- United States

- /

- Tech Hardware

- /

- NasdaqGS:SNDK

Is Fab2’s Advanced Flash Memory Launch Shifting the Investment Case for Sandisk (SNDK)?

Reviewed by Sasha Jovanovic

- In late September 2025, Kioxia Corporation and Sandisk Corporation announced the start of operations at their new Fab2 semiconductor facility in Kitakami, Japan, which will produce advanced 218-layer 3D flash memory using CBA technology for next-generation AI-driven storage solutions.

- A portion of Fab2's investment is subsidized by the Japanese government, highlighting official support for advancing high-performance memory manufacturing to meet global AI and cloud storage demand.

- We'll examine how the Fab2 facility's advanced capabilities may reshape Sandisk's investment narrative as AI-driven storage needs accelerate.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Sandisk's Investment Narrative?

For anyone considering Sandisk as an investment today, the big picture focus is on whether its commitment to next-generation flash memory pays off as AI and cloud storage needs surge. The Fab2 production launch with Kioxia is likely to shift near-term catalysts, giving Sandisk the manufacturing scale and technical edge it needs to produce advanced 218-layer 3D products just as AI storage demand rises. With government backing and a ramp-up that matches market trends, Fab2 could address key supply constraints and support potential revenue growth. However, recent price momentum and a sharp rise ahead of Fab2 output suggest that some of the good news may already be priced in, while risks around unprofitability, recent goodwill impairments, index exclusion, and execution on large-scale capital investments remain highly relevant. The impact of the Fab2 facility is hard to ignore, but investors should weigh expanding opportunities against the operational and financial challenges still facing Sandisk. On the other hand, index exclusion could influence institutional demand, something investors should have on their radar.

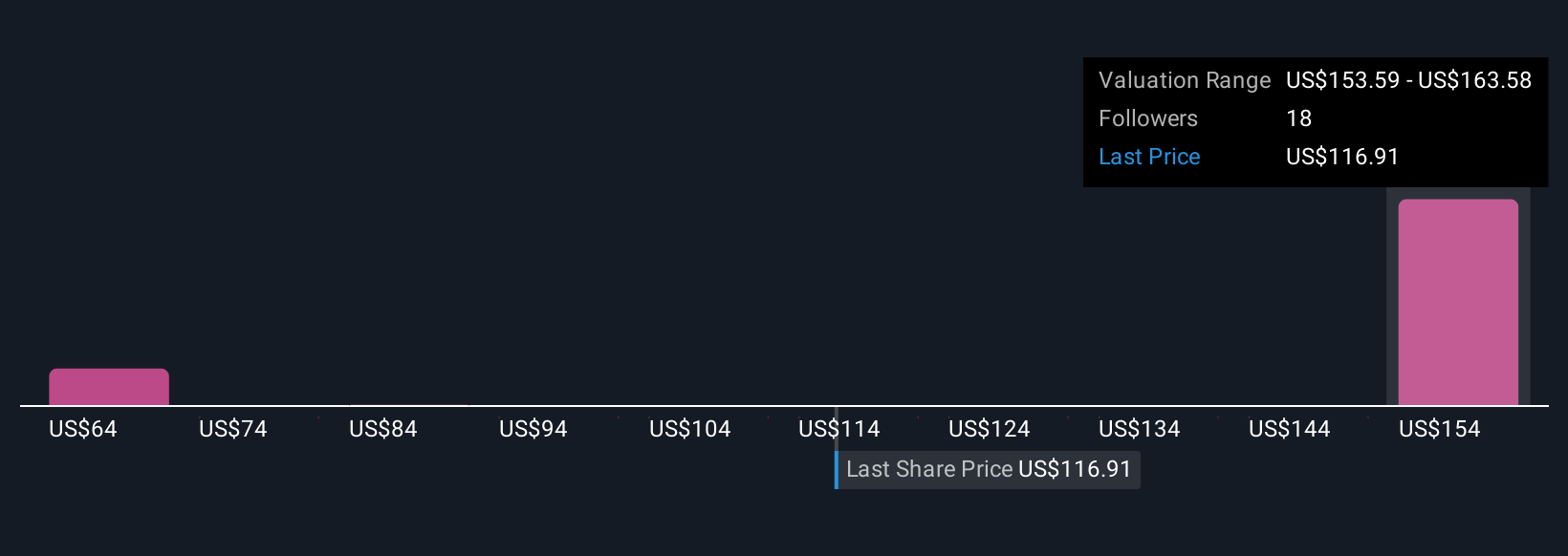

Sandisk's shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Sandisk - why the stock might be worth as much as 26% more than the current price!

Build Your Own Sandisk Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandisk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandisk's overall financial health at a glance.

No Opportunity In Sandisk?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDK

Sandisk

Develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives