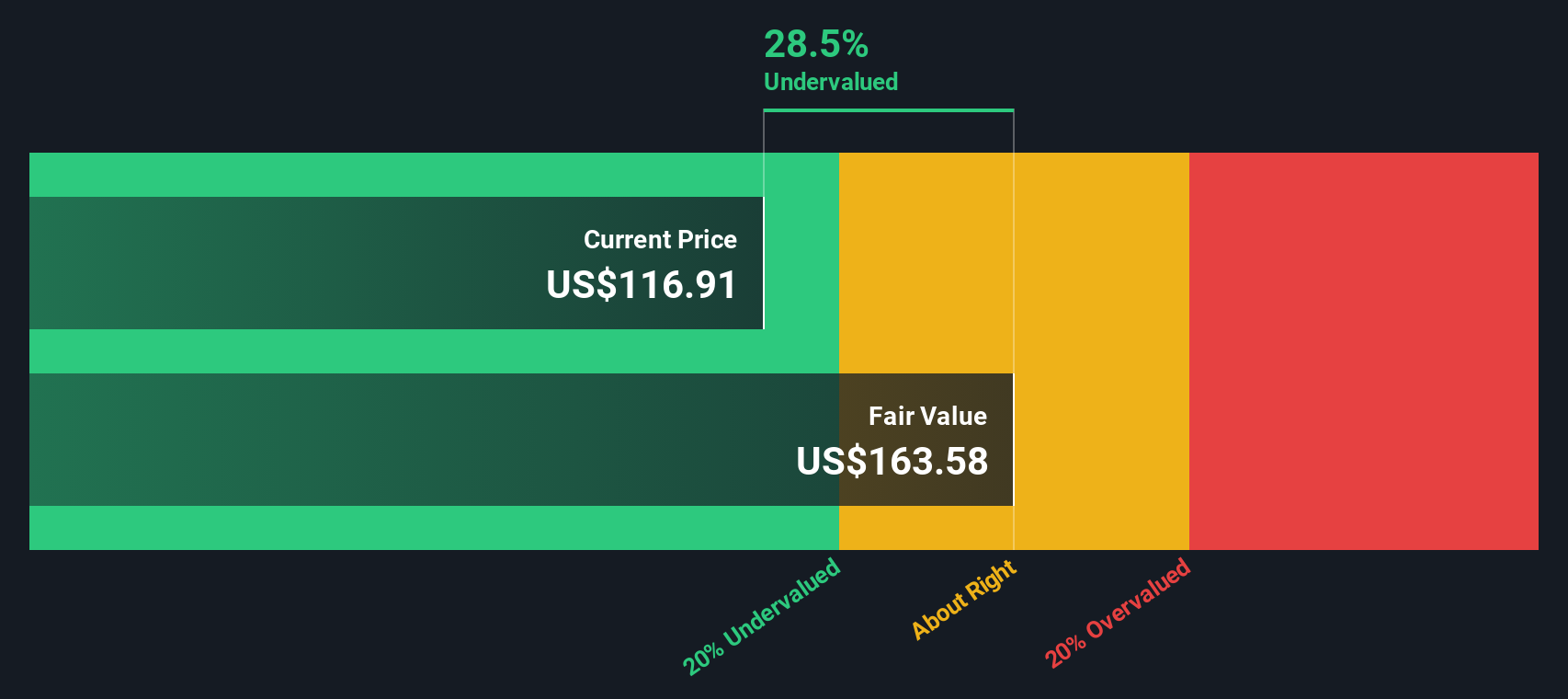

Another View: Discounted Cash Flow Says Undervalued Too

The SWS DCF model offers a different lens on valuation. Compared to the current share price, the model sees Sandisk trading at a 22.7% discount to its fair value. While both approaches highlight undervaluation, an important question is whether the DCF provides an extra margin of safety or introduces different risks to consider.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandisk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandisk Narrative

If you have a different view or want to dig deeper, you can easily craft your own take on Sandisk’s outlook in just a few minutes, Do it your way

A great starting point for your Sandisk research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Tap into the power of Simply Wall Street’s screens and elevate your watchlist with proven strategies and hidden gems before others catch on.

- Target fast-growing companies poised for the AI-driven future by starting with these 25 AI penny stocks. These companies show real market momentum and innovation.

- Maximize your portfolio’s income potential by selecting from these 18 dividend stocks with yields > 3%, which offers strong yields and steady performance in all market conditions.

- Stay ahead of the market by focusing on value picks with these 881 undervalued stocks based on cash flows, shown to trade below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives